Recently there has been some discussion in the Presidential race about the taxation of parents vs. childless taxpayers. The discussion has been ongoing, but it was kicked up again when a 2021 video of J.D. Vance resurfaced where he said that taxpayers with children should be lower tax rates than those without children. There was some political back-and-forth about this idea, much of it tied up in the framing of the issue, with the usual bad faith on both sides about the fundamental issue (in short: most Democrats and a small but growing number of Republicans support increasing the size of the Child Tax Credit).

Let’s leave the politicking aside for a moment and focus on policy. As many pointed out in response to Vance’s idea, we already do this. In fact, we have almost always done this in the history of the US income tax — “this” meaning giving taxpayers at least some break for having kids. For most of the 20th century, this was done through personal exemptions which usually included some tax deduction for children, and later in the century the Child Tax Credit was added (after 2017, the exemptions were eliminated in favor of a large CTC). Other features of the tax code also make some accounting for the number of children, most notably the size of the Earned Income Credit.

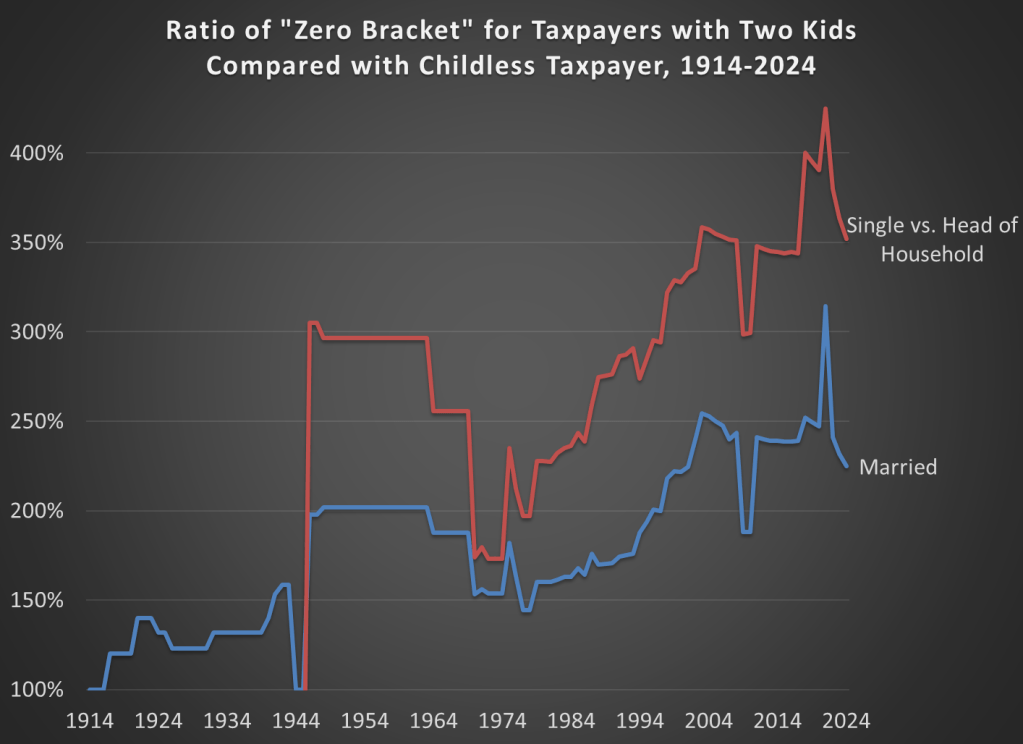

The chart below is my attempt to show how the tax breaks for children have affected four sample taxpaying households. What I show here is sometimes called the “zero bracket” — that is, how much income you can earn without paying any federal income taxes. The four households are: a single person with no children, a married couple with no children, a single person with two children (“head of household”), and a married couple with two children. All dollar amounts are inflation-adjusted to current dollars

For each taxpayer, I assume that they take the standard deduction and only take broadly available deductions and credits — such as the personal exemptions, Child Tax Credit, and Earned Income Credit. There are other credits available to parents of children, such as for childcare, but I don’t include those since not all parents will be able to use those. The chart also doesn’t include payroll taxes, but these taxes don’t differ based on the number of children.

Let me explain the calculation in the chart with an example. For a married couple with 2 children in 2024, the maximum income they can earn and not pay federal income tax is $65,708. Their “zero bracket” is a function of the standard deduction and Child Tax Credit. Subtracting the $29,200 standard deduction gives them $36,508 of taxable income, some of which is taxed at 10% and most of which is taxed at 12%. Their total tax is $4,000, which is reduced to $0 with the $4,000 Child Tax Credit ($2,000 per child).

Contrast that calculation with a married couple without children. They can only earn the standard deduction — $29,200 — for their zero bracket, as they don’t receive the CTC. They earn too much to qualify for the Earned Income Credit (though they did in 2021 when it was temporarily expanded). Conversely, imagine this couple earned $65,708 as the other married couples (with kids) did. They would owe $4,000 in federal income taxes (compared with $0 for the other couple). I perform similar calculations all the way back to 1914 for the 4 different taxpaying households (444 calculations in all! I have been working on this chart for a few years), which is shown in the chart above (note for tax wonks: the head of household status doesn’t officially exist until 1951, though it functionally does in 1946 — before that it generally was the same as married with children taxpayers).

Using the chart, we can notice a few things. First, there was almost always a tax break, sometimes a significant one, for households with children. If we focus just on recent history, you’ll notice that since about 1990 the “zero bracket” for childless taxpayers has stayed basically constant in inflation adjusted terms, while the zero bracket for households with children has steadily increased (mostly in the 1990s). There is also a one-year spike in 2021, when the CTC was expanded, which is what Democrats are currently proposing to make permanent (note: the 2021 CTC was $3,600 for kids under age 6 and $3,000 for other kids — I calculated it with one of each child).

Here’s another way of visualizing the same data, but instead looking at the ratio of the “zero bracket” for a taxpayer with and without kids. If the ratio is 100% in a given year, then taxpayers with and without kids are essentially taxed the same — you’ll notice that is rarely true, and certainly isn’t true today. You’ll notice that in 2024, a married couples with kids has more than double the zero bracket (225%) of childless married couples. It’s even higher for single parents vs. a single childless person. The zero bracket ratio for married couples has fluctuated between 225% and 250% for the past two decades, temporarily spiking to over 300% in 2021 with the expanded Child Tax Credit (this is true even though there was an increase in the EITC for childless taxpayers too that year).

So that’s the data, at least according to my calculations (even any year looks wrong, please let me know!). But knowing the data alone doesn’t tell us what the ratio in the second chart should be. Is a doubled zero bracket the right difference? Was triple correct? Should it be even higher? Even if most of us agree that taxpayers with children should pay less in taxes, we still don’t know how much less in taxes they should pay. Certainly $2,000 per child doesn’t cover the full cost of raising a child per year, but I don’t think most Americans would support a $16,000 subsidy per year per child (which is roughly the average cost per child per year). Alternatively, there is an argument against subsidizing taxpayers with children, which I have made before (short version: having children is a choice, and most of the benefits are internal to the family, rather than external).

But it’s important in this debate that we all know where the US tax code currently stands in terms of subsidizing parents directly.