Lately many journalists and folks on X/Twitter have pointed out a seeming disconnect: by almost any normal indicator, the US economy is doing just fine (possibly good or great). But Americans still seem dissatisfied with the economy. I wanted to put all the data showing this disconnect into one post.

In particular, let’s make a comparison between November 2019 and November 2023 economic data (in some cases 2019q3 and 2023q3) to see how much things have changed. Or haven’t changed. For many indicators, it’s remarkable how similar things are to probably the last month before anyone most normal people ever heard the word “coronavirus.”

First, let’s start with “how people think the economy is doing.” Here’s two surveys that go back far enough:

The University of Michigan survey of Consumer Sentiment is a very long running survey, going back to the 1950s. In November 2019 it was at roughly the highest it had ever been, with the exception of the late 1990s. The reading for 2023 is much, much lower. A reading close to 60 is something you almost never see outside of recessions.

The Civiqs survey doesn’t go back as far as the Michigan survey, but it does provide very detailed, real-time assessments of what Americans are thinking about the economy. And they think it’s much worse than November 2019. More Americans rate the economy as “very bad” (about 40%) than the sum of “fairly good” and “very good” (33%). The two surveys are very much in alignment, and others show the same thing.

But what about the economic data?

First, let’s look at the labor market. Here are four broad indicators.

The unemployment rate is the most widely used measure. It’s almost exactly where it was in 2019. But is this because people have dropped out of the labor force? No. Prime-age employment (ages 25-54) as a percent of the population is slightly above 2019. But are wages so bad that people have to hold multiple jobs? No. That’s the same as 2019 too (more on wages below). But aren’t lots of people on unemployment insurance? Nope. Same as 2019!

What about broader indicators of economic performance? GDP is the broadest. The growth rate (inflation adjusted) in the past year is slightly better than the same period from 2019. Industrial production is slightly higher (though basically the same) as it was in November 2019 (IP is a volume index, so it doesn’t need to be inflation adjusted). Our economy is growing at a healthy rate, and we’re producing a lot of stuff.

That GDP figure is inflation adjusted, as is everything in this post that needs to be. But inflation, of course, is a major sticking point for Americans when judging the performance of the economy. Again looking to surveys, for those rating the economy as “bad,” 96% select inflation as a reason for their rating (only 58% say GDP). Cumulative inflation since November 2019 is almost 20%, more than double what consumers are used to in normal 4 years. But if we look at the most recent data, it’s clear we are now back to more normal territory: 3.1% in November 2023 vs 2.1% in November 2019.

But while inflation is bad and has many costs, when judging economic performance and how households are doing, we need to consider another price that has also increased: the price of labor, which is wages and income to households. Here are several measures of wages and income as well as wealth, all inflation adjusted with the CPI-U:

Some of these measures are medians, some are averages, one is a stock market index. But they all show the same thing: economic conditions are better now than in 2023. For some of these you might say: well, not much better! And it’s true, some Americans could be rating the economy right now as “bad” because things haven’t improved much. But keep in mind again the recent measures of growth such as GDP: the economy is once again growing at a normal rate, despite some very bad times over the past 4 years.

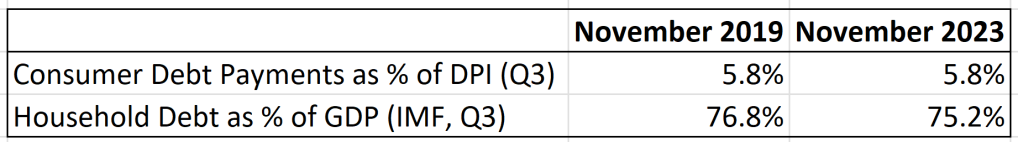

Finally, you might ask: is the current growth all an illusion? Is it built on households acquiring debt? The broad data indicates that this is not the case. Here are two measures of debt (remember to always use a denominator: in nominal terms, of course, most measures of debt are at record highs!):

So what’s going on? Again, this disconnect has been noted many times recently, and looks of people have offered speculative answers. Higher nominal prices are clearly one reason Americans rate the economy as bad, but clearly this can not last forever! If prices never rise one more penny but wages keep going up, at some point it will be obvious to the average person that their real income has increased since 2019. Maybe it’s just too close right now, and there is too much variation now with some Americans receiving raises that have been too small to keep up with inflation since 2019 (hello college professors!).

And if we look at the trends in consumer opinions about the economy, it seems many Americans are realizing that the economy is improving. While the University of Michigan indicator is still very low, it has increased significantly from June 2022, when it hit an all-time low (all-time meaning back to the 1950s!) with a score of 50. The preliminary December reading is almost up to 70. And for the Civiqs survey, while the current “net good” rating is -29%, that’s a big improvement from June 2022 when it was -57% (which was almost as low as the depths of Spring 2020, when it hit -61%).

You’ll notice that both of this surveys bottomed out in June 2022, which is also, not surprisingly, the month when annual inflation peaked at 8.9%.

You might be tempted to think that this is mostly a partisan issue. And there’s something too that. In the Civiqs survey, almost all Republicans rate the economy as bad. Democrats rate the economy as “net good” 33%, which is better than November 2019! But when we look at self-identified Independents, the swing in sentiment is clear: from +48% in November 2019 to -43% today. Partisanship swings the numbers against a Democratic president, but it’s not just that: Independents are very sour on the economy.

Perhaps there is no puzzle here at all. Americans might be correctly assessing the state of the economy, but with a significant lag. They get the direction right, just not the level. It will be very interesting to see how much the economy and economic sentiment continues to improve by November 2024.

One last time, here is all the data in one big table:

People measure their own progress not in absolute terms but in relative terms. We can throw whatever data at people confirming absolute improvements, they will never feel good if they are relatively worse off. There are rare periods of history when people were absolutely worse off. But that did not stop wars and revolutions.

The pandemic has reminded a lot of Americans how they are less important than others. The wealth gap has increased and assets are further away from their reach. This pessimism is a reflection on the death of the American dream.

Unfortunately economist live in a world of models where they measure things such a real GDP, wages, rational expectation etc. The real world is messy….it is based on feelings. Economists today are slaves to mathematical precision, mindlessly following limited metrics (wage growth, inflation, unemployment) and ignoring the big social picture.

LikeLike

There is a difference in how people treat the numerator (wages) and the denominator (inflation) in your analysis.

Most people don’t get automatic wage increases. Maybe I ask for a raise, or I quit and get a new job. If I get a 5% raise, it’s because I worked for it, not because the economy got better. Or maybe I don’t ask for that raise, but prices are still rising, therefore the economy sucks.

On the other side, people don’t directly experience *inflation*: they experience *price rises* from some anchor price. When eggs went from $1.50 in 2019 to $4 to $3 I don’t think “inflation was bad in 2020 but amazing in 2023”, I think “eggs are still expensive”. When eggs spike in price (0.1% of my expenses) but my rent stays the same (33+% of my expenses), I don’t feel happy about rent; I complain about how the economy sucks.

LikeLike