Now that we’ve all made it through the 2021 tax filing season, it’s worth thinking about a recurring question in tax policy: is it possible that most of us wouldn’t need to go through this annual ritual? Couldn’t the government just tell us how much we owe (or are due as a refund), or better yet, just deduct the correct amount from our paycheck so we’d have paid the right amount?

We need to imagine such a system: it exists in many developed nations around the world! And it’s true that, at least for many taxpayers, the IRS already has all the information on you it needs to calculate your taxes.

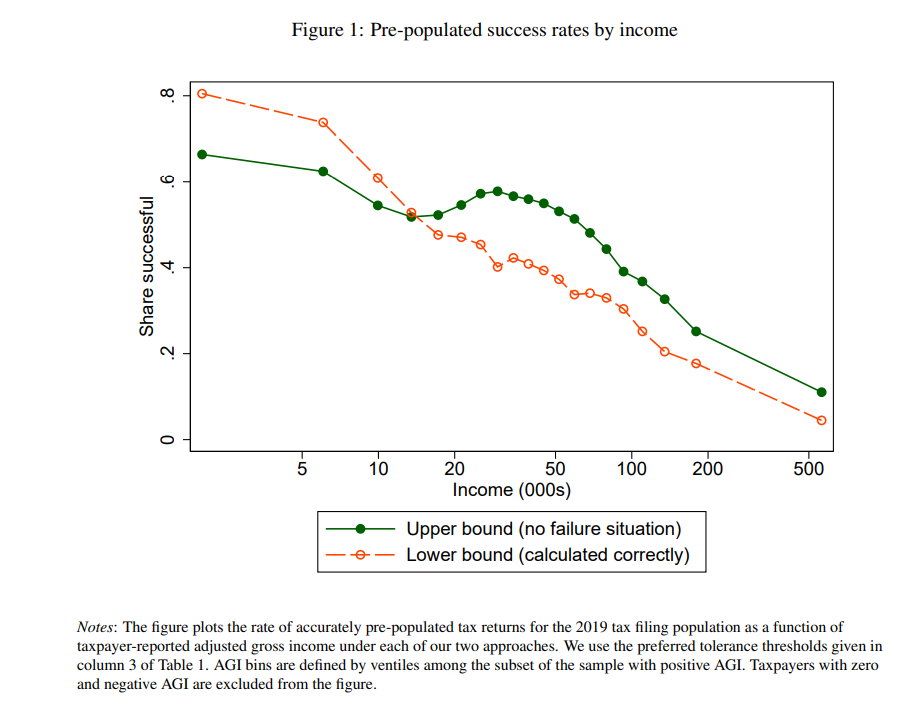

But how many US taxpayers would this be beneficial for? A new working paper which tries to quantify this question. In “Automatic Tax Filing: Simulating a Pre-Populated Form 1040,” the authors use a large sample of tax returns to estimate how many taxpayers a pre-filled return would work for. The results are almost split down the middle: it would work well for maybe half of US taxpayers (41-48% of taxpayers, depending on how we are defining successful). For the other half, it wouldn’t give you an accurate estimate of how much tax you owed.

And the errors can be large. For example, the authors report that “two-thirds of the cases where the lower bound approach is inaccurate, the pre-populated liability is higher than the reported liability, with a median gap of $4,200.” Note: looking at the tables, I think they mean to say “mean,” not “median” here, with the median being $1,400. Still, that’s a lot of errors in a direction that would hurt taxpayers if they didn’t fill it out on their own or pay someone to do it. And it’s not just one thing that’s causing pre-filled returns to be wrong. You might think itemized deductions are a big issue, and they are, but only for about 11% of returns (and in only 4% of returns is this the only issue). They find that 9% of returns didn’t even have the reported wages matching what the IRS showed!

Does this mean that pre-filled returns are doomed in the US? Perhaps not! They seem to work much better for younger, single filers, and as well as filers with very low income, as Figure 1 from the paper shows. Even so, the 60-80% success rate (depending on criteria) for very low income taxpayers isn’t especially encouraging. But one upshot of a pre-filled return is that there are possibly millions of taxpayers (maybe 8 or 12 million?) that don’t file a return because they aren’t legally required to (too low income), but they would benefit if they did because of refundable credits like the EITC and Child Tax Credit.

Maybe there is a compromise position. The IRS could send you a “suggested tax return,” but allow you to modify it. I suspect that, in most cases, those who are currently paying for a person or software to do their taxes would still do it. You can’t know if you are in the one-half of taxpayers where this information is accurate! The IRS could provide a list of “common reasons why you may be in the half of pre-filled tax returns that are wrong,” but we’re still shifting the burden back to the taxpayer.

I would like to suggest, instead, that there are a few changes we could make to our tax system (“simplifications,” if you will) that might make pre-filled returns much more viable.

