It seems to be an accepted fact that there is a momentum effect with stock prices: a stock which has done well over the past 6-12 months is likely to continue to do better than average over the next six months or so. A number of funds (ETFs) have been devised which try to take advantage of this factor.

On the other hand, sometimes trends reverse, and stock that was hot twelve months ago has now run up in price, and may be due for a pause.

Here we will compare several momentum ETFs against the plain S&P 500 fund, SPY. In order to make it an apples-to-apples comparison, I am looking mainly at momentum funds that primarily draw from the S&P 500 large cap universe of stocks, excluding small-cap or tech only funds. [1] These large cap momentum funds are MTUM, JMOM, and SPMO. These funds all select stocks according to various rules. Besides trying to identify stocks with raw price momentum, these rules typically aim to minimize risk or volatility. I added one outlier, GMOM, that is very diversified. This fund does not hold individual stocks. Rather, it draws on some 50 different ETFs, including funds that focus on fixed income, commodities, or international or small cap as well as large cap US stocks, seeking to hold funds that show good relative momentum.

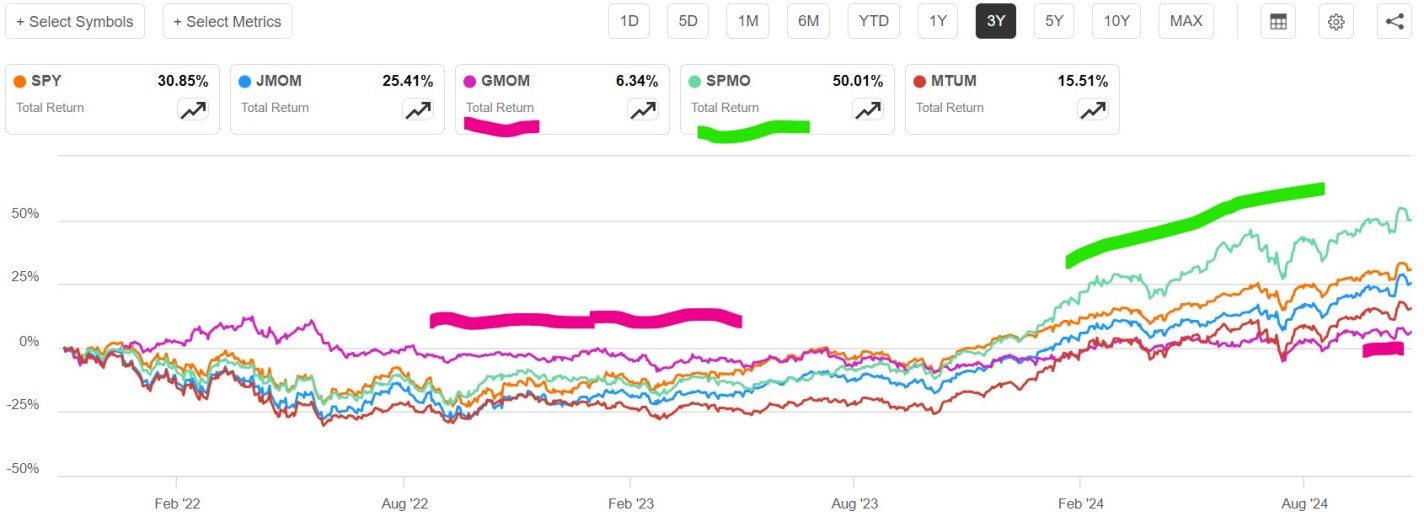

A plot of total returns over the past three years for these funds is shown below. It can be seen that plain SPY (orange line) beat all of the momentum funds except for SPMO (green line) in this timeframe. This is partly explained by the fact that SPY itself is a sort of momentum fund: the more a given stock’s price goes up, the bigger its representation in this capital-weighted fund. Also, over the past ten years or so, simply the biggest companies (the big tech quasi-monopolies like Google, Microsoft, etc.) have been generating more and more earnings, leaving the traditional auto and oil companies and banks, etc., in the dust.

