From a paper recently published in the Journal of Public Economics by Sarah Robinson & Alisa Tazhitdinova, here is the history of federal and state taxation in the past century in the US in one picture:

The paper primarily focuses on US state taxes, thus mostly ignoring local taxes, but in the Appendix the authors do show us similar charts for local taxes:

In broad terms, the history of taxation in the US in the 20th century is a history of the decline of the property tax, and the rise of the income and sales taxes. In 1900, there were barely any federal taxes (other than those on alcohol and tobacco), 50% of state taxes were property tax, and almost 90% of local taxes were property taxes. Property taxes were essentially the only form of taxation most Americans would directly recognize (excise taxes and tariffs were baked into the price of the goods).

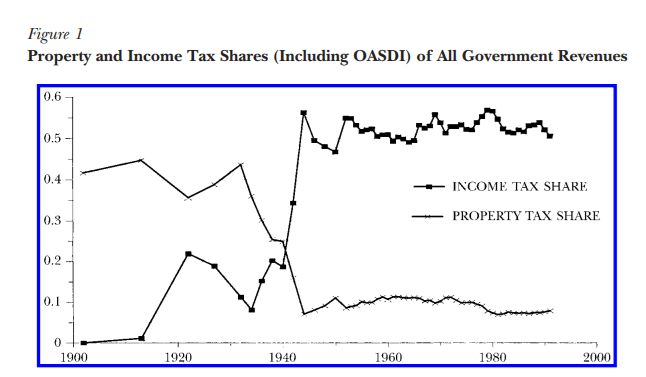

John Wallis (2000) provided a similar, and simpler picture of these changes: considering all taxes in the US, property taxes were over 40% of the total in 1900, but today are under 10%. Income taxes come out of nowhere and are now about half of all government revenues in the US:

Information processing and communication became cheaper, but human labor didn’t. I *think* more human labor is required for property tax assessment, whereas information processing/accounting and communication made W2’s, withholding, and payroll taxes easier/cheaper to impose. Not to mention that much of that compliance cost of income taxes is imposed on the private sector, which incentivizes economizing on resources. New property assessments by government employees don’t impose the same incentives for governments. Maybe all of this matters, maybe not.

LikeLike