The Fed has had an official inflation target of 2% since 2012, a commitment they reaffirmed just last month after their policy review:

The Committee reaffirms its judgment that inflation at the rate of 2 percent, as measured by the annual change in the price index for personal consumption expenditures, is most consistent over the longer run with the Federal Reserve’s statutory maximum employment and price stability mandates.

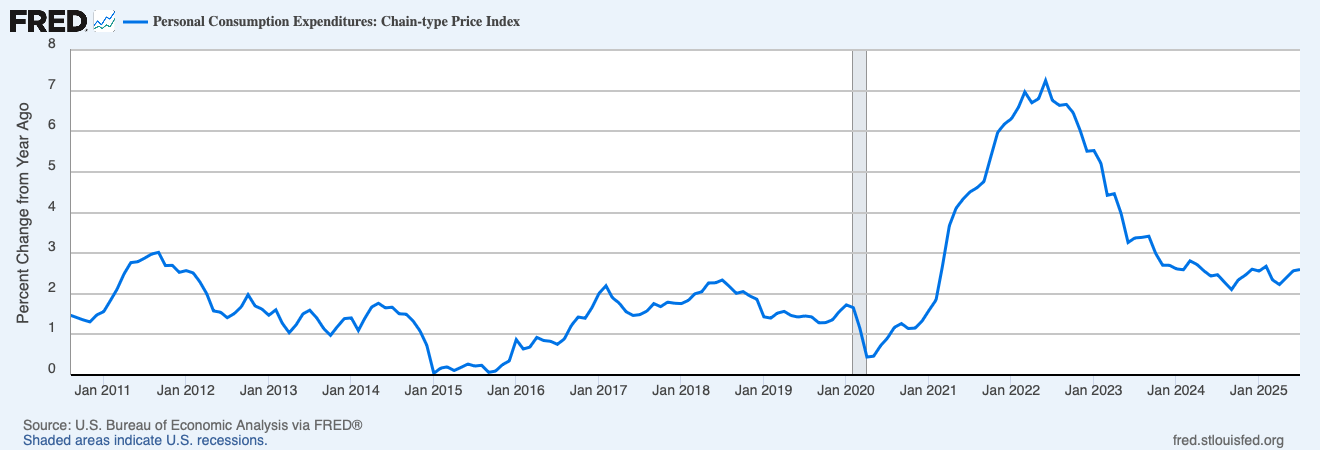

But since 2020, they haven’t been acting like it. Lets look at their preferred measure of inflation, the annual change in the PCE price index:

