Higher homeowner’s insurance premiums have been in the news. But are we just hearing about the extreme cases? This post is inspired by the FRED Blog post about property and casualty (P&C) insurance premium producer price indices. I dive a little deeper.

The insurance premium data is composed of seven components:

- Private passenger auto insurance

- Homeowner’s insurance

- Commercial auto insurance

- Non-auto liability insurance

- Commercial multiple peril insurance

- Worker’s compensation insurance

- Other property and casualty insurance

Non-auto liability insurance is further split up into A) medical malpractice insurance and B) other non-auto liability insurance.*

Before we look at the data, I can speak about my local experience in Southwest Florida. Specifically, my Homeowners Association is required to carry insurance on the external part of the townhomes. When I joined the board in 2021, our annual premium was $15k. By the end of the year, the carrier went into receivership. In 2022 our premium was $30k. And in 2023 it was closer to $60k. We won’t know until this summer, but we budgeted for the 2024 premium to be $90k.

This is a lot of money for an HOA with relatively few units. I’ve heard that the reason for the rise is 1) the rise in the value of properties, and 2) the nearby damages cause by hurricane Ian in 2022. Despite the high hurricane resistance of the homes in my particular town, Florida is generally susceptible to hurricanes. We also had greater demand for housing and consequent higher prices for homes after the Covid recession.

But is my experience generalizable? Let’s look at the national data. Below are the national series for all P&C and for homeowners insurance premiums going back to 1998. First, both have risen over time and general P&C has cumulatively risen at almost exactly the same rate as consumer prices. Homeowners insurance premiums have risen faster over the past 25 years, but we can see that they rose especially quickly prior to 2006 and in 2023.

Those two periods of rapidly rising premiums were each after periods of surging home prices. Insurance rates respond with a lag as policies are renewed. So, there sensibly seems to be some to the idea that high home prices contribute directly to insurance premiums. In one sense, it’s not at all surprising. In another sense, at least you now know that you’re not alone. Rising homeowners’ insurance premiums have been a recent trend at the national level.

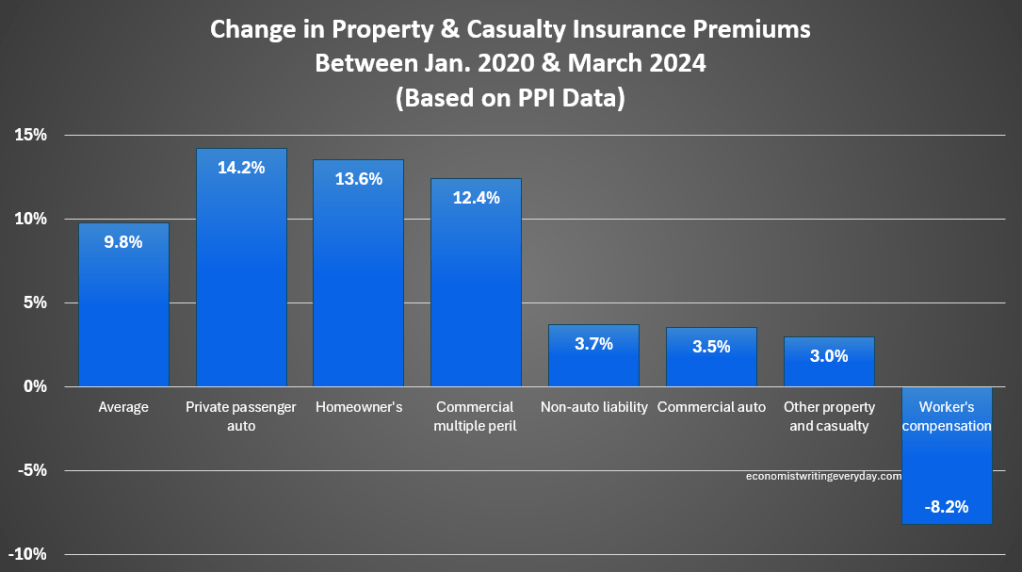

Below is the change in premiums since the pandemic for different types of P&C insurance. Cumulative inflation during that period was 17.1% and none of the premiums have outpaced general inflation (so far). And national all transaction house prices have increased by 46%. Insurance premiums are rising, but not nearly as much as the other goods in the consumer basket and nowhere near as fast as the price of housing. That’s a bit mysterious to me. If home values rise, then with constant risk proportionally higher premiums. My knee-jerk reactions are that: A) maybe there has been a policy intervention that has affected premiums, and B) maybe the higher premiums are yet to come. Regardless, the national figures don’t come close to the 4-fold increase that my HOA has experienced in SWFL. Florida may not be alone in its insurance premium craziness, but it’s not been crazy for the entire US.

Also worth noting in the above figure is that worker’s compensation insurance is *down* 8.2% over the past four years. I don’t know why that is, but my quick-and-fast explanation is that fewer people in-person means that there are fewer people to insure. Working from home carries much less liability for employers.

*There’s not a lot of excitement in these areas. Medical malpractice premiums rose by 0.9% and have been pretty flat for the past decade. Product and other non-auto premiums rose by 4.2%.

Insurance markets are regulated by the states, not federally, so what Florida requires from insurance companies may differ considerably from what Kansas requires. This may also be leading to the disparity in premium increases across the country.

LikeLike

Absolutely

LikeLike