By not focusing on U.S. large cap stocks, the diversified GMOM (marked with purple highlighter line) is less volatile. Its price did not drop nearly as much as the other funds in 2022, but it missed out on the great 2023-2024 stock run-up. SPMO (marked with green highlighter) really took off in that 2023-2024 big tech fiesta, by virtue of being concentrated in stocks like Nvidia, which went up roughly 10X in this timeframe. But this outperformance may be something of a one-off lucky strike. SPMO is still about the best of the momo funds, normally at least keeping up with SPY, but it does not consistently outperform it.

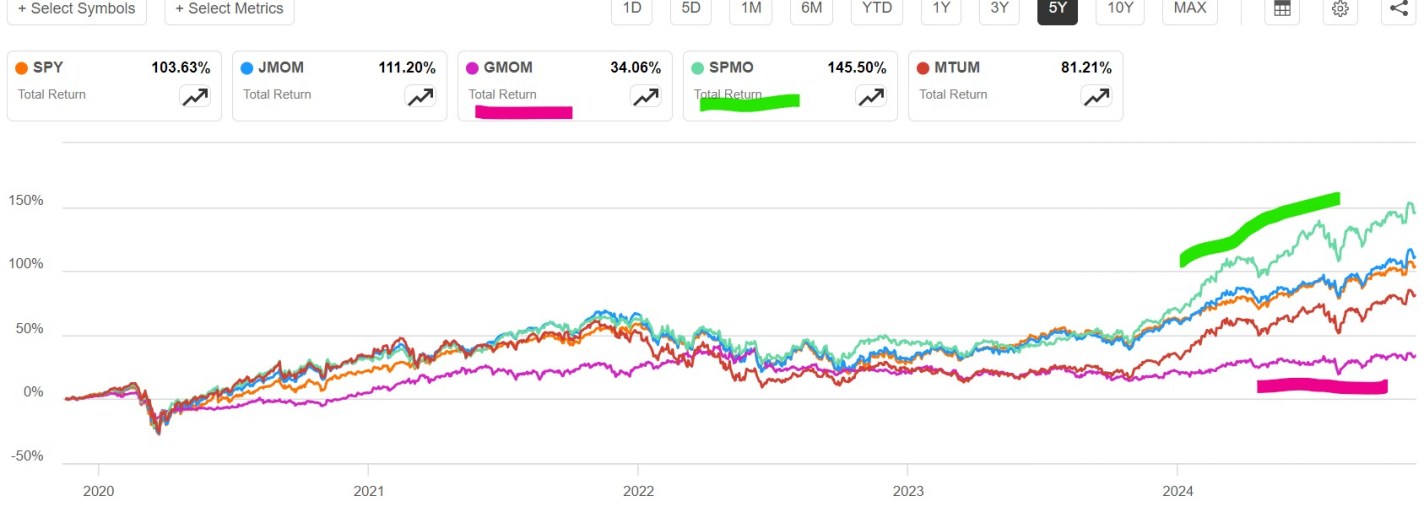

The five-year plot below illustrates similar trends, though it is a bit harder to read. Again, SPMO (green highlighter) largely keeps up with SPY, with a big outperformance spurt at the end. And GMOM is pretty flat; that really hurt it in the big 2020-2021 runup of big tech stocks. Over this five-year timeframe, JMOM kept up with SPY, and actually edged a bit ahead. MTUM, like most of the stock momo funds, actually ran ahead of SPY in the 2020-2021 runup, but fell somewhat more in 2022, and then got left in the dust in 2023. It is likely that it fell prey to trend reversal, which is a constant hazard for momentum funds. For most of 2022, the “best” stocks were dull value stocks, while tech stocks did terribly. Thus, a plain momentum algo fund would come into 2023 loaded with non-tech stocks. I suspect that is what happened to MTUM.

