The Federal Reserve cut interest rates yesterday for the first time since 2019. They raised rates dramatically in 2022 to fight off high inflation, and kept them high since. This cut signals that they are now less worried about inflation, which is now nearing (but not at) their 2% target, and more worried about the slowing (?) labor market. To me their action was reasonable, but doing a smaller cut or waiting longer would also have been reasonable, because the labor market is giving such mixed signals at the moment.

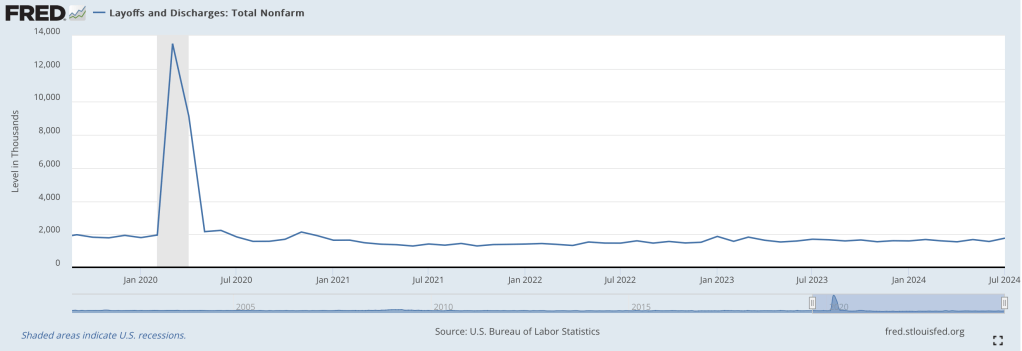

Most concerning is that unemployment increased from 3.5% last July to 4.3% this July. On previous occasions that unemployment in the US increased that rapidly, we then saw recessions and much more growth in unemployment. But unemployment ticked down to 4.2% last month, and layoffs have been flat:

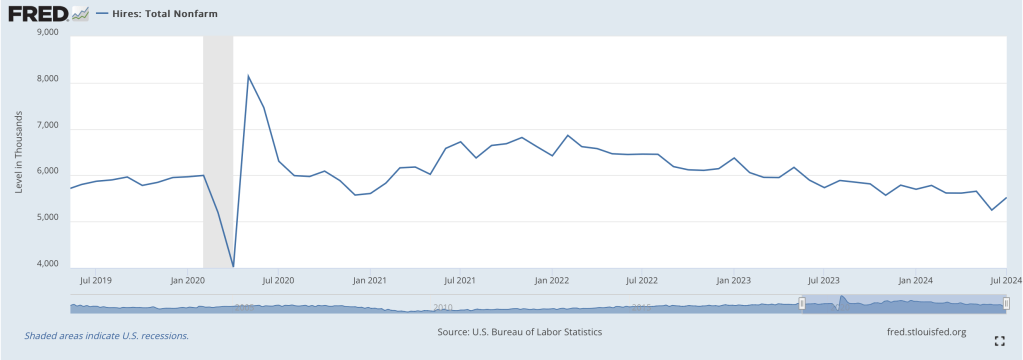

How do you get a big increase in unemployment without a big increase in layoffs? There are two main ways, one good and one bad, and we have both. The bad news, especially for new graduates, is that hiring has slowed:

But the better news is that there are simply more people wanting to work. This is generally a good sign for the economy; in bad economic times many people don’t count as “unemployed” because they are so discouraged that they don’t bother actively looking for work. In July though, prime-age labor force participation hit 84%, the highest level since 2001:

The prime-age employment-to-population ratio just hit 80.9%, also the highest level since 2001:

Labor force participation and employment-to-population among all adults are not so high, though it could be a positive that many people under 25 are in school and many people over 54 are able to retire. Finally, total payrolls got a big downward revision, but one that still implies positive growth every month.

Looking beyond the labor market though, GDP grew at a strong 3.0% in Q2, and is projected to be similar in Q3. Inflation breakevens are exactly on target. Overall it looks like some recession indicators that worked historically, like the Sahm Rule and Yield Curve Inversion, are about to break down- especially now that the Fed cutting is rates.

I’ve read that the surge in job seekers is largely due to a surge in immigrants, legal and otherwise. I don’t have a dog in this fight, just curious if other readers (who have knowledge, not just opinions) agree with this.

LikeLike