There tends to be a significant rise in broad stock indices the last two weeks of the old year and into the first two trading days of the new year. This is termed the “Santa Claus” rally. Sometimes it is focused on the last five trading days of the old and the first two days of the new.

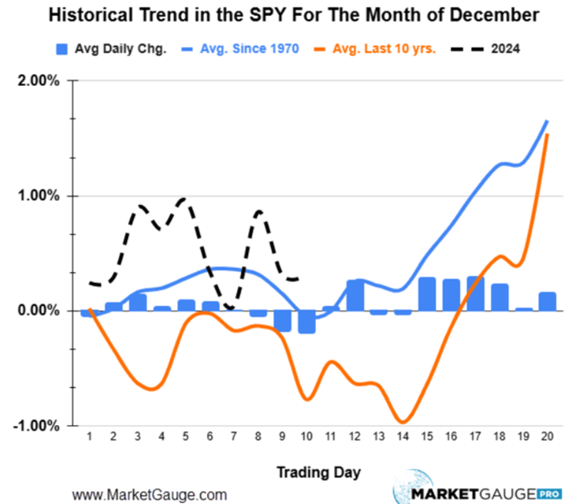

Here is a chart showing average changes in S&P 500 prices for the month of December for 1970-2023 (blue line), and more recent data (last ten years, orange line).

Some possible reasons for this year-end rally are:

Tax-loss harvesting: Investors may sell stocks at the end of a year to claim capital losses, to offset capital gains. They may then repurchase these stocks at the start of the new year.

Low trading volume: Larger institutional investors often go on holiday in this timeframe, leaving the market more to individual retail investors, who may be more optimistic.

Herd mentality: If most investors believe stocks will go up, then probably stocks will go up.

Santa Predicts the Future

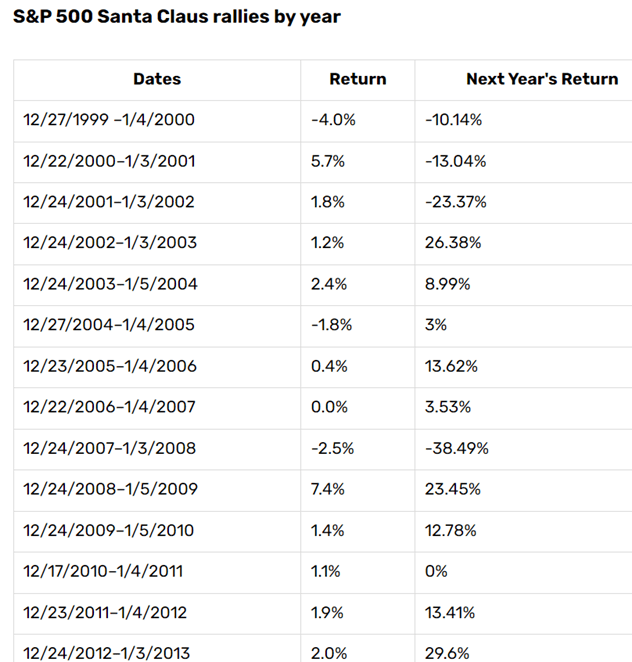

Perhaps even more significant is the power of the Santa Claus rally to predict stock returns in the coming year. The following table lists returns for the last five trading days of the old year plus the first two days of the new year, and also the returns for the whole new year:

The table above was published in 2023, so the full year 2023 stock returns at that point were “TBD”. We now know the 2023 returns were hugely positive (approx. 23%). So, for 1999-2023, Santa came to town 19 out of 24 times for a year-end rally. Also, since 1999, the market rose 19 times during the Santa Claus rally; the following year, the S&P posted gains 15 times. Out of the 5 times the market lost ground during same period, the market fell in 3 of the following years. So the market performance in this transitional timeframe correlates well with the stock gains for the whole new year.

Will stocks soar again this holiday season? I have no idea. We are off to a shaky start, with the S&P 500 down about 1.5% in the past five days , through 12/22. This after the market hated the Fed’s more hawkish stance last week, being now likely slower to reduce interest rates than previously assumed.

As usual, nothing here should be considered advice to buy or sell any security.