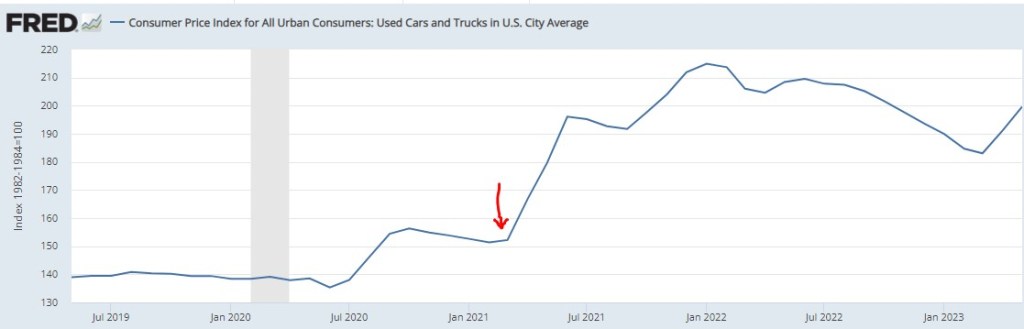

I write about various topics, usually with at least some loose connection to economics. Sometimes these are fairly macro issues, other times there are specific, actionable observations. For instance, back in March of 2021, we inferred from the critical shortages of semiconductors that car manufacturing would be severely crimped, likely leading to big price increases in cars. Our post “Chip Shortages Shutting Down Auto Assembly Lines; Buy Your Car Now Or Else” came out just in time (red arrow below) to alert the readership here:

https://fred.stlouisfed.org/series/CUSR0000SETA02 – – Consumer Price Index for All Urban Consumers: Used Cars and Trucks in U.S. City Average

Chocolate Prices

But now, a price increase of more ubiquitous import looms. Most of us were not in the market for cars in March of 2021, but some 81% of us eat chocolate, with the average American consuming about 9.5 pounds a year. Indeed, 50% “cannot live without it every day.”

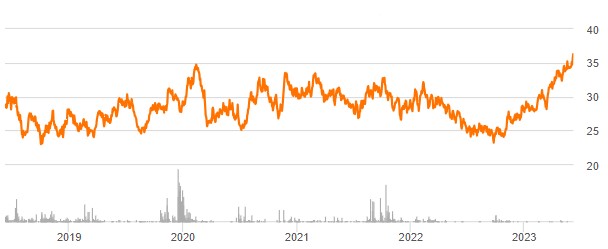

And so, it is with a heavy heart that I bring warning of a rise in the price of chocolate. Back in pandemic lockdown, I was bored and speculated a few bucks in cocoa futures, as tracked by the NIB exchange traded fund. My shares went up, and then down, and I sold out to limit losses (which was a good move at the time), and moved onto other investments.

Imagine my surprise when I randomly checked on NIB this week and saw the price ramp-up in the past few months:

Source: Seeking Alpha

A quick internet search led to a CNBC article which confirmed my worst fears:

“The cocoa market has experienced a remarkable surge in prices … This season marks the second consecutive deficit, with cocoa ending stocks expected to dwindle to unusually low levels,” S&P Global Commodity Insights’ Principal Research Analyst Sergey Chetvertakov told CNBC in an email.

…Chetvertakov added that the arrival of the El Niño weather phenomenon is forecast to bring lower than average rainfall and powerful Harmattan winds to West Africa where cocoa is largely grown. Côte d’Ivoire and Ghana account for more than 60% of the world’s cocoa production.

The price of cocoa will feed into the price of consumer chocolate products, especially dark chocolate which has more actual cocoa content. And the price of sweets generally will rise on the back of sugar prices, which stand at 11-year highs, driven again largely by weather.

There is still time to stock up ahead of the hoarders…

Talk about news you can use. Off to the grocery store!

LikeLike

One of the all time great books about money and investing is “The Money Game” by “Adam Smith” (George J.W. Goodman). Originally published in 1968, it is still in print which is a testimony to the acuity of the author’s observations about human nature and its wit and style.

This post triggered a memory of that book, which I read during the administration of Lyndon B. Johnson.

Chapter 18 is “Timing, and a Diversion: The Cocoa Game” Get the book, read the chapter. Avoid investing in commodities.

LikeLike