Supporters of prediction markets tend to emphasize how they are great tools for aggregating information to produce accurate forecasts. If you want to know e.g. who is likely to win the next election, you can watch every poll and listen to pundits for hours, or you can take ten seconds to check the odds. This is great for people who want information- but how do prediction markets fare as investments for their actual participants?

Zero Sum

The big problem with prediction markets as investments is that they are zero sum (or negative sum once fees are factored in). You can’t make money except by taking it from the person on the other side of the bet. This is different from stocks and bonds, where you can win just by buying and holding a diversified portfolio. Buy a bunch of random stocks, and on average you will earn about 7% per year. Buy into a bunch of random prediction markets, and on average you will earn 0% at best (less if there are fees or slippage).

Low Liquidity

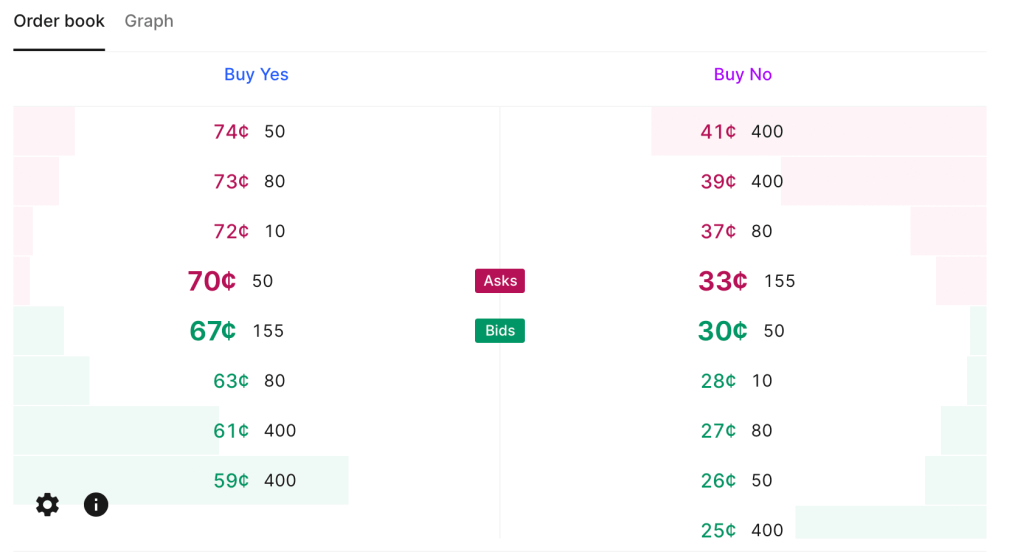

This zero sum problem is close to inevitable based on how prediction markets work. They currently have one other big problem, though it is not inevitable, and is getting better as they grow: liquidity. There are some stocks and bonds where big institutions can buy or sell millions of dollars worth without moving the price. But in markets like Kalshi or PredictIt, I personally move prices often by betting just hundreds, or sometimes even just tens, of dollars. Buying at scale means getting worse prices, if you can even buy at all. PredictIt has a bet limit of $850 per contract for regulatory reasons. This definitely excludes institutional investors, but even for individuals it can mean many markets aren’t worthwhile. Say an outcome is already priced at 90 cents, the most you can make by betting it happens is about $94. That’s not nothing but its also not enough to incentivize lots of in-depth research, especially given the risk of losing the $850 if you are wrong and the opportunity cost of investing the money in stocks or bonds. Kalshi in theory allows bets up to $25k, but most of their markets haven’t had the liquidity to absorb a bet anywhere near that (though this could be changing).

Easy Alpha

Given these negatives, why would anyone want to participate in prediction markets, except to gamble or to generously donate their time to create information for everyone else? Probably because they think they can beat the market. Compared to the stock market, this is a fairly realistic goal. Perhaps because the low liquidity keeps out institutional investors, it isn’t that hard for a smart and informed investor to find mispricings or even pure arbitrages in prediction markets. This seems to be especially true with political prediction markets, where people often make bets because they personally like or dislike a candidate, rather than based on their actual chances of winning; that is exactly the kind of counterparty I want to be trading with.

I’ve been on PredictIt since 2018 and earned a 16% total return after fees; this was on hundreds of separate trades so I think it is mostly skill, not luck. Of course, even with this alpha, 16% total (not annual) return over 6 years is not great compared to stocks. On the other hand, I tended to put money in right before big elections and take it out after, so the money is mostly not tied up in PredictIt the whole time; the actual IRR is significantly better, though harder to calculate. On the other other hand, the actual dollar amount I made is probably not great compared to the time I put in. On yet another hand, the time isn’t a big deal if you are already following the subject (e.g the election) anyway.

Uncorrelated Alpha

The other big positive about prediction markets is that there is no reason to expect your returns there are correlated with your returns in traditional markets. Institutional investors are often looking for investments that can do well when stocks are down, and are willing to sacrifice some expected returns to get it. In fact, there may be ways to get a negative correlation between your prediction market returns and your other returns, hedging by betting on outcomes that would otherwise harm you. For instance, you can hedge against inflation by betting it will rise, or hedge against a recession by betting one happens. If you are right, you make some money by winning the bet; if you are wrong, you lose money on the bet but your other investments are probably doing well in the low-inflation no-recession environment.

Going Forward

Prediction markets have long been in a regulatory grey area in the US, but with the emergence of Kalshi and the current CFTC, everything may soon be black and white. Kalshi has won full approval from the CFTC for a variety of markets, but the CFTC is moving to completely ban betting on elections (you can comment on their proposal here until July 9th).

One great place to discuss the future of prediction markets will be Manifest, a conference hosted by play-money market Manifold in Berkeley, CA June 7-9th. It features the founders of most major US predictions markets and many of the best writers on prediction markets. I’ll be there, and as I write tickets are still available.

Do the various betting market brokers have cross -brokerage contracts such that a person can buy from one brokerage while the seller used another? As in, is there as NYSE analog? That seems like a step toward liquidity and standardization.

LikeLike

There’s nothing like that, which is part of why its not unusual to find arbitrages available across exchanges

LikeLike