To understand why changes need to be made, take, for example, the British system of “pay as your earn.” In some sense, it is similar to the US withholding system. Taxes are withheld from every paycheck. But it’s radically different than the US in another way: the amount of withholding is adjusted throughout the year, so that at the end of the year you’ve paid the exact right amount (unless you have other non-wage income, such as being self-employed, then you need to file a return). In the US, employers withhold taxes from your check based on an estimate of how much tax you will owe. That estimate does include most of the relevant information for someone with a simple tax situation, such as whether you are married and how many children you have. So what’s missing?

In addition to the possibility of self-employed income, there is one major thing missing from your income tax withholding estimate: your spouse’s income. You see, the United States is one of the few remaining OECD countries that primarily taxes income based on the family unit (you can use “married filing separately” as a status, but generally there is no benefit and you might lose some deductions). Most countries tax based on your individual income, even if you are married. This is important for two reasons. First, it means there is a “secondary-earner penalty,” where one spouse faces a much higher marginal tax rate (this is different from the “marriage penalty,” but that’s a topic for another day. For purposes of a pre-filled tax return, the second and larger issue is that your employer has no idea how much tax to withhold because it is dependent on how much your spouse makes (and whether you are married).

Moving the US to a system of individual taxation to joint taxation would improve the tax system in a number of ways, but a big one is that it would simplify the calculation of your taxes. And many countries, including the UK, have moved to this sort of system in the later part of the 20th century. Prior to 1970, just one country (Greece) used individual rather than joint taxation, but now it is the most common way to tax income in the OECD, and many US states also tax income this way or otherwise eliminate marriage penalties.

Another reform/simplification which would also make pre-filled returns more successful is to just do less through the tax code. The United States uses its tax code to do a wide range of things, such as “spending” revenue on various goals that could be done through the normal budget (and it’s not a small amount of money), trying to encourage various behaviors, and so on. Many of these show up as “itemized deductions,” but that is by far not the only place in the tax code. To again use the UK as a model, they do allow some deductions, but it is much more limited. Some charitable contributions are deductible, but even this is simplified since it can be done through the payroll system (and thus incorporated into taxes withheld). Mortgage interest, one of the big deductions in the US, doesn’t exist in the UK (though it did from the early 1980s until 2000 — big deductions can be eliminated politically!).

Other changes could be made too which are both good and increase the likelihood of a pre-filled system being successful. But let me close by pushing back on the idea of a pre-filled tax system in a little bit. Let’s imagine we had a system that was 100% accurate, and it could all be done through withholding. I think there are some severe downsides to this idea. Chiefly is that I believe that citizens should be well-informed about how their government functions, including how the tax system works. Knowing how your own personal situation is affected by the tax system is a key way of understanding the system overall. For example, judging by the replies to a recent Tweet of mine, many college graduates don’t seem to realize they or their parents got several thousand (perhaps $10,000) of tax credits while they were attending college!

Of course, most Americans are politically ignorant in many ways already. But I do worry that moving to a pre-filled tax system would make them even more ignorant. My guess is that most Americans have no idea how much they pay in income taxes per year. There isn’t even one line you can look to on the current tax form to see that total amount! Maybe, maybe, a pre-filled tax return would increase voter knowledge by have a clear “tax bill” line which showed you how much you paid. But my guess is that it would even further detach Americans from understanding how the tax system works, which would make the public debate over taxes even worse (and it’s pretty bad already).

This sounds like a great idea. It doesn’t have to be perfect, it just needs to be better than the billions of hours lost every year with the current system.

1. Everytime I fill out my taxes, 40% is stuff the IRS already knows (It’s the same W2 my employer sent you!) and 40% is irrelevant (farm income? wash sales?)

2. I’m guessing a majority of people with a complicated income situation (self-employed, trust fund, multiple incomes, etc.) can afford a tax professional, anyway.

3. Simple corrections, like linking spouses’ SSNs, are simple.

4. If the correction isn’t so simple? I’ll have to fill out an additional schedule… which I do now, anyway.

5. You can’t seriously think that filling out a 1040 is an effective civic teaching tool. But if you really value that “feature”, how about turning the “pre-filled” form into an itemized receipt? You saved X because of your retirement plan, Y for mortgage deduction, Z for having kids. Thank you for your payment. ($X will be sent to the social security fund, Y to the DoD, Z to the national park system….)

LikeLike

The current tax system is doing a horrible job educating people about the taxes they pay. The forms are incredibly complex and difficult to follow.

A pre-filled system could include an explanation of taxes that explains the major factors leading to your taxes being higher or lower, with actual or approximate numbers where possible.

LikeLike

a fairly logical step towards tax incentives, or vice versa, tightening entry taxes so that uncertified products do not enter the US market, this is primarily a concern for the end consumer

LikeLike