The Republicans hold a majority in both chambers of congress and they are the party of the president. They want to use that opportunity to pass substantial legislation that addresses their priorities. Hence, the One, Big, Beautiful Bill (OBBB). But, just like the Democratic party, Republican congressmen are a coalition with various and sometimes divergent policy agendas. There are ‘Trump’ Republicans, who want tariffs, executive orders, and deportations. There are more liberal members who want more free markets. You can also find the odd ‘crypto bro’, blue-state representatives, and deficit hawks. Given the slim majority in the House of Representatives, they all have to get something out of the legislation. Put them together, and what have you got?* You get a signature piece of legislation that no one is happy about but everyone touts.

One example of such compromise is the State and Local Tax federal income tax deduction, or SALT deduction. The idea behind it is that income shouldn’t be taxed twice. If you pay a part of your income to your state government in the form of taxes, then the argument goes that you shouldn’t be taxed on that part of your income because you never actually saw it in your bank account. The state took it and effectively lowered your income. The state and local taxes get deducted from the taxable income that you report to the federal government. The reasoning is that you shouldn’t need to pay taxes on your taxes.

Paying taxes on your taxes sounds bad. And plenty of people don’t like one tax, much less two. The Tax Foundation has done a lot of good work to cut through the chaff and has published many pieces on the SALT deduction over the years.**

Cut and Dry SALT Deduction Facts:

- It’s a tax cut

- It reduces federal tax revenue

- It adds tax code complication

- It is used by people who itemize rather than take the standard income tax deduction

- Prior to the 2017 Tax & Jobs Act, there was no limit on the SALT deduction. After, the limit was $10k.

- The current OBBB increases the SALT deduction.

Those are the basics. Everything else is analysis. The Grover Norquist Republicans never see a tax cut that looks bad, so they’d like to see the SALT limit raised or disappear. Tax think tanks that like simplicity don’t like the SALT deduction because it adds complication. Plenty of others say they don’t like complication, but often change their mind when it comes to the details (much like cutting government waste). Think tanks tend to be a bit lonely on this point.

