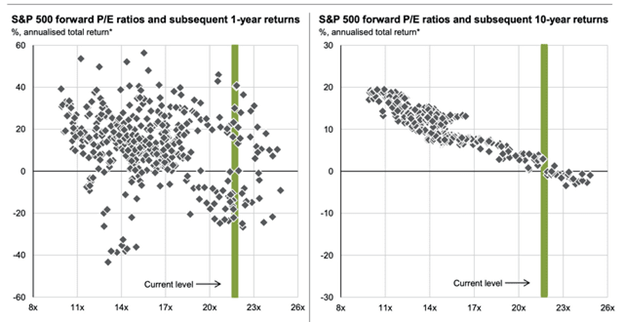

I saw this scary-looking graphic of S&P 500 returns versus price/earnings (P/E) ratios a couple of days ago:

The left-hand side shows that there is very little correlation between the current forward P/E ratio and the returns in the next year; as we have seen in the past few years, and canonically in say 1995-1999, market euphoria can commonly carry over from one year to the next. (See here for discussion of momentum effect in stock prices). So, on this basis, the current sky-high P/E should give us no concern about returns in the next year.

However, the right-hand side is sobering. It shows a very strong tendency for poor ten-year returns if the current P/E is high. In fact, this chart suggests a ten-year return of near zero, starting with the current market pricing. Various financial institutions are likewise forecasting a decade of muted returns [1].

The classic optimistic-but-naïve response to unwelcome facts like these is to argue, “But this time it’s different.” I am old enough to remember those claims circa 1999-2000 as P/E’s soared to ridiculous heights. Back then, it was “The internet will change EVERYTHING!”. By that, the optimists meant that within a very few years, tech companies would find ways to make huge and ever-growing profits from the internet. Although the internet steadily became a more important part of life, the rapid, huge monetization did not happen, and so the stock market crashed in 2000 and took around ten years to recover.

A big reason for the lack of early monetization was the lack of exclusive “moats” around the early internet businesses. Pets.com was doomed from the start, because anyone could also slap together a competing site to sell dog food over the internet. The companies that are now reaping huge profits from the internet are those like Google and Meta (Facebook) and Amazon that have established quasi-monopolies in their niches.

The current mantra is, “Artificial intelligence will change EVERYTHING!” It is interesting to note that the same challenge to monetization is evident. ChatGPT cannot make a profit because customers are not willing to pay big for its chatbot, when there are multiple competing chatbots giving away their services for practically free. Again, no moat, at least at this level of AI. (If Zuck succeeds in developing agentic AI that can displace expensive software engineers, companies may pay Meta bigly for the glorious ability to lay off their employees).

My reaction to this dire ten-year prognostication is two-fold. First, I have a relatively high fraction of my portfolio in securities which simply pump out cash. I have written about these here and here. With these investments, I don’t much care what stock prices do, since I am not relying on some greater fool to pay me a higher price for my shares than I paid. All I care is that those dividends keep rolling in.

My other reaction is…this time it may be different (!), for the following reason: a huge fraction of the S&P 500 valuation is now occupied by the big tech companies. Unlike in 2000, these companies are actually making money, gobs of money, and more money every year. It is common, and indeed rational, to value (on a P/E basis) firms with growing profits more highly than firms with stagnant earnings. Yes, Nvidia has a really high P/E of 43, but its price to earnings-growth (PEG) ratio is about 1.2, which is actually pretty low for a growth company.

So, with a reasonable chunk of my portfolio, I will continue to party like it’s 1999.

[1] Here is a blurb from the Llama 3.1 chatbot offered for free in my Brave browser, summarizing the muted market outlook:

Financial institutions are forecasting lower stock market returns over the next decade compared to recent historical performance. According to Schwab’s 2025 Long-Term Capital Market Expectations, U.S. large cap equities are expected to deliver annualized returns of 6% over the next decade, while international developed market equities are projected to slightly outperform at 7.1%.1 However, Goldman Sachs predicts a more modest outlook, with the S&P 500 expected to return around 3% annually over the next decade, within a range of –1% and 7%.42 Vanguard’s forecasts also indicate a decline in expected returns, with U.S. equities falling to a range of 2.8% to 4.8% annually. These forecasts suggest that investors may face a period of lower returns compared to the past decade’s 13% annualized total return.