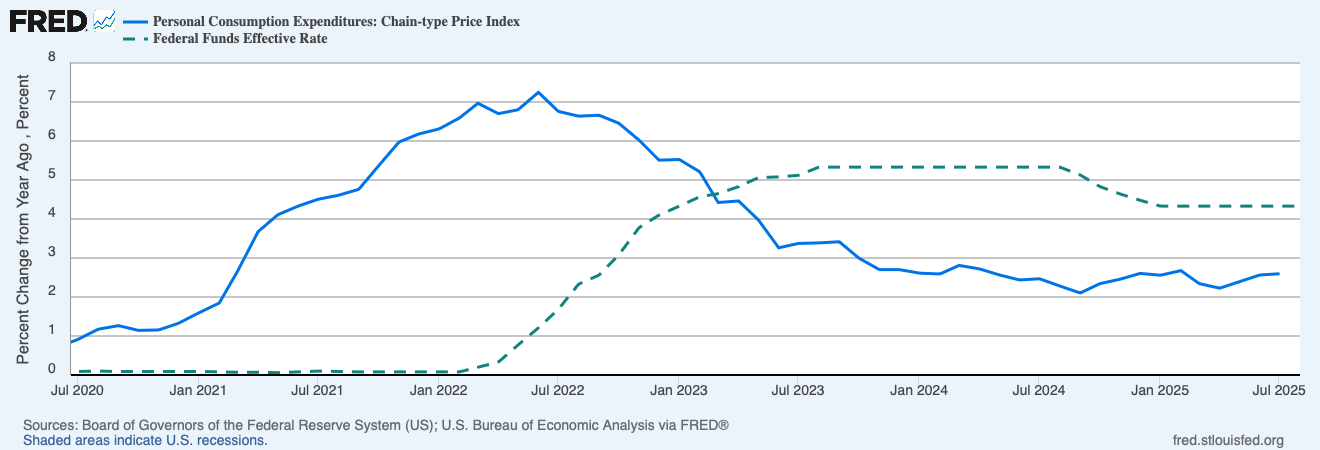

The last time annual inflation was at or below 2.0% was February 2021. The Fed just cut rates despite inflation being at 2.6%. If you didn’t know about their 2% target and were trying to infer their target based solely on their actions, what would you guess their target is?

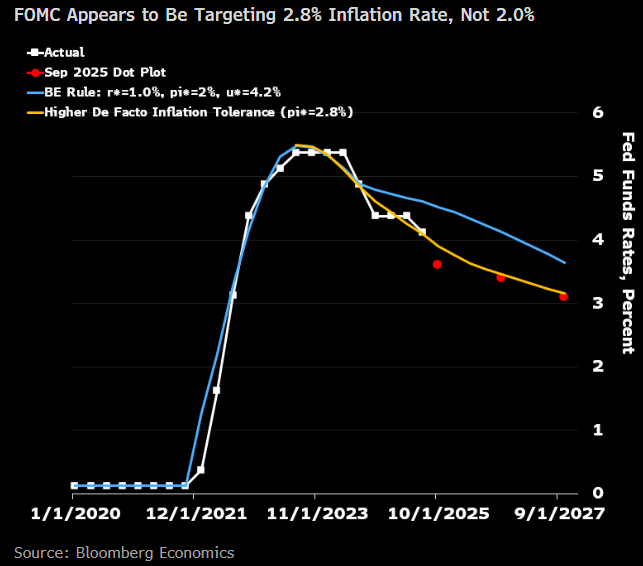

Considering the post-Covid period, I see their actions as being more consistent with a 3% target than a 2% target. They stopped raising rates once inflation got below 3.4%, and started cutting them again once inflation got below 2.4%. The Fed’s own projections show more rate cuts coming despite the fact that they don’t expect inflation to get back to 2.0% until 2028! Bloomberg’s Anna Wong does the math and infers their target is 2.8%:

Perhaps the Fed’s target should be higher than 2%, but if they have a higher target, they should make it explicit so as not to undermine their credibility. Or at least make explicit that their target is loose and they’d rather miss high than low, if that is in fact the case. This is what Greg Mankiw would prefer:

I feel strongly that a target of 2 percent is superior to a target of 2.0 percent….. It would be better if central bankers admitted to the public how imprecise their ability to control inflation is. They should not be concerned if the inflation rate falls to 1.6. That comfortably rounds up to 2. And they should be ready to declare victory in fighting inflation when the inflation rate gets back to 2.5. As the adage goes, that is good enough for government work. Maybe the Fed should even ditch a specific numerical target for inflation and instead offer a range, as some other central banks do. The Fed could say, for example, that it wants to keep the inflation rate between 1 and 3. Doing so would admit that the Fed governors are notquite as godlike as they sometimes feign.