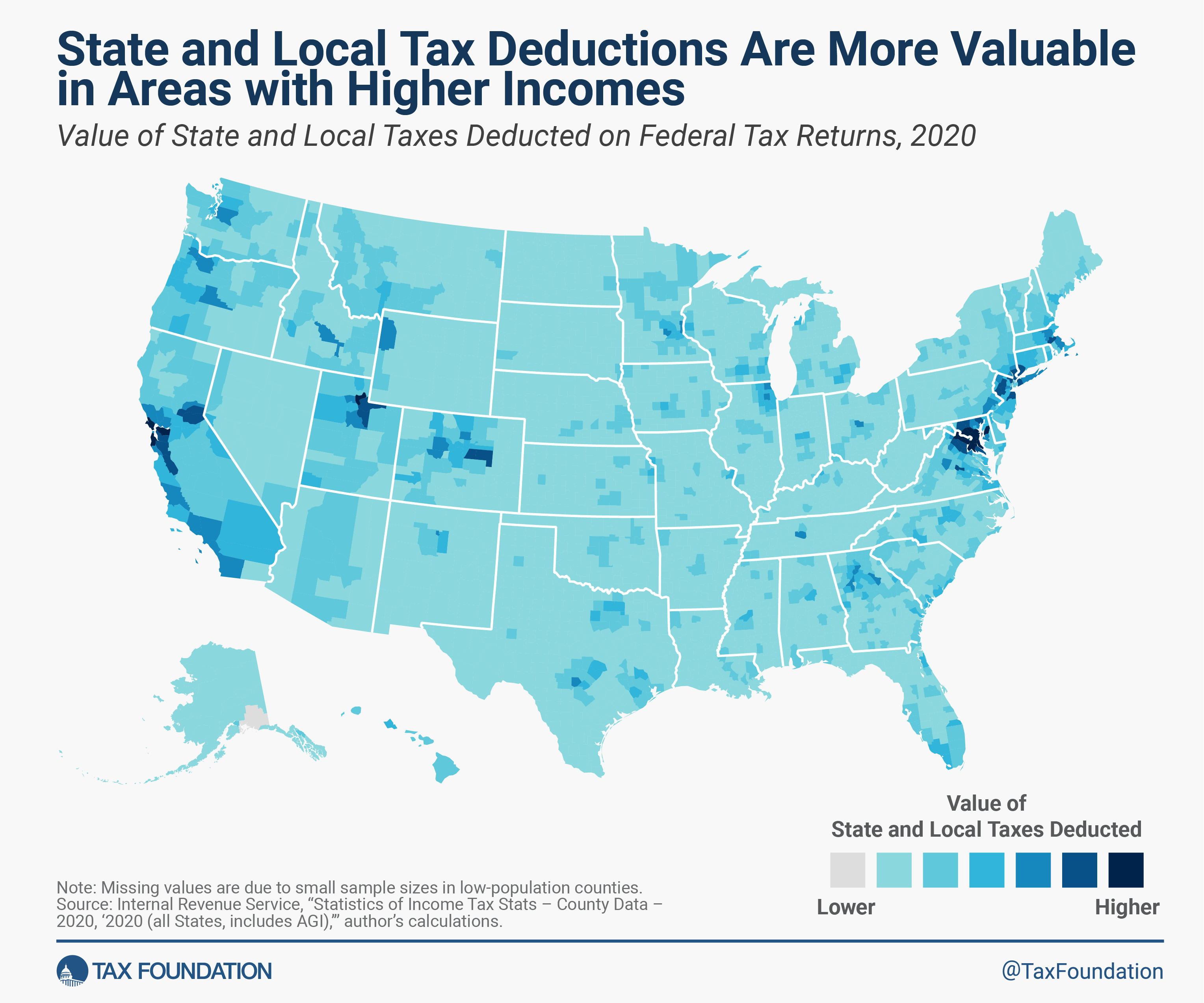

People mostly care about the SALT deduction due to the distributional effects. Who ends up benefiting from the deduction? The short answer is people who 1) itemize & 2) have heavy state and local tax bills. Who is that? Rich people of course! They have high incomes and lots of wealth and real estate – on which they pay taxes. But not all rich people pay loads of state taxes. So the SALT deduction is a tax cut that primarily benefits rich people who live in high tax districts. Where’s that? See the below.

Most of the SALT deduction beneficiaries live in ‘Blue’ states because they tend to have higher taxes. This adds a layer of political complication. Republicans say they don’t like taxes. But they are more tolerant if the taxes hit states that are unlikely to elect Republicans at the federal level. The Republicans in the House of Representatives who are from those ‘Blue’ states have made keeping the SALT deduction a priority. Since their votes are needed for the slim majority, this is the issue on which they’ll get a concession.

