I like a good lump sum tax. People *must* pay the tax without exception and the advantage over current progressive marginal income taxes is that the marginal wage received doesn’t fall with greater earnings. Employment rises and output rises. To the extent that college students fail to understand their student loans, the indebted graduates essentially pay a lump sum tax each period.

Of course, the exception is income based repayment (IBR) – especially with forgiveness after X years. IBR adjusts the incentives substantially. Under the standard system, your wages are garnished if you fail to make loan payments. Under IBR, lower earnings trigger lower monthly payments. Clearly, in contrast to the standard method, IBR incentivizes more leisure, less income, more black market activity, and higher loan balances. Indeed, all the more so if there is a forgiveness horizon. Someone just has to have low enough income for say 15 years, and their past debt is forgiven (with caveats & conditions).

My principal objection to IBR policy is the resulting malinvestment in human capital. Defaulting on loans is a sign that some investment was inadequately productive to repay the resources consumed by its endeavor. We call that a loss. Real resources of time, attention, and goods and services were consumed in order to produce capital that failed to serve others more than the opportunity cost of those resources.

Indeed, we really need to know the purpose of government’s involvement in student loans. If the purpose is to incentivize human capital production as such or to reward a particular constituency, then it’s not clear that paying back any loans is sensible policy. After all, more education can produce plenty of human capital – graduate degrees for everyone! But, if the purpose is to encourage productive human capital, greater incomes, and higher standards of living, then the design of loan repayment is important (and necessary).

Of course, the government could design a system that helps to filter students by the college major that is right for them and place students on free tracts for specialization. But people in the US find it distasteful to remove an individual’s choice in lieu of government designs on this margin. Barring such a system, standard loan repayment provides the correct incentives.

One of the strongly implied reasons for debt forgiveness and IBR is for the alleviation of suffering. Indebted people would prefer to not make payments. I have all sorts of feelings about justice and thoughts about incentives. But, that doesn’t make debt relief any less of a socially acceptable concern. It’s a public policy priority whether I like it or not.

Is there some middle ground?

One scheme is for the lender to instead be a equity shareholder. That is, instead of the borrower owing debt payments, they could instead owe a percentage of their income for a defined period of time. Purdue University tried this for a period. But the funding for it fizzled out. That’s a predictable outcome because when the rubber meets the road, there is nothing to stop a student from staying home or otherwise abstaining from activities which produce income. The IBR system is partially this anyway. Borrowers make debt payments if they have high incomes, with a limit on the lender’s upside, and then borrowers make equity payments as a percentage of earnings if they have low incomes. The IBR system gets left holding the bag either way. What a cruddy investment!

One scheme would be to adopt the equity model at all levels of income with expiring shares. It’s not sensible to have the shares expire anytime soon. The shares could expire at death, or maybe after 40 years. There’s an argument to be made that the social security retirement payments are a function of the human capital investment and should be counted as income. This is called indentured servitude, and people don’t like the sounds of that.

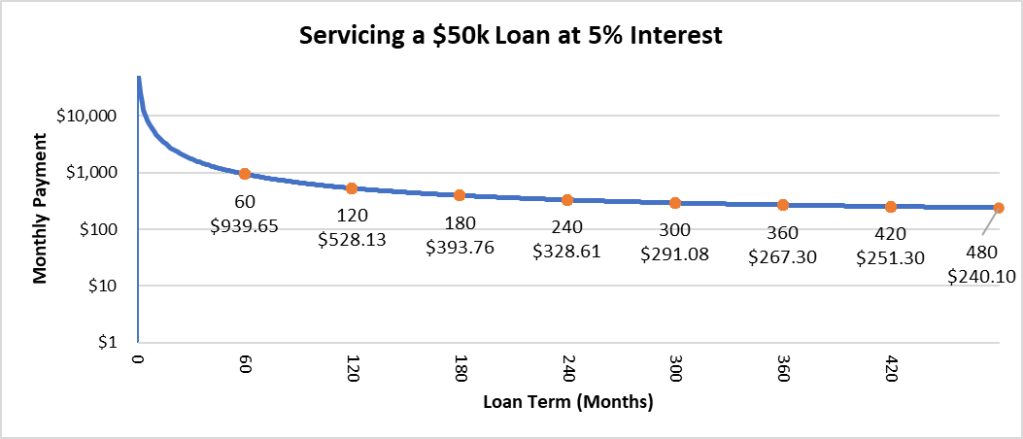

Another ‘middle way’ would be to substantially lengthen the term of student loans. Instead of 10 or 15-year payment plans, we could adopt 40-year payment plans. In this manner, the debt could be repaid early, the payments would be low, and more appropriate incentives would be in place for the creation of long-living productive capital. The debt would not vary with income or be forgiven prior to the 40 year term – there would be less need, given the smaller payments. Below is a graph of the monthly payment at different loan terms. A monthly payment of $240 is very affordable now and it would be even more affordable after 40 years of inflation.

This system has some advantages. Being debt, it can be paid-off early, so no indentured servitude. Politically, it keeps payments low and alleviates suffering and misery. We could even permit the conversion of existing loans to maturity dates at the borrower age of 62, alleviating sentiments of injustice. My ideal would be to have no payment suspensions of any kind. But, I suspect that unemployment or other hardship exceptions would remain applicable as a political matter. The above system is clear and I strongly prefer it to the shell game of obscure benefit transfers to favored constituencies. The current student loan policy mess exemplifies the words of Frederic Bastiat as “the great fiction, through which everybody endeavors to live at the expense of everybody else.”

This scheme of extending student loan payments does nothing to impede colleges and universities from increasing tuition on a yearly basis. Tuition rates started to increase once Sallie Mae was able to lobby Congress to remove bankruptcy protection for private student loans. Big Ed has to have some skin in the game, and the only way for colleges to self-regulate tuition prices to a more affordable level is if student loans can be partially dischargeable for amounts above what would be the rate of inflation. The market works!

LikeLike

Sorry if I’m missing something. Discharging student loans would increase demand (because they are cheaper). Loan payments go to the lender, not to the University who has already been paid. Discharging student loans with*increase*the price due to the higher demand.

I am very much in favor, however, of lenders offering different interest rates and discriminating by major and institution. Lenders could also approve maximum loan values per semester by institution according to repayment rates of prior graduated classes. Or the government could just get out!

LikeLike