It happens that the SPMO algo has features that try to protect it from loading up on non-growth stocks during a bear market. So, it seems to be the best general momentum stock fund. It selects stocks which have shown positive momentum over the past twelve months, with the most recent month excluded (so as not to discriminate against a stock which had a temporary drop). Its chief vulnerability is that it only updates its holdings once every six months (mid-March and mid-September), so it is often acting on very old information. (Supposedly, it is better to update a momentum fund every three months).

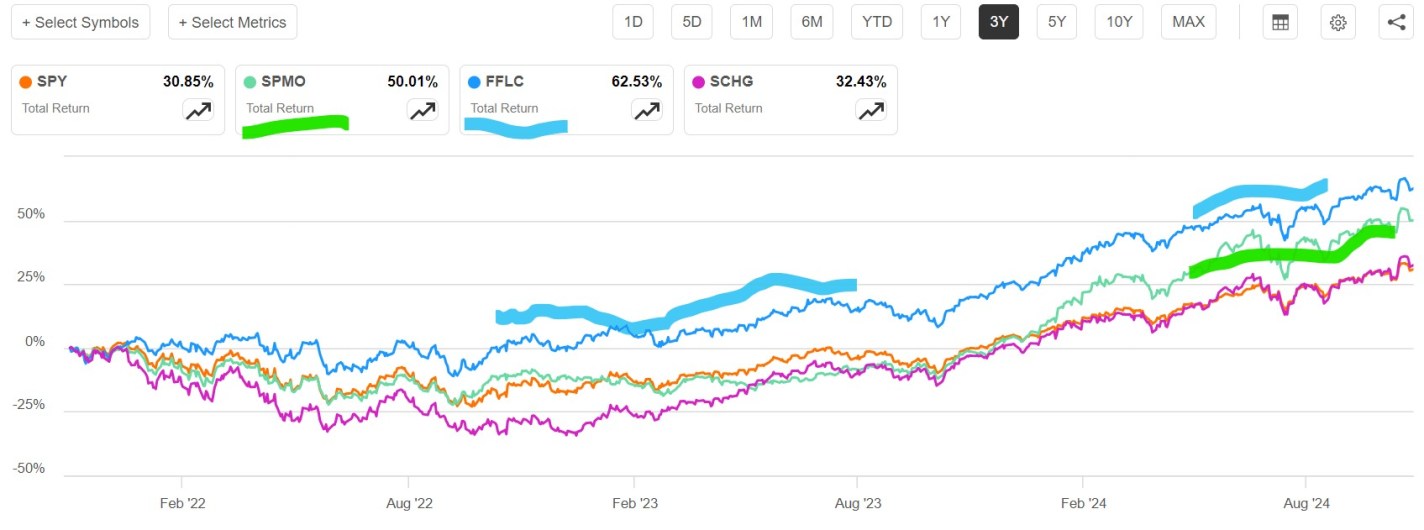

How does SPMO compare to a top actively-managed fund like FFLC or plain growth stock fund SCHG? The three-year plot below shows that FFLC (blue line, 63% total return) beat SPMO (green line, 50% return). Although SPMO had an impressive surge in the past year, FFLC just kept steadily outperforming SPY over the whole three-year period. This suggests that having good human judgement at the helm, able to adapt to differing market environments (2022 bear vs. 2023-2024 tech bull) can do better than a single, focused algorithm. I prefer a fund which keeps steadily outperforming “the market” (i.e., S&P 500) rather than one which only occasionally has moments of glory, so I hold more FFLC than SPMO.

In the plot above, the growth fund SCHG suffered more in 2022 when the tech high-flyers fell to earth, but made up for it in 2023-2024, to end up matching SPY over three years. On longer time-frames, SCHG handily beats SPY, as we noted in an earlier article on growth stocks.

[1] See this Insider Monkey article for a listing of ten best U.S. stock momentum funds. Some of these focus on small cap, mid cap, or technology stocks.

One thought on “The Trend Is Your Friend: Momentum Stock Funds”