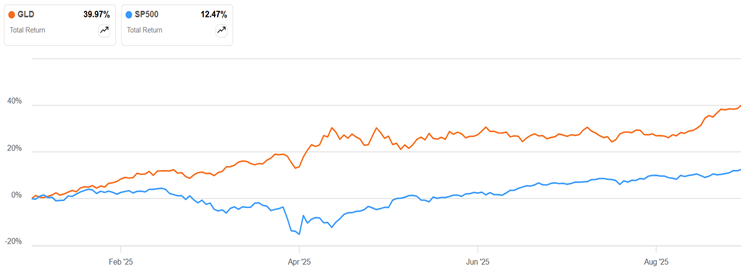

Stocks (e.g., S&P 500) are up 12.5 % year to date. That is pretty good for 9.5 months. But gold has been way better, up 40%:

Fans of gold cite various reasons for why its price should and must keep going up (out of control federal debt and associated money-printing, de-dollarization by non-Western nations, buying by central banks, etc.). I have no idea if that is true. But if it is, that raises the question in my mind: for the limited amount of funds I have to invest in gold, can I get more bang for my investing bucks, assuming gold continues to rise?

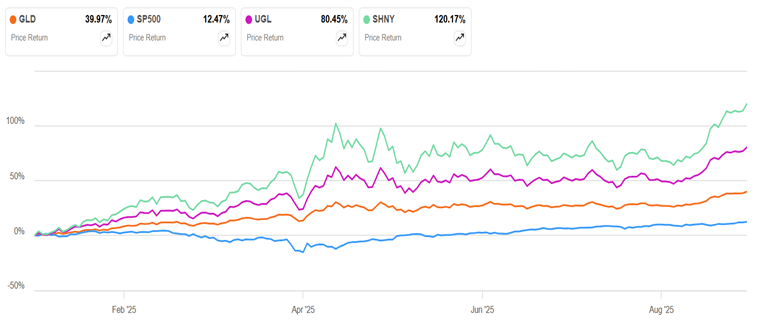

It turns out the answer is yes. A straightforward way is to buy into a fund which is 2X or 3X leveraged to the price of gold. If gold goes up 10%, then such a fund will go up 20% or 30%. Let’s see how two such funds have done this year, UGL (a large 2X gold fund) and a newer, smaller 3X fund, SHNY:

Holy derivatives, Batman, that leverage really works! With GLD (1X gold) up 40%, UGL was up 80% year to date, and 3X SHNY is up 120%. So, your $10,000 would have turned into $24,000. The mighty S&P500 (blue line) looks rather pitiful in comparison.

But wait, there’s more. Let’s consider gold “streamers”, like WPM (Wheaton Precious Metals) or FNV. They give money to mines in return for a share of the production at fixed, discounted prices, so their cash flow soars when gold prices rise. Year to date, FNV is up 73%, while WPM is up 91%.

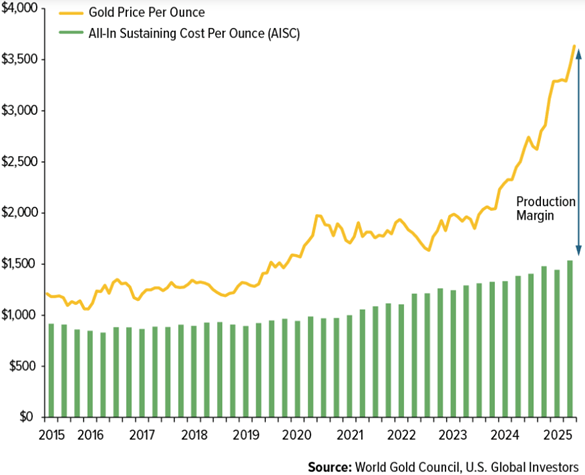

And then there are the gold miners themselves. They tend to have fairly fixed breakeven costs of production, currently around $1200-1400/oz. Again, their profit margin rockets upward when gold prices get far above their breakeven:

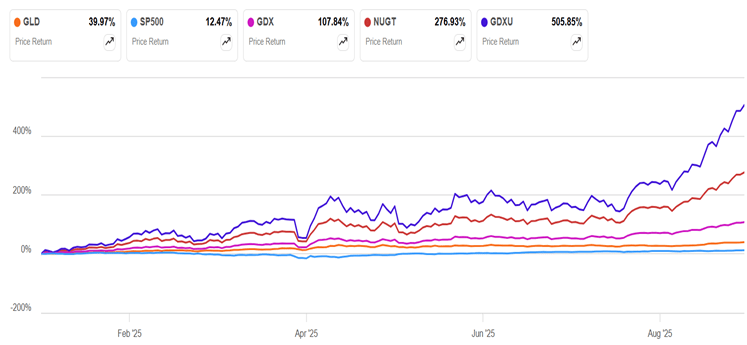

GDX is a large fund of representative mining stocks. For icing on the cake, there are funds that are 2X (NUGT) or 3X (GDXU) leveraged to the price changes in mining stocks. The final chart here displays their year-to-date performance in all their glory:

The blue S&P 500 line is lost in the noise, and even the orange 40% GLD line is left in the dust. The 1X miner fund was up 108%, the 2X fund NUGT was up 276%, and the 3X GDXU was up 506%. Your $10,000 would have turned into $51,000.

Of course, what goes up fast will also come down fast, since leverage works both ways. For instance, from Oct 21 to Dec 30, 2024, gold was down a mere 4%, but WPM was down 15%, the 1X gold miner GDX was down 20%, and 3X GDXU down an eye-watering 54%. That means that your $10,000 turned into $4,600 in two months. Imagine watching that unfold, and not panic-selling at the bottom. Gold fell by more than half between 2011 and 2015. If it fell by even 20% (i.e., gave up half of this year’s gains), I could see a 3X miner fund losing over 90% of its value (just a guess).

One more twist to mention here is the “stacked” fund GDMN, which uses derivatives to be long 1X gold PLUS 1X gold miners. It is up 151% this year, which is nearly four times as much as gold. This fund seems to have a nice combination of decent leverage with moderate volatility. It has on average kept pace with the 2X miner fund NUGT, with shallower dips. NUGT has surged way ahead in the past two months as miner stock prices have gone nuts, but that is somewhat exceptional.

Disclaimer: As usual, nothing here should be considered advice to buy or sell any security.