Last year I posted that the Philly Fed had started a new quarterly survey on Labor, Income, Finances, and Expectations (LIFE). I thought it looked promising but had yet to achieve its potential:

It will be interesting to see if this ends up taking a place in the set of Fed surveys that are always driving economic discussions, like the Survey of Consumer Finances and the Survey of Professional Forecasters. If they keep it up and start putting out some graphics to summarize it, I think it will. My quick impression (not yet having spoken to Fed people about it) is that it will be the “quick hit” version of the Survey of Consumer Finances. It asks a smaller set of questions on somewhat similar topics, but is released quickly after each quarter instead of slowly after each year. If they stick with the survey it will get more useful over time, as there is more of a baseline to compare to.

But a year later the survey now has what I hoped for: a solid baseline for comparisons, and pre-made graphics to summarize the results. It continues to show complex and mixed economic performance in the US. People think the economy is getting worse:

They are cutting discretionary (but not necessity) spending at record levels:

They are worried about losing their jobs at record levels:

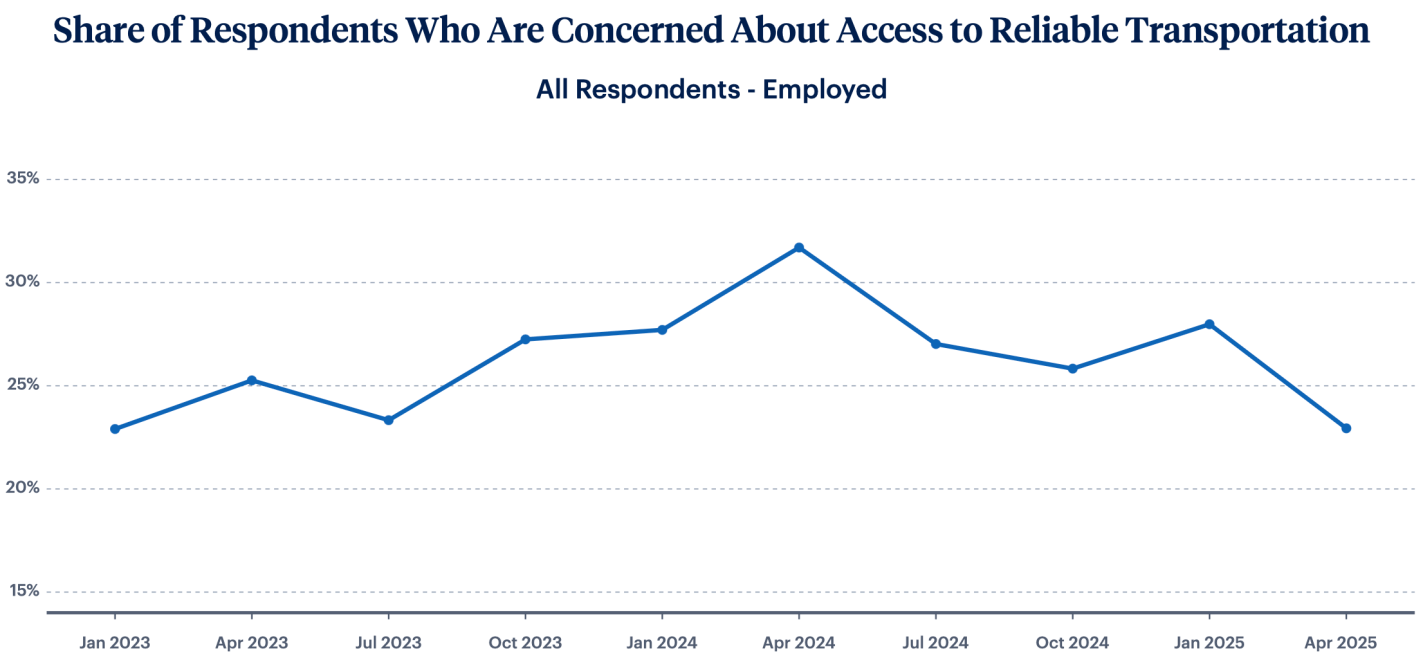

But key areas like housing, childcare, and transportation are stabilizing:

Overall I think we can synthesize these seemingly contradictory pictures by saying that Americans’ finances are fine now, but they are quite worried that things are about to get worse, perhaps due to the tariffs taking effect. You can find the rest of the LIFE survey results (including all the non-record-setting ones) here.