How bad are things? You know, in terms of our democracy and economy crumbling under the great wheel of history as the current administration tries to waddle us into fascist kakistrocracy. Are they bad? Maybe! Or maybe things are mostly fine and all we have to cope with is fear-peddling journalists and neurotic academics hyperventilating through what promises to be a four-year panic attack.

Well, Tyler is looking for market indicators. Signs that the market is internalizing the possibility of deteriorating government and political institutions into prices. That’s a really tall order, even more so than what it might seem to those of us who tend to rely on prices to reveal collective wisdom and the best underlying forecast. Prices reflect the expected benefits and the opportunity cost of an asset or choice in question. Opportunity cost can be explained in a number of ways, but they all boil down to the best outside option. It’s always going to be trickier to expect convenient and obvious price indicators for risk that is inescapable, where there is little in the way of an outside option. If you want a good forecast for avian flu, poultry and egg prices work pretty well, reflecting culled supply, reduced demand from a fearful public that thinks carnitas is sufficiently tasty, and the moves made by speculators who think that things are (or are not) going to get worse. So what are the analogous prices for those speculating that the center will or will not continue to hold in the Great American Project?

If you believe that the Trump administration is, in fact, trying to backdoor in an authoritarian revolution while walling off the largest economy from the rest of the world into a protectionist backwater, all while undermining the global reserve currency, what exactly is the outside option? Where can the money go? The people? The ideas? There are no doubt answers to those questions, but while most of the developed world is struggling with protectionist and authoritarian fevers, all while many entertain the prospect of a Russian invader who is already actively attacking a democratic nation, a host of obvious answers don’t rush to mind.

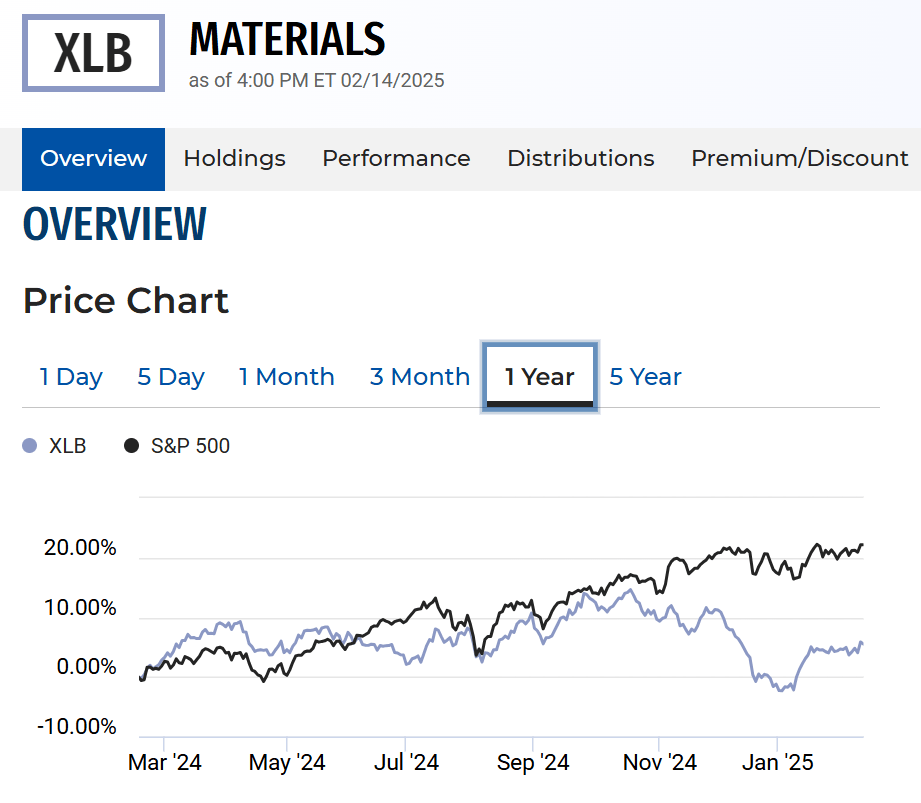

But let’s not punt entirely. Let’s get a little more micro. Is the market internalizing a more protectionist future for the US market and the global economy? Here’s the S&P 500 index for the “Materials” sector vs the entire S&P 500 over the last year:

Correlation is not causation, but the rapid drop off in the value of “chemicals, construction materials, containers and packaging, metals and mining, and paper and forest products” since what was effectively a coin-flip election is certainly convenient to the hypothesis that the market thinks materials previously circulating the global economy are not as likely to find their most valued uses under the Trump administration. If the market thinks we should take the threats of protectionism seriously, why shouldn’t we treat the administration’s threats to default on the debt similarly? Of weaponizing the DOJ against political opponents or ignoring court decisions? There’s not going to be a silver bullet composite price, but for each individual threat we should be looking for a relevant price.

