Over the winter break I was able to catch up on a lot of podcasts. I also began listening to the Marginal Revolution podcast (which is phenomenal). I especially enjoyed the final episode of season 1 about options and how many transactions can be characterized as giving someone an option. Here, the term option echoes a financial option. You pay today for the ability to do something in the future. In financial markets, you can purchase the right to buy or sell at a particular price in the future.

But lots of things count as options. Staying in the financial context, purchasing a stock gives you the option to sell that stock at the future spot price. So, in this way, something can be characterized as an option even though we are not accustomed to describing as such explicitly. More mundane transactions can also be interpreted as options. Assume that you buy a can opener. You are buying the option to have that tool on hand in the future and to open some shelf-stable food. You can choose to exercise the option simply by opening your kitchen drawer.

But financial options often include the possibility of losing money. It may be that your grocery purchases never include canned items and that you never have occasion to use your can opener. Maybe that’s a bad investment. You sunk your money into something that you never used. Except… You did in fact have the option to use the can opener. Maybe you had peace of mind that you were well prepared just in case a guest arrived with a can of something. Buying a can opener is like buying an option.

Returning to the realm of finance, let’s discuss buying on margin. Buying an asset on margin is when you borrow from your broker in order to purchase a financial asset. It’s not entirely free money. They have rules about the amount you can borrow and, of course, you must pay back the loan with interest.

Once you buy a financial asset on margin, you suddenly have an option in the broad sense of the word. You have the option to repay the borrowed money with interest by making cash deposits into your brokerage account. What’s the value of that? Well, you were able to purchase financial assets at the price that you preferred rather than waiting for your cash to become available. Had you waited, you may have missed the low price.

But once you own the assets that you purchased on margin, what option is there except to repay the loan? The option is not whether you will repay. The option is *how* you repay. Rather than depositing funds to repay the loan, you could instead hold the asset while the price increases. If the price increases enough, then you can sell your assets with an adequate capital gain to repay the loan and the accrued interest. So, buying an asset on margin gives you an option. You can A) repay from cash that you hold elsewhere, or B) repay with the proceeds earned from selling after the asset has appreciated.

Furthermore, with enough appreciation, you have the option to sell all of the original shares and redeem the cash that remains after repaying your loan. The other alternative is that you can sell just barley enough to repay your loan, and then retain some of the assets that you purchased as yet unrealized gains. In this case, you end with a zero debt balance and a greater quantity of the asset than when you began. This option can help you to enjoy appreciation that you correctly forecast without bearing the taxes that are associated with realized gains.

Example

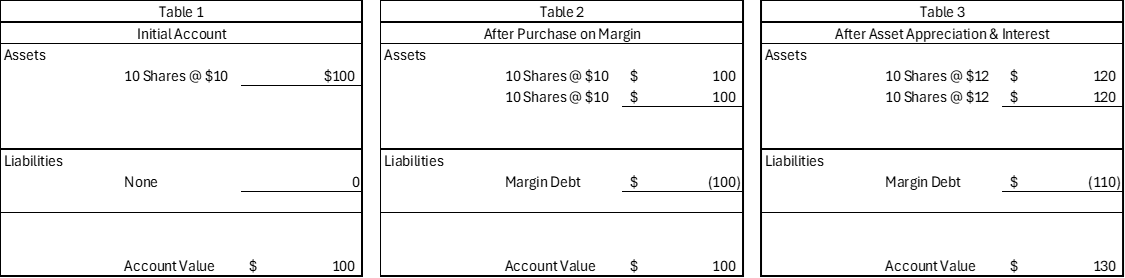

Here is an example. The three tables below illustrate how buying on margin works. I assume that there is a 20% appreciation and a 10% cost of borrowing. Table 1 describes an initial account that contains 10 shares of stock. Table 2 describes the account after an additional 10 shares are purchased on margin. Notice that the account value doesn’t change because the liabilities and assets both rose by an identical value. Table 3 describes the account after the stock price rises by 20% and interest accrues. This is the baseline that is shared between repayment alternatives.

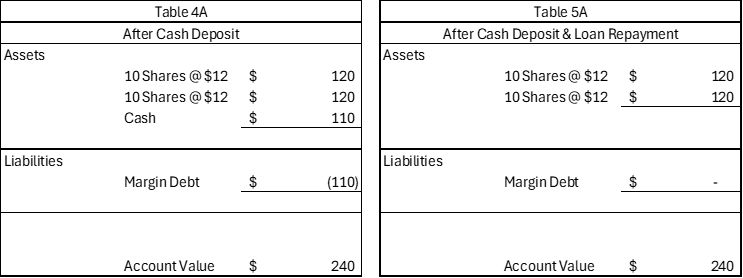

Your first option (A) is the deposit cash to repay the margin debt. In this case, buying on margin provided the option of buying at the earlier price and paying for it later (with interest). At the end of the day, you enjoyed the asset appreciation even though you didn’t have the cash on hand. Your account increases in value so long as the appreciation is greater than the interest.

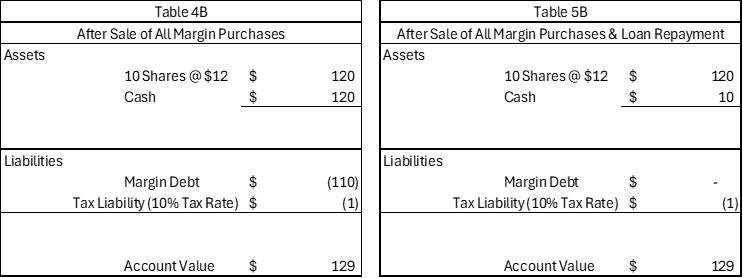

The second option (B) is to sell all of the assets that were purchased on margin. Then, you can repay the margin debt without needing to make additional cash deposits. A disadvantage is that you bear a subsequent tax liability due to the capital gain. But, you’re still better off than if you didn’t borrow at all.

