I have a credit card that gives me rewards. I get a nice 5% cash-back on purchases from Amazon and a lower cash-back rate on other purchases. Sometimes, there are promotions that provide a rate of 10% or even 15%. But what are these rewards worth?

To simplify, there are two reward options:

Option 1 adds to my Amazon gift-card balance. It’s attractive. When I’m checking out at Amazon, it shows me my reward balance and it also shows me what the total cost of my purchase could be if I applied the gift card. It’s like they’re trying to pressure me to redeem my rewards in this particular way.

Option 2 is simply to transfer my rewards as a payment on my credit card or as a credit to my bank account (for the current purposes, they’re identical). Either way, the rewards translate to the same number of dollars.

Say that I spend $1,000 at Amazon. Whether I choose option 1 or 2 has value implications.

Option 1

The calculation is simple. If I spend $1,000 at amazon this month, then I can spend another $50 in gift card credits at Amazon next month. That’s the end. There are no more relevant cashflows. I used my credit card one month, and then was rewarded the next month. The only detail worth adding is the time value of money, which at 7% per year*, yields a present value of rewards at $49.72. Option 1 is nice in the moment. It’s so enticing to have a lower Amazon check-out balance due.

But you should never select Option 1.

Option 2

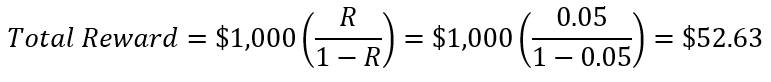

Option 2 is to take the reward as a credit card payment or as additionally bank deposits. You should always select this option if you have the liquidity and are trying to maximize your net present value. Why? Every dollar that you spend using your credit card earns a reward. Spending from the Amazon gift card balance does not. So, after spending $1,000, you receive $50 a month later. If you also spend that $50 at Amazon via your credit card, then you will receive an additional $2.50 two months after the initial $1,000 expenditure. Spend the $2.50 and you’ll receive $0.125 in in the 3rd month. You receive 5% back each time that you spend from your credit card. This process continues forever, but converges to a constant sum. Mathematically, the total additional spending power that you get from spending the initial thousand dollars is:

That works out to an effective reward rate of 5.26% over the course of a year. That’s a reward rate that is 0.26 percentage points higher – or 5.2% higher than the advertised rate and the rate that is earned by spending the gift-card reward. However, you don’t receive the $52.63 immediately. That additional balance is spread out over several months. The present value of those payments, again at a 7% discount rate, is $52.32. That’s 4.64% more present value than taking the gift card balance.

Therefore, so long as one is does not have a binding liquidity constraint, it is *always* a better idea to reimburse your cash rewards as additional credit card spending. The total cash back received is greater and, more importantly, the present value of that cash back is greater. This is why my credit card company, who surely has some sort of cost-sharing contract with Amazon, prefers and pressures me to make purchases using the gift card balance. The cost to my financier and the benefit to me is 4.64% higher when I instead take my rewards as cash.

*7% per year is the average return on the S&P 500 without dividends.

**Obviously the reward rate and the discount rate change the math. Below is a table that displays the additional present value when the reward on a $1,000 purchase is taken over a year as cash rather than as a gift card purchase.

I’m leaving money on the table, but when it comes to rewards card I just can’t. My brain is so maxed out right now. Keeping track of where the points are going and where I need to spend them is something I will pay to avoid. Great post, though. I don’t mean this as a criticism of you.

LikeLike

Thanks!

I don’t keep track of points. But I do like rules. And finding a rule that always makes you better-off is worth knowing if it saves/generates value without additional cognitive load.

Really, I just use my card and always redeem points as a card payment. That’s the rule.

LikeLike

That sounds very reasonable. I think you are doing it right and I am the one leaving money on the table. I do have a “cash back” sort of system, but I’m certain it is sub-optimal.

LikeLike

I am with you on not wanting to track various categories of points. I get offers all the time for cards that give you 3% in one or two categories (with certain conditions), 2% in others, and 1% for the rest. But I stick with my simple dumb card with 1.5% reward on all purchases, rebated directly to my bank account so I can see it.

LikeLike