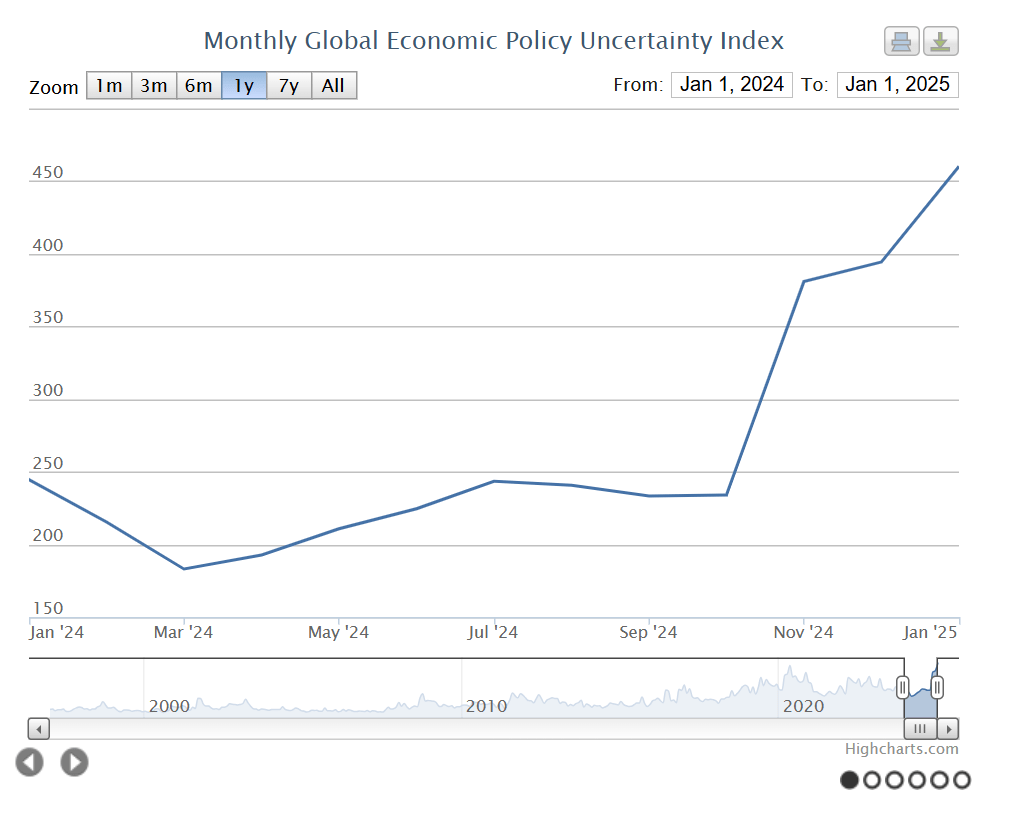

If we are going to accept the hypothesis that any one single price indicator is going to be hard to identify, how about a forecasting index? The folks beind the Policy Uncertainty Index have a measure that reflects the language used in a large variety of publications combined with professional forecasters to reveal not what the future of policy is likely to be, but how much disagreement there is about it. Again quite the increase in the aftermath of a coin-flip election, which is odd because you would expect their to be more uncertainty before a coin-flip election, not afterwards. Shouldn’t we know what we are getting to a greater degree now what we know who is holding the office? I mean, assuming we actually know who is wielding power and influence within the office…

So there are some metrics that point towards a more isolationist future characterized by less predictable government institutions. That’s not nothing. We should be careful not to expect the markets to hand us a forecast on a silver platter, however. In both 1962 and 1983, it’s entirely possibe that nuclear war was averted by Stanislav Petrov and Vasily Arkhipov, who respectively refused to launch missiles and report (erroneously indicated) US missile launches, as dictated by Soviet protocol. As chaos is injected into the US government, including those tasked with overseeing the nuclear arsenal, we should perhaps look to the past. What were the prices that revealed how close we were to history-forking events? Did any price reflect the ebbs and flows in that underlying risk, the changing cultures within the Soviet military and the growing and shrinking prospects of nuclear war? Or did prices instead remain largely untouched by such tides of history? Not to get melodramatically apocalyptic, but perhaps prices cannot accurately reflect the prospect of a world without connection to the markets of today. So it goes. There’s some risk you simply can’t diversify, insure, or reallocate against.

Which prices will reflect those risks?

This is surprising to me, since I would have thought that interest would flock towards assets that are related to hard commodities. There’s a lot to quibble about with the value of a greenback, but it’s significantly harder to quibble about the value of hydrochloric acid, or bauxite.

LikeLike