For what it’s worth, I will pass along a couple of points from an optimistic take on the current stock market pullback, by Seeking Alpha author Dividend Sensei. The article is “History Says Shut Up And Buy: 12 Hyper-Growth Blue Chips To Buy Right Now”. His thesis is that corrections come and go as specific fears come and go, but tech stocks only keep going up, so now is a good time to buy.

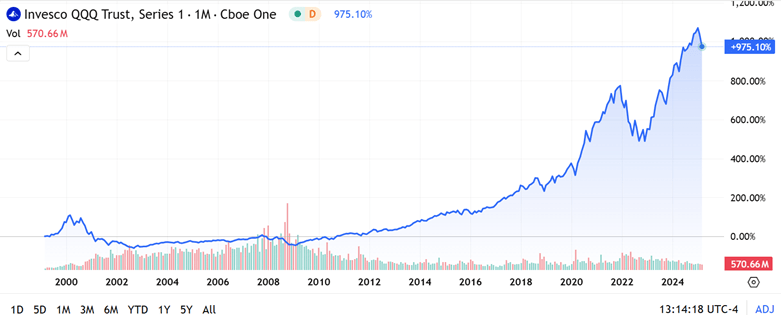

History seems to be on his side. Below is a 25-year plot of the NASDAQ 100 fund QQQ. It is true that on a really long scale, any significant dip would have been a good buying opportunity. And the run-up since 2016 has been astonishing. $10,000 invested then would be about $50,000 now. I find it sobering, however, that (just going by eyeball) it took about fourteen years for QQQ to regain its 2000 peak. That might be longer than most investors want to wait. And in the shorter term, these tech stocks lost some 80% of their market value between 2000 and 2002, and revisited that low in 2008. We can look back now from decades later and call this a “dip”, but at the time it felt like an endless investment nightmare.

(I should add that the 2000 peak pricing was not supported by appreciable cash earnings, but by breathless hype about this new thing called the “internet” that was going to change EVERYTHING. This past year has seen similar hyperventilation over AI, but in contrast to 2000, now the big tech firms make ginormous gobs of money, and gobs more each year. So maybe it really is different this time…)

QQQ total return since March 1, 1999; % scale. From Seeking Alpha.

The Psychology of Market Corrections

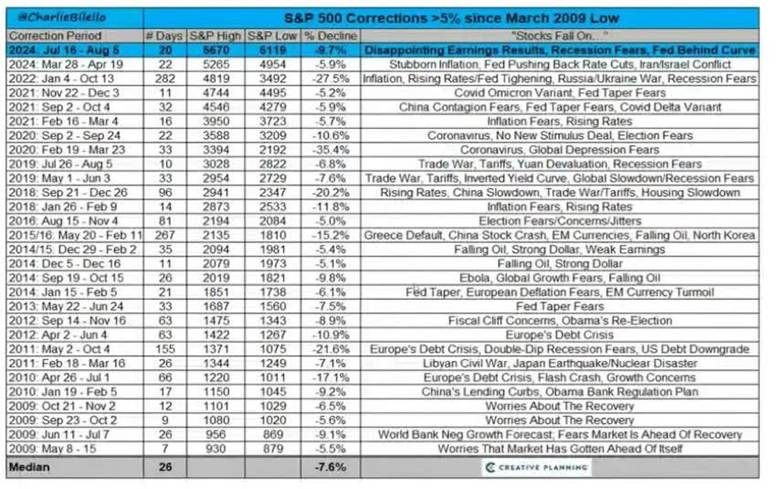

The author pointed out that every correction is based on some deep fear, and eventually that fear dissipates. I thought this table he showed of the fear factors involved in the 30 or so stock market pullbacks since the March 2009 low was interesting and instructive:

The type here may be hard to read, so I will repeat here the two most recent “fears” listed, both from 2024:

March 28-Apr 19 (5.9% drop): “Stubborn Inflation, Fed Pushing Back Rate Cuts, Iran/Israel Conflict”

July 16-Aug 8 (9.7% drop): “Disappointing earnings results, Recession Fears, Fed Behind Curve”

These are recent enough that any market-engaged reader here will resonate with these concerns which loomed so large at the time. And yet, the collective market shrugged them all off to post a robust 21% gain for all of 2024.

Where do we go from here? I have no idea. As of writing this Tuesday morning, we seem to be bumping along at a level 2-3% higher in QQQ than the lows last week, but still 10-11 % lower than a month ago. This has brought it to levels of about late September, 2024. If I look at a five-year log plot and draw an eyeball-fit straight line through it all, it seems like prices went above that line for Nov-early Feb, in a burst of post-election enthusiasm, but have now come back to the trendline. Barring some macro or geopolitical disaster, therefore, one might expect QQQ to trend 10-15 % higher in the next twelve months (with a standard deviation of another 10% or so around the trendline). But as old-time Yankees catcher Yogi Berra said, “It’s tough to make predictions, especially about the future.”

Disclaimer: Nothing here should be considered advice to buy or sell any security.