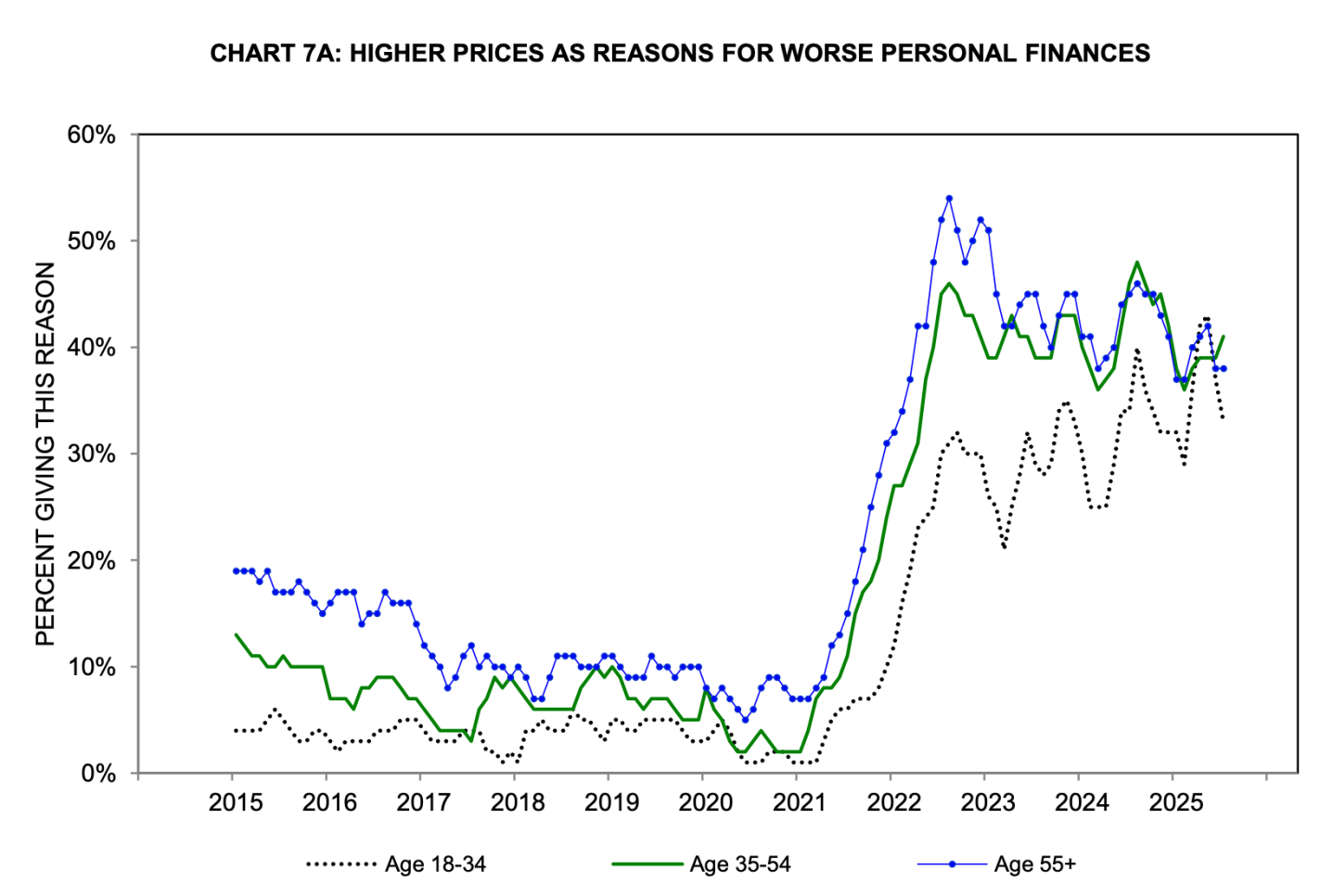

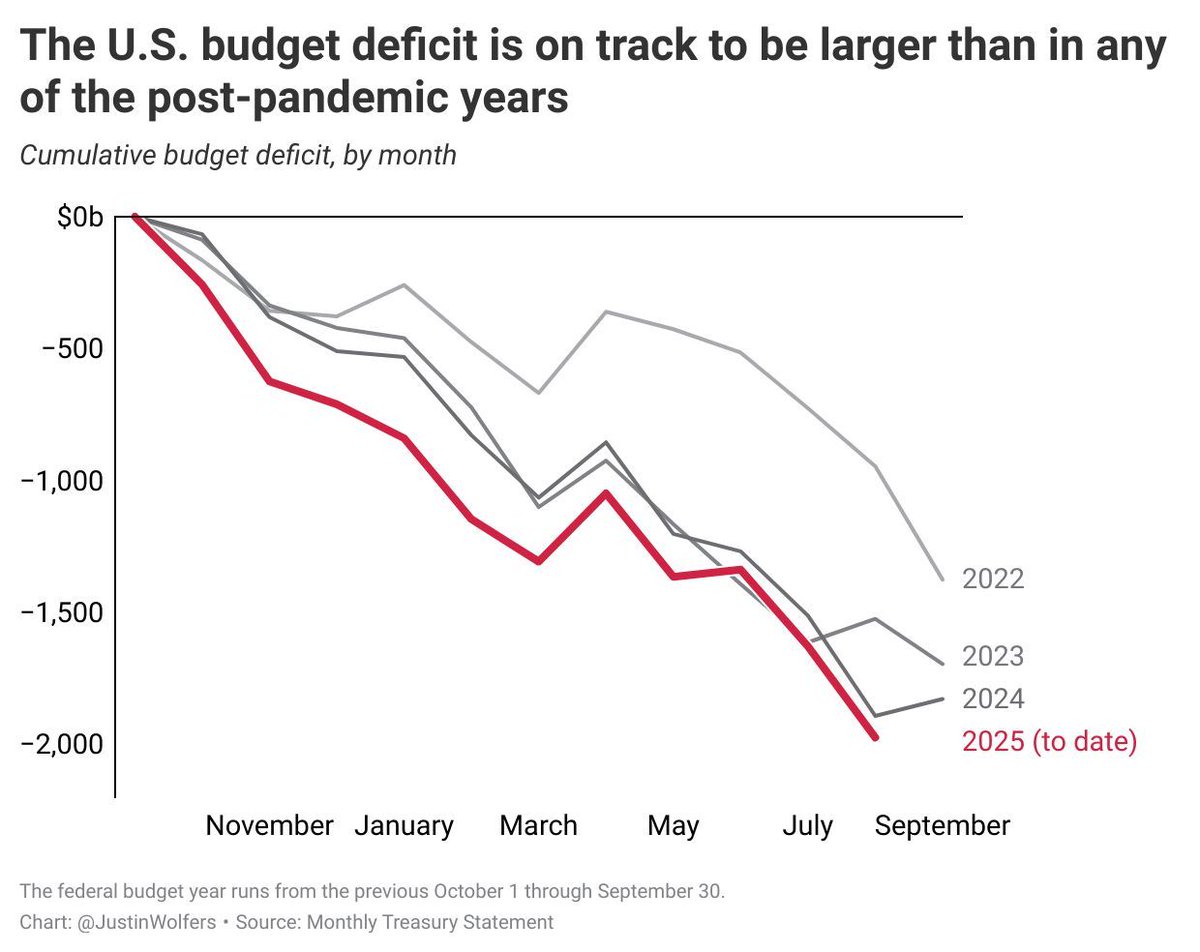

The Fed seems to have taken Mankiw’s approach to heart, except with a preferred range of 2.0-3.5%. I take Mankiw’s point about not being able to fine-tune everything, but given the bigger picture I think the Fed should if anything err on the low side of 2.0%. The Federal deficit is in the trillions and rising, inflation has been above target since 2021, and consumers never got over the Covid-era increase in the price level:

The Fed let inflation stay mostly below 2% during the 2010s, to the detriment of the labor market. They updated their policy framework in 2020 to allow for “Flexible Average Inflation Targeting”, where they would let inflation stay above 2% for a while to make up for the years of below 2% inflation. This is part of why they let inflation get so out of hand in 2022. This made up for the 2010s and then some- our price level is now 3-4% higher than it would be if we’d had 2.0% inflation each year since 2007. But the sudden big burst of inflation in 2022 led the Fed to abandon this flexible targeting idea in the 2025 framework. The lack of “make up” policy latest framework means that they don’t see themselves as needing to do anything to repair their 2022 mistake- “just don’t do it again”.

We’re certainly being stuck with permanently higher prices as a result, and I worry we will be stuck with higher inflation too.