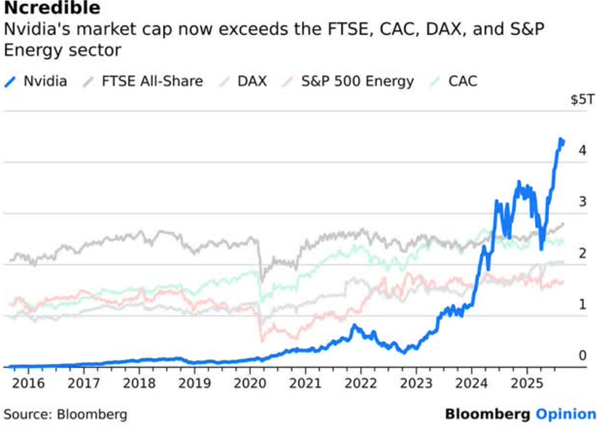

Tech stocks (e.g. QQQ) roared up and up and up for most of 2023-2025, more than doubling in those three years. A big driving narrative was how AI was going to make everything amazing – productivity (and presumably profits) would soar, and robust investments in computing capacity (chips and buildings), and electric power infrastructure buildout, would goose the whole economy.

Will the Enormous AI Capex Spending Really Pay Off?

But in the past few months, a different narrative seems to have taken hold. Now the buzz is “the dark side of AI”. First, there is growing angst among investors over how much money the Big Tech hyperscalers (Google, Meta, Amazon, Microsoft, plus Oracle) are pouring into AI-related capital investments. These five firms alone are projected to spend over $0.6 trillion (!) in 2026. When some of this companies announced greater than expected spends in recent earning calls, analysts threw up all over their balance sheets. These are just eye-watering amounts, and investors have gotten a little wobbly in their support. These spends have an immediate effect on cash flow, driving it in some cases to around zero. And the depreciation on all that capex will come back to bite GAAP earnings in the coming years, driving nominal price/earnings even higher.

The critical question here is whether all that capex will pay out with mushrooming earnings three or four years down the road, or is the life blood of these companies just being flushed down the drain? This is viewed as an existential arms race: benefits are not guaranteed for this big spend, but if you don’t do this spending, you will definitely get left behind. Firms like Amazon have a long history of investing for years at little profit, in order to achieve some ultimately profitable, wide-moat quasi-monopoly status. If one AI program can manage to edge out everyone else, it could become the default application, like Amazon for online shopping or Google/YouTube for search and videos. The One AI could in fact rule us all.

Many Companies May Get Disrupted By AI

We wrote last week on the crash in enterprise software stocks like Salesforce and ServiceNow (“SaaSpocalypse”). The fear is that cheaper AI programs can do what these expensive services do for managing corporate data. The fear is now spreading more broadly (“AI Scare Trade”); investors are rotating out of many firms with high-fee, labor-driven service models seen as susceptible to AI disruption. Here are two representative examples:

- Wealth management companies Charles Schwab and Raymond James dropped 10% and 8% last week after a tech startup announced an AI-driven tax planning tool that could customize strategies for clients

- Freight logistics firms C.H. Robinson and Universal Logistics fell 11% and 9% after some little AI outfit announced freight handling automation software

These AI disruption scenarios have been known for a long time as possibilities, but in the present mood, each new actual, specific case is feeding the melancholy narrative.

All is not doom and gloom here, as investors flee software companies they are embracing old-fashioned makers of consumer goods and other “stuff”:

The narrative last week was very clearly that “physical” was a better bet than “digital.” Physical goods and resources can’t be replaced by AI like digital goods and services can be at an alarming rate

As I write this (Monday), U.S. markets are closed for the holiday. We will see in the coming week whether fear or greed will have the upper hand.