Everybody follows a different path. Sometimes that path includes a late start on saving for retirement. Say that you have $0 in your retirement account right now. Is it too late? What can you get as a result of contributing $100 per month? Maybe more than you think.

Let’s start with an annuity equation that tells us our balance at retirement with some assumptions baked in. Let’s assume that we have zero dollars saved and contribute $100 per month. What rate of return do we earn? The S&P earns an average of 10% per year, which may not keep happening. We can conservatively assume 7.5%, but there are other concerns. Taxes and inflation will both eat away at that. Let’s subtract 2.5% for inflation with the Fisher approximation, leaving a real rate of return of 5%. We’ll chop off 20% due to taxes*. Below is the annuity equation that tells us the balance at retirement, depending on how many years from now you retire.

Assuming that you retire at 65 years of age, the graph below describes your balance at retirement depending on the age at which you started saving $100 per month. Of course, it’s not the balance that most people are worried about. Rather, we care about the implied monthly retirement check. The graph describes that on the right axis too, assuming that constant real payments will be made forever as perpetuity payments. We can see that getting started early matters a lot. But starting at age 40 still gets you real monthly retirement payments that are just shy of $200. That’s not too shabby.

Of course, nobody receives all of the perpetuity payments.

We all expect to live to some age that is less than forever. So, the size of your monthly retirement check depends on the number of years that you expect to collect before kicking the bucket. The longer your retirement lasts, the smaller the monthly payments that you can afford to pay yourself. There’s an explicit tradeoff. Assuming that you receive payments during each month of retirement, you can get bigger retirement checks or you live longer. Given some balance at retirement, you can’t increase one without decreasing the other.

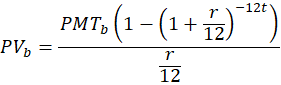

How does your lifespan affect the size of your monthly check? We’ll use the annuity equation again, but this time we assume that you time your demise perfectly such that the balance is zero when you meet the grim reaper. The PV is your balance at age 65, t is the number of retirement years that you receive monthly payments of PMT, and r is the same as earlier. We now face the problem that, even assuming that we know r, we have three variables. Our balance at 65 matters a lot.

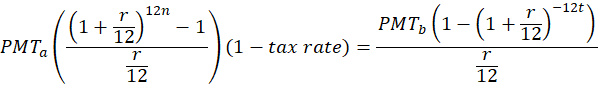

Luckily, we already found a way to find the balance at retirement. We can endogenize it to the first equation at the top by assuming that our balance is just what we accrued from our monthly $100 contributions to our retirement account. Substituting gives us:

Solving for the monthly retirement check, we can see that it depends on n, the number of years we contributed to our retirement account, and t, the number of years that we receive monthly payments in retirement. Solving for the monthly retirement check amount and assuming our same real rate of return and monthly contribution yields:

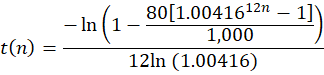

We still face the problem of having 3 unknown variables. To address this, we’re going to create something analogous to an isoquant – an isopayment. Let’s assume that you want to receive monthly retirement payments of $1,000 after taxes. What combinations of contribution years and retirement years can yield that outcome? Easily, we just solve for t as a function of n. Now we can graph it!

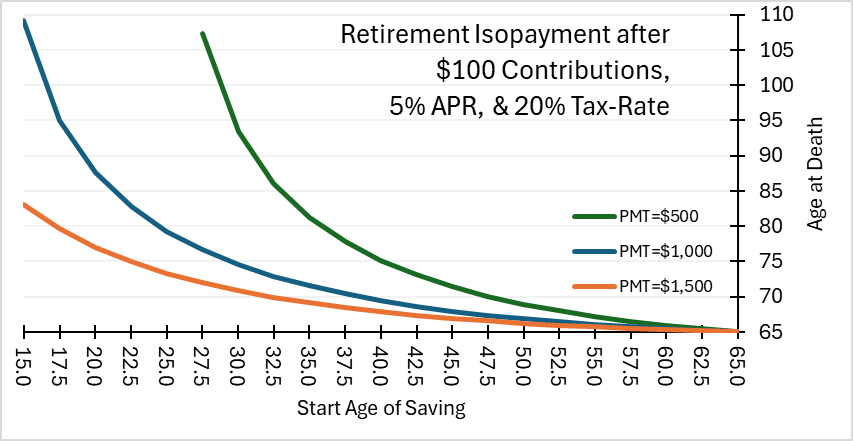

Below is the graph that fixes everything except the age at which someone begins contributing and the age at which they meet their maker. If you want to enjoy $500 of real, after-tax monthly income once you hit age 65, then you can start your modest $100 monthly contributions by the time your about 36 years old – assuming you only plan to make it to age 80. If you plan to be a centenarian, then you’ll want to start contributing by your late 20s.

The point is that we have options. Knowing when we start contributing (and how much) and our life expectancy gives us a sense of what our retirement checks will be. Economics is the dismal science, and your attitude toward the topic at hand depends on your perspective. If you plan to reach the national life expectancy age of about 77.5, then you can get a net real retirement payment of $500 if you start contributing $100 by age 38. Or, if you want $1,000, then you must start contributing by age 20. You notice that the iso-payments seem to have a vertical asymptote. Indeed, if you start contributing early enough and your monthly retirement check is small enough, then you can afford to live forever. And it only costs $100 per month.

*Whether you pay your 20% at the time of contribution or withdrawal doesn’t matter if you’re in the same tax bracket in both cases.

“the national life expectancy age of about 87.5”

Its currently 77.5 for the US

LikeLike

yes!

I realized that I flipped the digits, then forgot to fix it. Thanks! And, it means that one can start saving at 38 rather than 33 for the same monthly payment.

LikeLike