I keep reading and hearing people who are waiting for the shoe to drop on the next recession. They see high interest rates and… well, that’s what they see. Employment is ok and NGDP is chugging along.

One indicator of economic trouble is the delinquency rate on debt. That’s exactly what we would expect if people lose their job or discover that they are financially overextended. They’d fail to meet their debt obligations. But the broad measure of commercial bank loans is quiet. Not only is it quiet, it’s near historic lows in the data at only 1.25% in 2023Q2. Banks can lend with a confidence like never before.

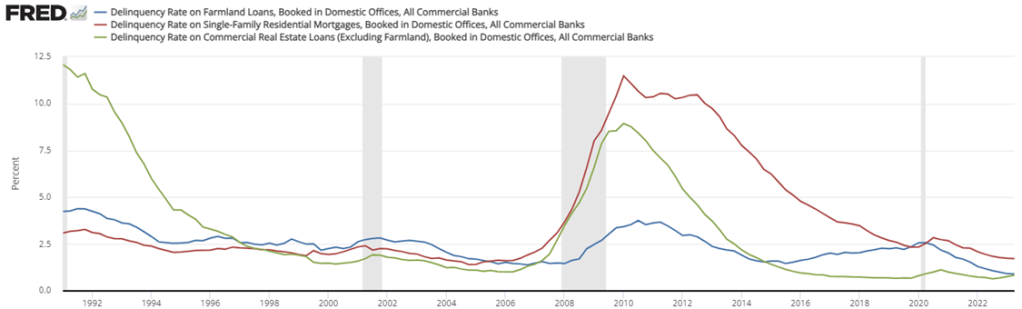

But maybe that overall delinquency rate is obscuring some compositional items. After all, we know that many recessions begin with real-estate slowdowns. Below are the rates for commercial non-farmland loans, farmland loans, and residential mortgages. All are near historical lows, though there are hints that they’re might be on the rise. But one quarter doesn’t a recession make. I won’t show the graph for the sake of space, but all business loan delinquency rates have also been practically flat for the past five years.

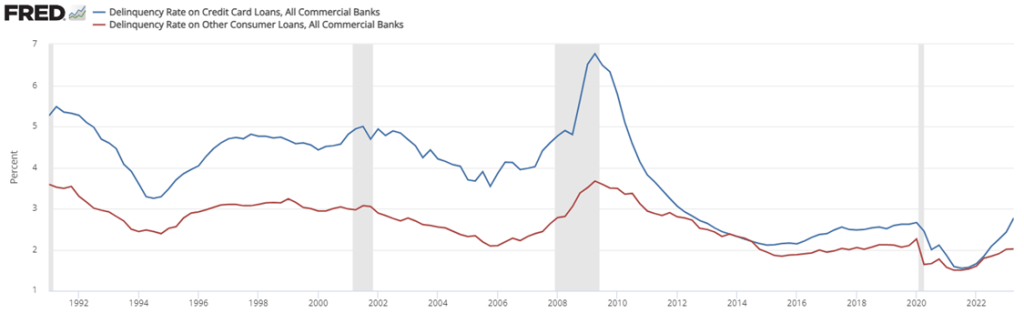

Consumption is the largest component of spending in the US economy. How are consumers doing? Below illustrates the delinquency rate on credit card debt and other non-mortgage debt. Now we’re starting to see some action. Both rates have risen steadily since the 2nd half of 2021 – especially credit card delinquency rates which have been on a steady march upward, more than doubling over the course of the past year. In fact, they haven’t been this high since 2012. But, both rates are still quite low by historical standards.

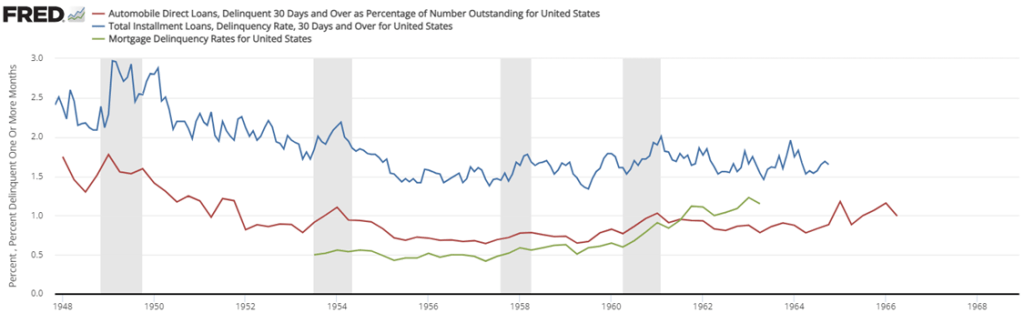

Such steep rises in credit card delinquency have only happened twice in the modern data. Once was prior to the 2008 financial crisis, and the other was prior to 1997 when there was no recession and we had the fastest RGDP growth of the decade. We do have access to some related historical data however. Below are several consumer loan delinquency rates for the mid-twentieth century. If history is any judge, then I’m not seeing consumer debt defaults as a harbinger of recession. Indeed, it looks more like a coincident or even lagging indicator.

IOW, there’s no impending recession in this data.