A corporate tale

Once upon a time I was enrolled in a project economics training workshop at a certain unnamed (but generally honest) S&P 500 company, taught by a finance guy from corporate. We got on the subject of making assumptions. The planner knew he was among fact-friendly engineers, not corporate toadies, so he unguardedly told us a story. He was part of a team of young up and coming managers who (as often happened at that stage in their career track) were thrown together in a planning role. They were tasked with coming up with a plan for the upcoming year for I think some large division of the company. They worked hard and put their most realistic assumptions into the plan, and found that, as a result of market shifts beyond our control, next year’s earnings were going to decline slightly.

When they presented this result to management, they were told, “No, go back and bring us a plan for how we are going to grow earnings by [say] 8% next year.” The quick-witted young planners got the message and went back and tweaked their assumptions until they got earnings to grow the required amount. They weren’t exactly lying, but they all knew their “plan” was not straight down the middle realistic. However, the managers were happy, and that was what mattered. Such is the corporate mindset. If analysts or planners want to succeed in their careers, they have to produce what is desired by the layers above.

Earnings “beats” are often pointless

According to FactSet, with the vast majority of S&P 500 companies having reported their first quarter (Q1 2023) earnings, 78% of them reported actual earnings per share (EPS) above the mean average of analysts’ estimates. So nearly 80% of companies “beat estimates”. Woo hoo! What a great quarter for earnings!

But… the actual S&P 500 earnings declined by 2.1% from the previous (actual) earnings. Hmm, maybe not such a great quarter after all. And this is on top of a decline in the previous quarter, as well. But nobody talks about that.

This is another example of the systematic bias in “earnings estimates”, which makes the quarterly hurrahs over “beating” estimates somewhat silly. We have complained about this earlier. Here is the problem: most published analysts are employed by investment banks or similar “sell-side” institutions which are always courting the favor of large companies, since they want the companies to do business with them. What sorts of earnings estimates do the corporate brass want to see?

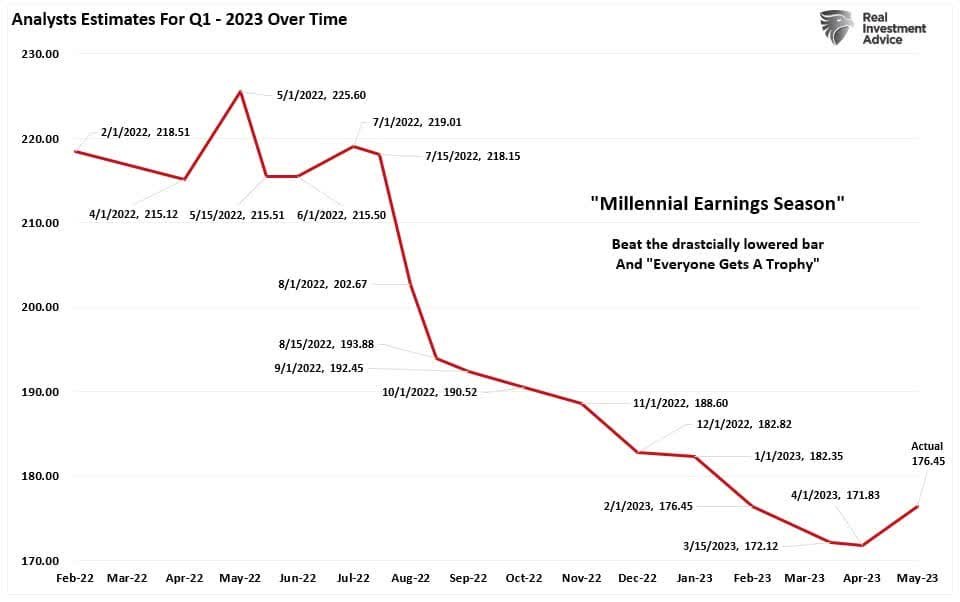

Well, for earnings that are due to be reported a year or more in the future, they want to see high estimates, which would justify high stock prices now. And for earnings that are due to be reported in a few weeks, the managers want to see low estimates, which they can then (tah-dah!) “beat.” And so, we see a reliable pattern of analysts starting with unrealistically high estimates, and then ratcheting down, down, down in the year before the actual reporting date.

Bring on the charts

A recent article by Seeking Alpha author Lance Roberts illustrates some of these trends. I pulled a couple of his charts here. First, here is a plot showing the decline in Q1 2023 estimates over the past 18 months or so, as analysts do their usual dance:

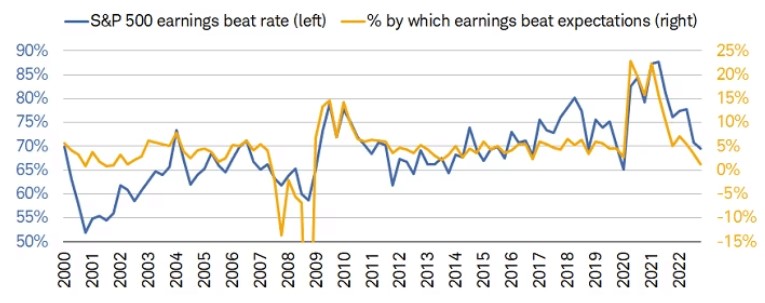

The blue line in the figure below shows the percentage of S&P 500 companies which “beat” their final (lowered) estimates. If the estimates were fair and unbiased, we would expect this number to be around 50%. In fact, in the past decade it has been around 70%, and growing with time.

Earnings beats or misses do get headlines and contribute to near-term stock price moves, but from a fundamental point of view there is more sizzle than steak here.