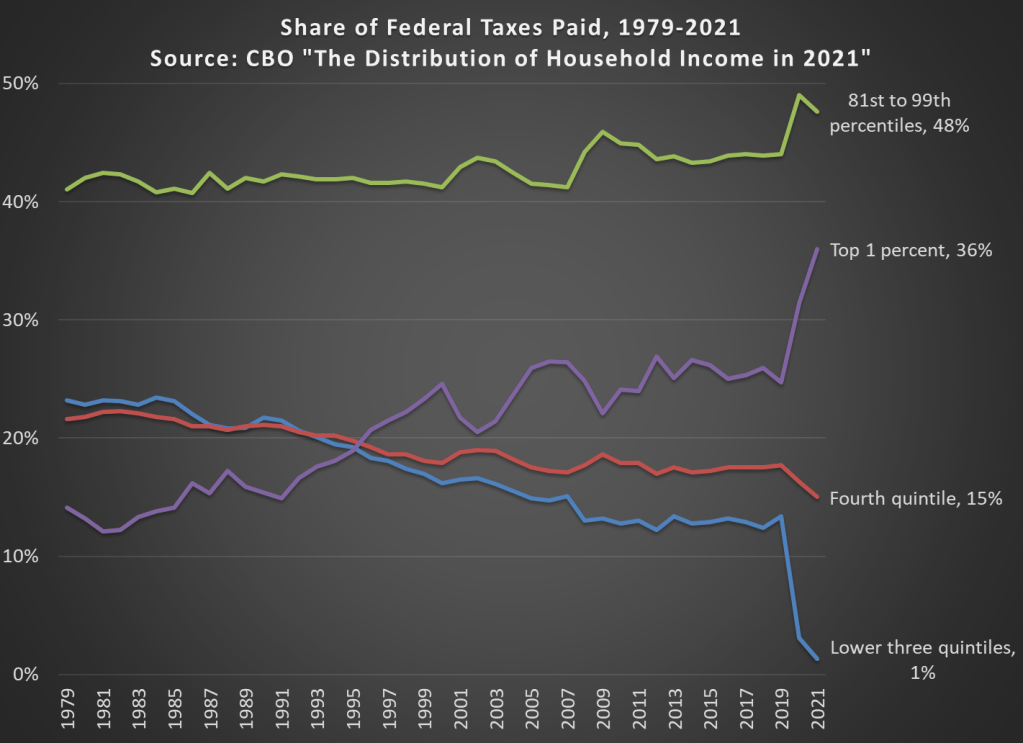

In 2021 the top 1 percent of taxpayers in the United States paid 36 percent of all federal taxes (they have 21.1 percent of income). This figure had been below 20 percent until the mid-1990s, and as recently as 2019 it was just 24.7 percent (they had 15.9 percent of the income that year).

The data comes from the latest CBO report on “The Distribution of Household Income in 2021.”

The increase is primarily due to a large number of high-income households realizing capital gains in 2021. With all the talk lately of potentially taxing unrealized capital gains, it’s important to note that we do tax realized gains, and these change a lot from year to year. Another contributing factor is that the share of the bottom 60 percent of households only paid 1 percent of federal taxes in 2021, a big drop from 2019 due to a big increase in temporary refundable tax credits.