41 states now require students to take a course in economics or personal finance in order to graduate high school:

12 states representing 21% of US high schoolers passed mandates for personal finance classes just since 2022. This sounds like a good idea that will enable students to navigate the modern economy. But does it work in practice?

A 2023 working paper “Does State-mandated Financial Education Affect Financial Well-being?” by Jeremy Burke, J. Michael Collins, and Carly Urban argues that it does, at least for men:

We find that the overall effects of high school financial education graduation requirements on subjective financial well-being are positive, between 0.75 and 0.80 points, or roughly 1.5 percent of mean levels. These overall effects are driven almost entirely by males, for whom financial education increases financial well-being by 1.86 points, or 3.8 percent of mean financial well-being.

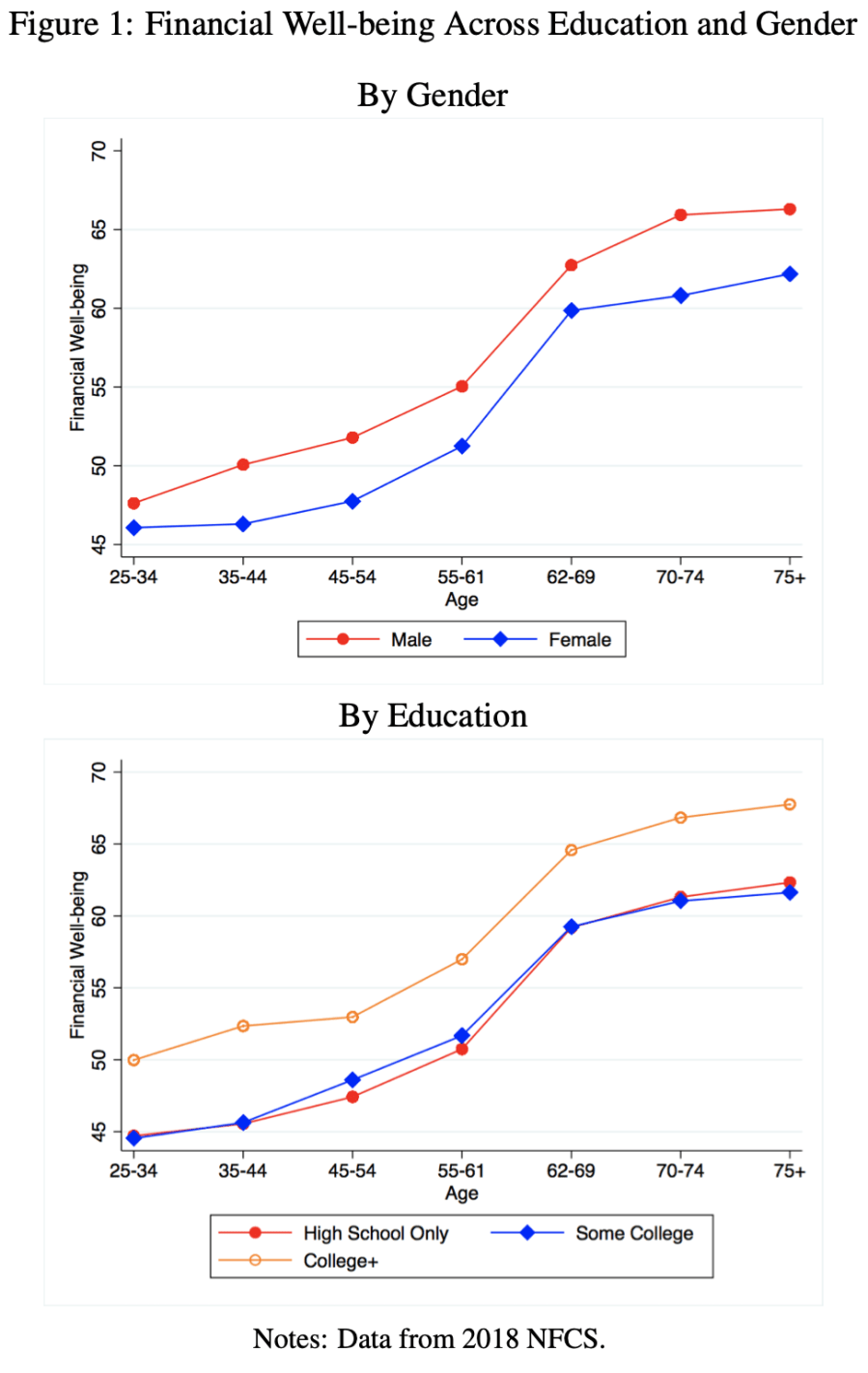

The paper has nice figures on financial wellbeing beyond the mandate question:

As soon as I heard about the rapid growth in these mandates from Meb Faber and Tim Ranzetta, I knew there was a paper to be written here. I was glad to see at least one has already tackled this, but there are more papers to be written: use post-2018 data to evaluate the new wave of mandates, evaluate the economics mandates in addition to the personal finance ones, and use a more detailed objective measure like the Survey of Consumer Finances.

There’s also more to be done in practice, hiring and training the teachers to offer these new classes:

our estimates are likely attenuated due to poor compliance by schools subject to new financial education curriculum mandates. Urban (2020) finds evidence that less than half of affected schools may have complied. As a result, our estimated overall and differential effects may be less than half the true effects

I am the Director of Education at the Florida Council on Economic Education. We are a non-profit with a 50 year history of training teachers, developing curriculum, and providing in-class simulations in Economics and Personal Finance. All of this at no cost to the teachers. We also lobbied for years to mandate personal finance as a graduation requirement and were thrilled when it was finally signed into law. As you would suspect, there were a variety of reasons why the legislation took so long to get to the finish line. But there was one obstacle year after year that almost proved an immovable force, resistance from school superintendents to another mandate from the DOE. Especially one that would arrive unfunded. No money for training, resources, or any aspect of the rollout of the course. All Districts know is that the class of 2027 must have this course under their belt to graduate. The State DOE has updated the standards for instruction but has left the remainder of the implementation up to the local Districts. Questions pertaining to the placement of the course in the four year sequence, teacher training, appropriate support materials, and, since it’s a half year course, what to match it with in a full-year course guide vexed many Districts. I travel across the state and speak with personnel from large and small Districts. I train teachers, write curriculum and distribute it freely, we produce a consumable workbook aligned with the latest standards for classroom use, and we offer a stock market and budgeting simulation state-wide for classroom use. We do this today, without any funding from the State. It is my observation that many Districts have been dragging their feet and that teachers are so overwhelmed with the deteriorating climate here in public education that they have little drive for working beyond their required time. As a result, students are receiving a product pushed out of the factory that has been assembled in haste and without much of a blueprint. There is no state-wide assessment to measure the efficacy of the course and in this era where every student graduates (no matter what) plenty of opportunities to fast-track a passing grade.

I believe students benefit from a well structured and carefully presented personal finance course. I’m skeptical of what is happening here.

LikeLike