The tariffs still have me thinking about buying VIX calls and stock puts (especially when policy changes loom on certain dates like July 8th), and on the bigger question of finding the sort of investments that did well in the 1970’s, another decade of stagflation that was kicked off by a President who broke America’s commitment to an international monetary system that he thought no longer served us.

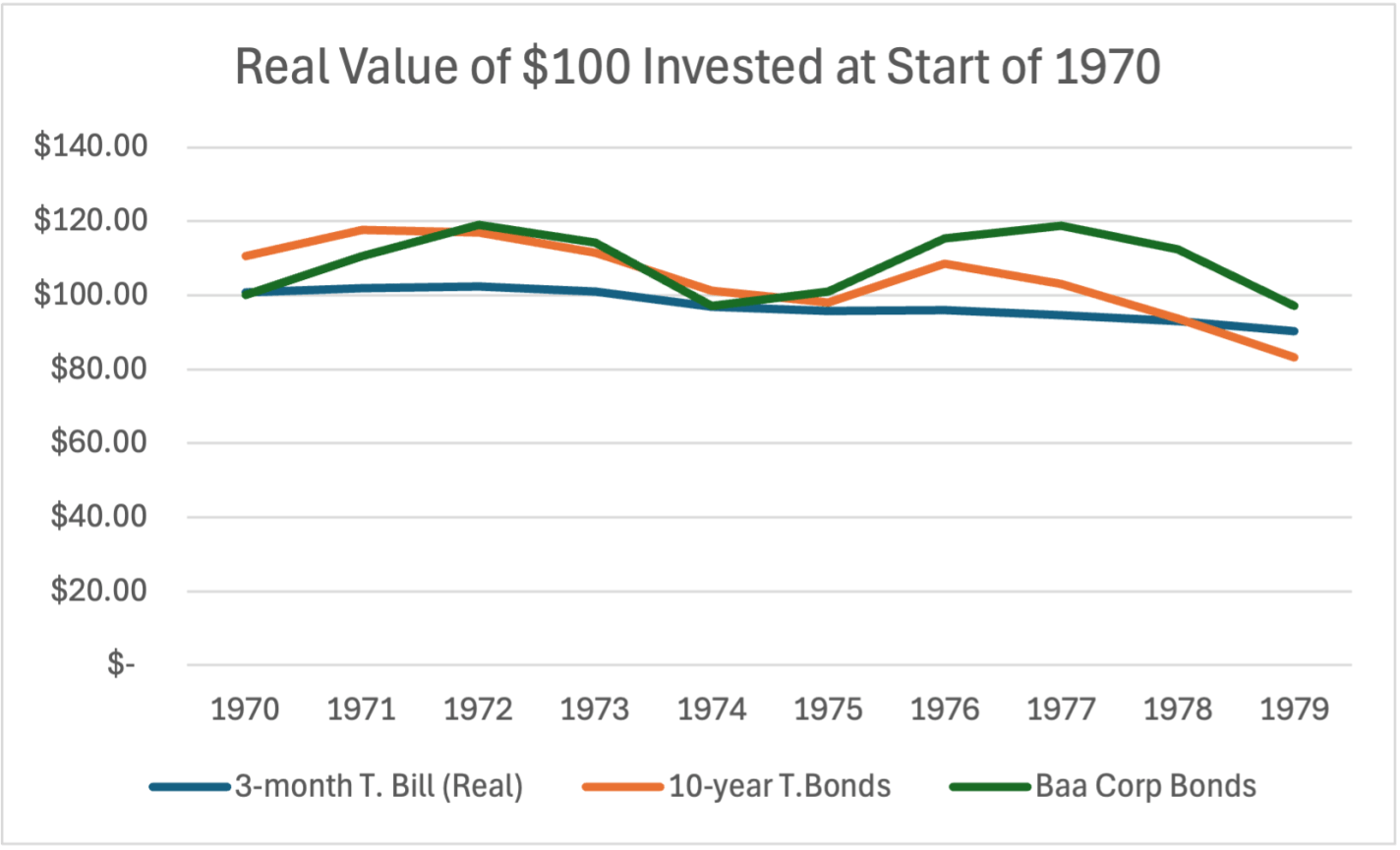

That’s how I concluded last week. So this week I’ll answer the question- what were the best investments of the 1970’s? When the dollar is losing value both at home and abroad, holding dollars or bonds that pay off in dollars does poorly:

