Back in early 2021, when we were still locked down, bored and restless, and trillions of pandemic stimulus dollars were pouring into our bank accounts to fund speculative investments, Keith Gill took to social media to argue that the stock of videogame retailer GameStop (GME) was deeply undervalued. He appeared on YouTube as “Roaring Kitty,” and on Reddit under an unsavory moniker. He rallied an army of retail investors on Reddit to buy up shares of GME, which was heavily shorted by big Wall Street firms. As hoped by the Redditors, this led to a “short squeeze,” where the shorts were forced to buy shares to cover, which drive GME price to the stratosphere. We discussed this phase of the drama here.

The drama continued as the jubilant retailers sucked so much money from short-selling hedge fund Melvin Capital that it ultimately shut down; the Robin Hood brokerage firm widely used by Redditors suspended trading in GME for a crucial couple of days, leading to suspicions it caved to pressures from the Wall Street firms and threw the retail investors under the bus; and key parties, including Roaring Kitty himself, were called before a Congressional committee to explain themselves. The story of Roaring Kitty and the meme stock craze was turned into a movie last year called “Dumb Money.”

Keith Gill largely vanished from messaging boards in early 2021. But he came roaring back on Sunday (May 11), posting on X a sketch of a man leaning forward in a chair, a meme among gamers that things are getting serious:

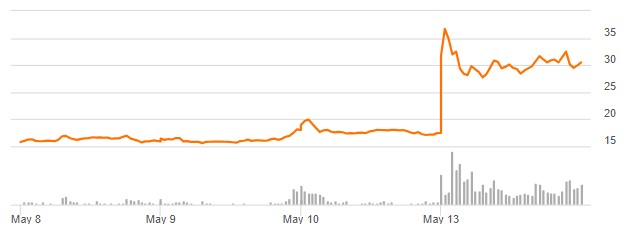

It seems that the Kitty has not lost his magic. That X post has garnered over 20 million views, and apparently triggered a new surge in GME stock (and in other heavily shorted stocks as well, which is a significant knock-on effect). Here is a five-year chart of GME, showing the craziness in early 2021, which then died down over the next couple of years:

GME stock had finally approached something approximating fundamental fair value, with occasional ups and downs, then Roaring Kitty posted his sketch, and, blam, the next day, the stock nearly doubled:

Keith Gill has followed up with tweets of video clips with a fight theme, including Peaky Blinders, Gangs of New York, Snatch, Tombstone, X-Men Origins: Wolverine, V is for Vendetta and The Good the Bad and the Ugly ; get that testosterone out there roiling (typical meme stock Redditors are youngish males).

As of Tuesday morning, GME had nearly doubled again, up to $57. (I am reasonably sure it will plunge again within the next few months, but I am not into shorting, and the options pricing structure does not make it easy to set up a favorable bearish trade here).

This response is not like the world-shaking short squeeze of 2021, but it still shows an impressive power of social media influencers and memes to move markets.

I wonder if this is a sign we are nearing the top again… in 2021, GME spiked in January, then overall markets peaked in December and had a bad 2022

LikeLike

Good question. It seems like meme bubbles aren’t going as high or as long now as in 2021. GME has already dropped back down to around 35, and sister meme stock AMC is down by half from its sympathy spike yesterday. And millennial males are back at work instead of day trading their trillions in stimulus, so I feel we are not back in 2021.

That said, when I eyeball S&P500 charts, it looks like we are pretty pricey. But the market can stay irrational…

I remember after big stock runups 1995-1998 I thought they could not possibly go any higher. Wrong. Big correction eventually came (2001) but in the meantime, stocks kept going up and up for the next two years.

So I much try to time the market, just keep long plus cash-like assets, and rebalance whenever a big dip does come.

LikeLike