Michael Burry is famed for being among the first to both discern and heavily trade on the ridiculousness of subprime mortgages circa 2007. He is a quirky guy: brilliant, but probably Asperger‘s. That comes through in his portrayal in the 2015 movie based on the book, The Big Short.

He called it right with mortgages in 2007, but was early on his call, and for many months lost money on the bold trading positions he had put on in his hedge fund, Scion Capital. Investors in his fund rebelled, though he eventually prevailed. Reportedly he made $100 million himself, and another 700 million for his investors, but in the wake of this turmoil, he shut down Scion Capital.

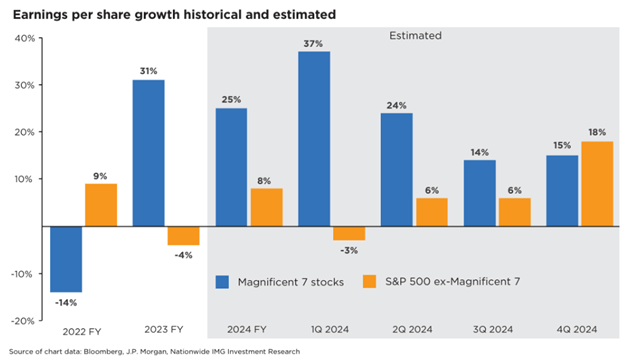

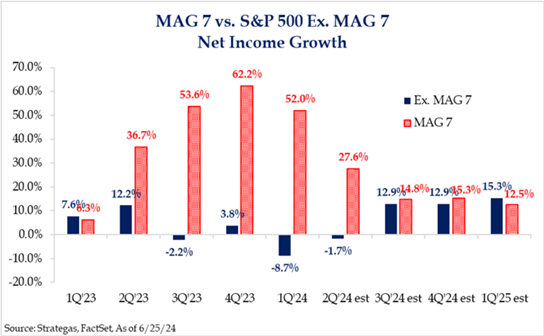

In 2013 he reopened his hedge fund under the name Scion Asset Management. He has generated headlines in the past several years, criticizing high valuations of big tech companies. Disclosure of his short positions on Nvidia and Palantir may have contributed to a short-term decline in those stocks. He has called out big tech companies in general for stretching out the schedule of depreciation of their AI data center investments, to make their earnings look bigger than they really are.

Burry is something of an investing legend, but people always like to take pot shots at such legends. Burry has been rather a permabear, and of course they are right on occasion. For instance, I ran across the following OP at Reddit:

Michael burry is a clown who got lucky once

I am getting sick and tired of seeing a new headline or YouTube video about Michael burry betting against the market or shorting this or that.

First of all the guy is been betting against the market all his career and happened to get lucky once. Even a broken clock is right twice in a day. He is one of these goons who reads and understands academia economics and tries to apply them to real world which is they don’t work %99 of the time. In fact guys like him with heavy focus on academia economic approach don’t make it to far in this industry and if burry didn’t get so lucky with his CDS trade he would be most likely ended up teaching some bs economic class in some mid level university.

Teaching econ at some mid-level university, ouch. (But a reader fired back at this OP: OP eating hot pockets in his moms basement criticizing a dude who has made hundreds of millions of dollars and started from scratch.)

Anyway, Burry raised eyebrows at the end of October, when he announced that he was shutting down his Scion Asset Management hedge fund. This Oct 27 announcement was accompanied by verbiage to the effect that he has not read the markets correctly in recent years:

With a heavy heart, I will liquidate the funds and return capital—minus a small audit and tax holdback—by year’s end. My estimation of value in securities is not now, and has not been for some time, in sync with the markets.

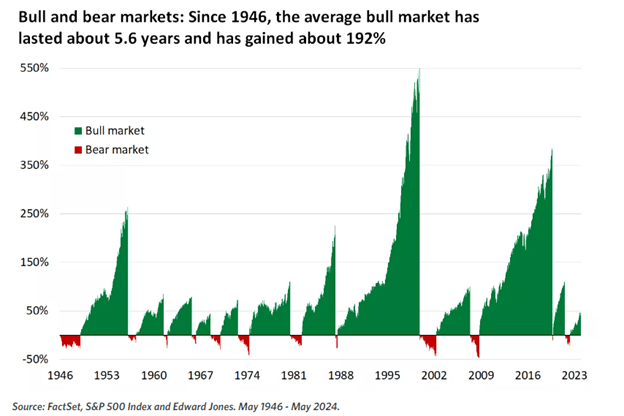

To me, all this suggested that Burry’s traditional Graham-Dodd value-oriented approach had gotten run over by the raging tech bull market of the past eight years. I am sensitive to this, because I, too, have a gut bias towards value, which has not served me well in recent years. (A year ago I finally saw the light and publicly recanted value investing and embraced the bull, here on EWED).

Out of curiosity, therefore, I did some very shallow digging to try to find out how his Scion fund has performed in the last several years. I did not find the actual returns that investors would have seen. There are several sites that analyze the public filings of various hedge funds, and then calculate the returns on those stocks in those portfolio percentages. This is an imperfect process, since it will miss out on the actual buying and selling prices for the fund during the quarter, and may totally miss the effects of shorting and options and convertible warrants, etc., etc. But it suggests that Scion’s performance has not been amazing recently. Funds are nearly always shut down because of underperformance, not overperformance.

Pawing through sites like HedgeFollow (here and here) , Stockcircle, and Tipranks, my takeaway is that Burry probably beat the S&P 500 over the past three years, but roughly tied the NASDAQ (e.g. fund QQQ). This performance would naturally have his fund investors asking why they should be paying huge fees to someone who can’t beat QQQ.

What’s next for Burry? In a couple of tweets on X, Burry has teased that he will reveal some plans on November 25. The speculation is that he will refocus on some personal asset management fund, where he will not be bothered by whiny outside investors. We shall see.