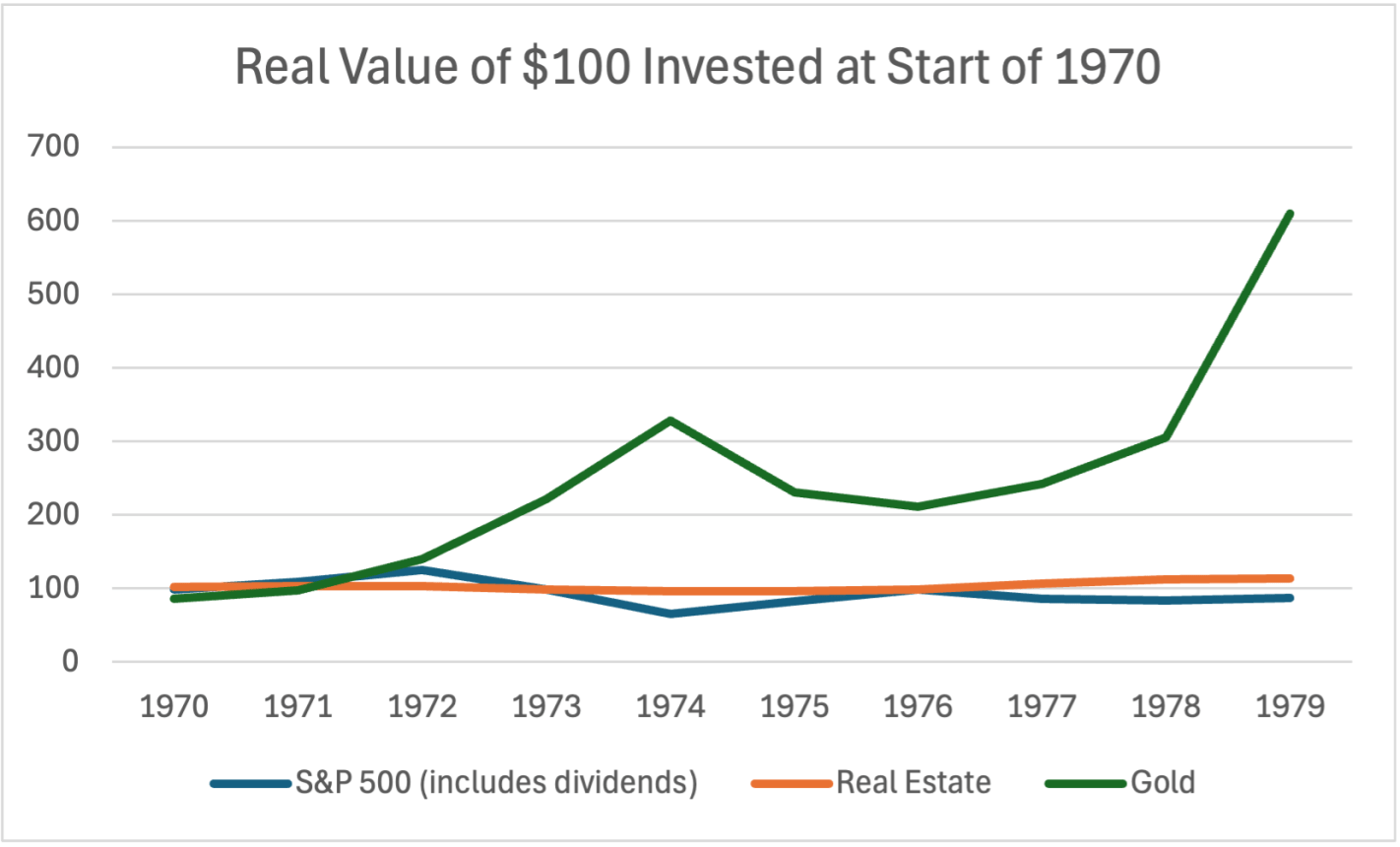

Stocks can do alright with moderate inflation, but US stocks lost value in the stagflation of the 1970’s. Foreign stocks and commodities generally performed better. Real estate held its value but didn’t produce significant returns; gold shone as the star of the decade:

Gold is easy to invest in now compared to the 1970s; you don’t have to mess with futures or physical bullion, there are low-fee ETFs like IAUM available at standard brokerages.

Of course, while history rhymes, it doesn’t repeat exactly; this time can and will be different. I doubt oil will spike the same way, since we have more alternatives now, and if it did spike it wouldn’t hurt the US in the same way now that we are net exporters. Inflation won’t be so bad if we keep an independent Federal Reserve, though that is now in doubt. At any time the President or Congress could reverse course and drop tariffs, sending markets soaring, especially if they pivot to tax cuts and deregulation in place of tariffs ahead of the midterms.

Things could always get dramatically better (AI-driven productivity boom) or worse (world war). But for now, “1970s lite” is my base case for the next few years.