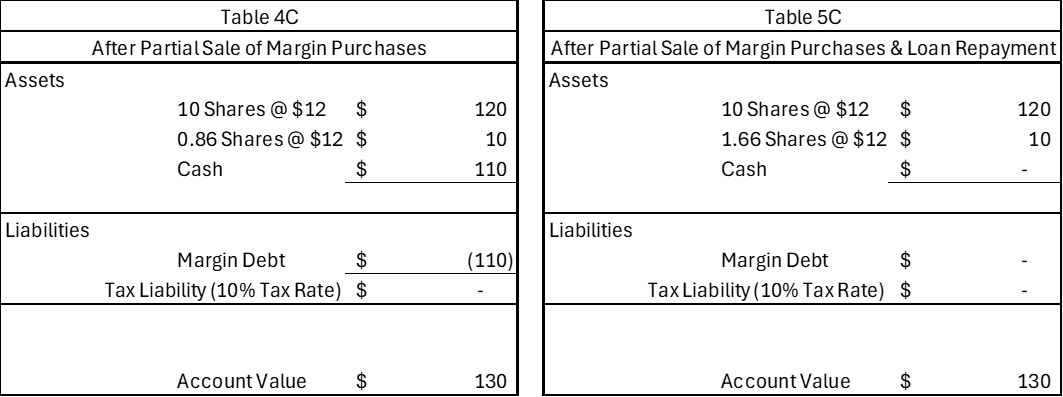

Finally, there is nothing that says you need to sell all of your margined assets. In the last option (C), you could instead sell just enough to repay your margin debt, and then keep the remainder in the form of assets rather than cash. This means that the greater account value remains unrealized rather than realized. You can convert your assets to cash and realize your gain at a future time, maybe when the tax environment is more favorable.

The bottom line is that buying on margin gives you access to purchasing power now. You have the option of (A) accessing prices now and making cash deposits in the future, (B) repaying the debt and realizing a taxable gain, or (C) repaying your debt and holding your unrealized gain in the form of more assets than you had in the first place. Choosing between (B) & (C) lets you choose between the tax conditions that exist now versus what might be more favorable conditions later (combined with the risk of holding a risky asset).

Buying on margin gives you options and the ability to lose more than the value of your assets. If you buy on margin and the value of an asset falls, then you need to sell more shares than you purchased if that is your method of repayment. This is why one must complete an additional application in order to be approved for trading in options or on margin. Both can put you in debt.

Scott has discussed options in the past:

https://economistwritingeveryday.com/2023/11/28/stock-options-tutorial-1-options-fundamentals/

https://economistwritingeveryday.com/2024/01/02/stock-options-tutorial-2-how-options-are-priced/

Reading the title only at first, I thought you were going to talk about how the payoff for a leveraged portfolio looks like that off a call option:

Assume for simplicity that we fund our portfolio with 100 dollars in our own equity and 100 dollars of a loan from our broker. We buy 200 dollar of stock (think, shares of an S&P500 ETF). In addition youpay your broker a bit of interest. The stock starts trading at 100 dollars.

Assume further for simplicity that our broker will instantly liquididate the portfolio when our equity reaches zero, but won’t touch it otherwise. So our playoff is: max(2 * share price – $100, 0) – interest.

Now compare an option portfolio:

We start with 100 dollar of our own money. We buy options for two shares with a strike price of 50 dollar. Remember that the shares are currently trading at hundred dollar. Each option will cost us roughly 50 dollar in intrinsic value and a bit extra for the time value.

The resulting payoff as a function of the share price is exactly the same.

(In practice, our options will eventually expire. So to replicate the leveraged portfolio we will have to roll them over. But paying the option premium again and again is exactly the same as paying the interest on our loan again and again.)

So in this sense, leverage is like a call option. (Thanks to put call parity, you can also construct an equivalent portfolio with put options.)

A small comment on what you actually wrote: you say that buying a share is like an option, because you get the opportunity to later sell the share at the spot price.

That’s one way to analyse the situation, but I don’t think it’s very insightful. Options as an analytic tool make more sense when you (voluntarily) enter into an agreement with a counterparty now that will result in obligations later.

Eg when buying a put option, your counterparty will have to buy your stock at the strike price whether they want to or not. (And you generally only exercise when your counterparty wouldn’t want to trade at the strike price.)

LikeLike

P.S You seem to also be focussed on repayment?

My broker just adds the interest to my loan, and never bothers me about repayment (as long as I have sufficient equity in my account.)

i guess the portfolio will perhaps eventually be liquidated when I go into retirement and need the money. But you could imagine a trust fund with an account that forever leaves the loan outstanding, and just withdraws some equity every once in a while (assuming over the long run the shares growth faster than the debt.)

LikeLike

Both of your comments are on point. I agree that transacting with a 2nd party make options more interesting analytically (my time an attention are scarce and I have to choose my audience).

I do think that non-finance endeavors have plenty of interesting characteristics that are option-like. Mises, for example, describes the value of holding non-financial assets as providing option value. My students tend to be interested in realized gains since there is a lot of life and consumption opportunity ahead of them. That’s also part of why I wanted to emphasize the qualitative differences when of divesting.

LikeLike

Buying on margin seems tantamount to simultaneously selling a put & buying a call.

LikeLike