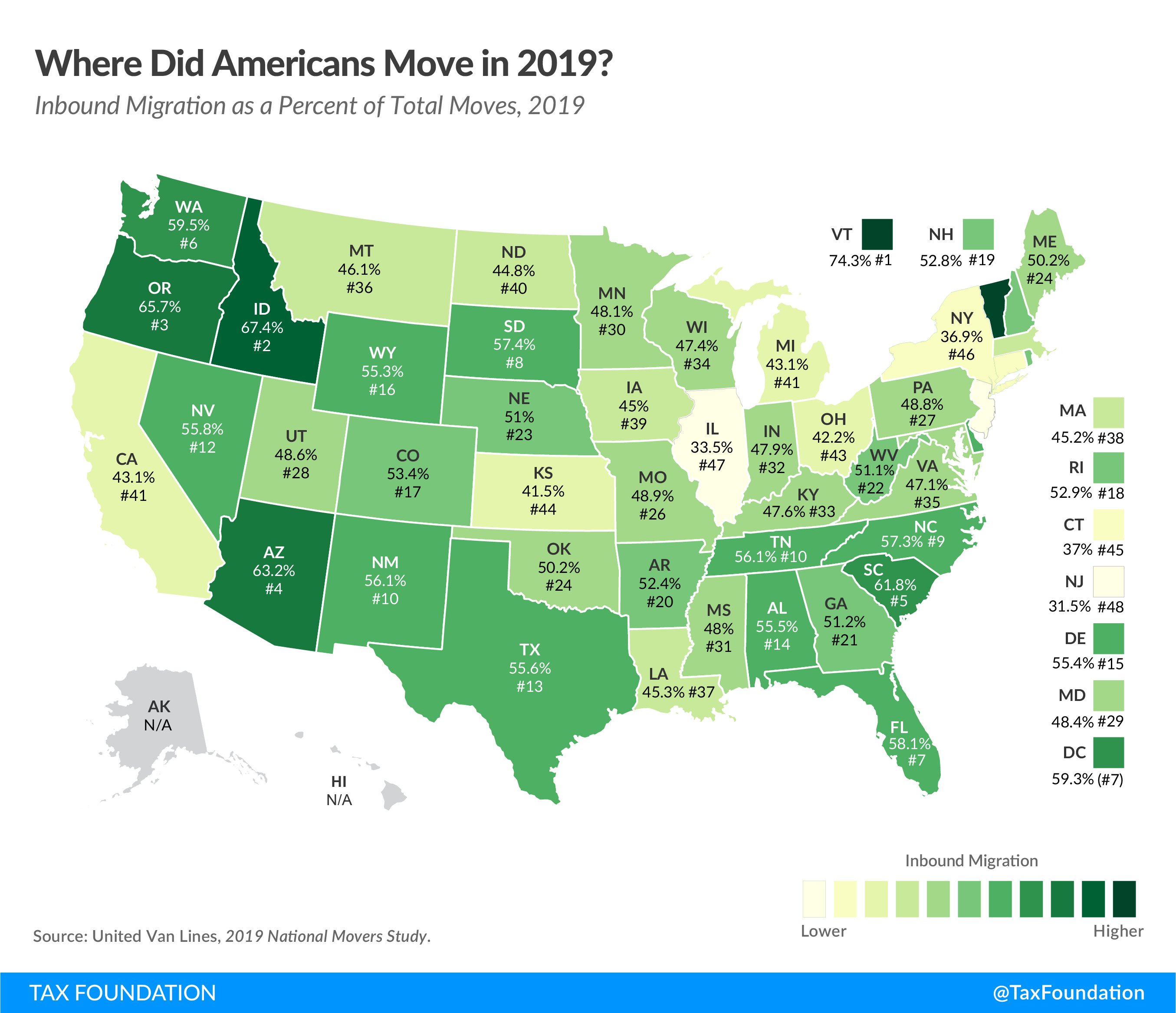

Economically, the SALT makes it cheaper for individuals to live in high-tax jurisdictions. That’s distortionary. It loosens the joint between productive state policy and the feedback provided by economic activity and migration. All states provide a mix of services and tax structures. Competition from other states makes the local economic activity especially endogenous to the state policies. But, if residents are insulated from local policy, such as high taxes, by receiving a tax deduction, then they have a weaker incentive to change local policy or migrate to another state. Consequently, states wallow in worse policy than they otherwise would.

There’s more complication than what I’ve written here, especially regarding pass-through entities. But the interested wonks can examine the links below.

OPINION: I think that there should be no SALT deduction. It’s a harmful carve-out in the tax code for the reasons stated above. Politically, as we’re seeing, it’s easy to change a low deduction number to a higher number. But it would be far more difficult to resurrect if we killed it entirely.

*Obtuse Bibbidi-Bobbidi-Boo (OBBB)

**Here is a list of Tax Foundation publication, where I interned once upon a time, in chronological order:

- State and Local Tax (SALT) Deduction

- Policymakers Must Weigh the Revenue, Distributional, and Economic Trade-Offs of SALT Deduction Cap Design Options

- Congressional Policymakers Should Tread Carefully When Weighing New Corporate SALT Deduction Limits

- Disallowing Business SALT Raises Significant Revenue for Reconciliation but Slows Economic Growth

- A More Generous SALT Deduction Cap in the Big, Beautiful Bill Would Cost Revenue and Primarily Benefit High Earners

- Senate Softens Blow for Pass-Throughs Using Current SALT Workarounds

One thought on “Salty SALT in the OBBB”