Wiley publishes a series of short books on investing called “Little Books, Big Profits“.

I previously reviewed Vanguard founder John Bogle’s entry in this series, the Little Book of Common Sense Investing:

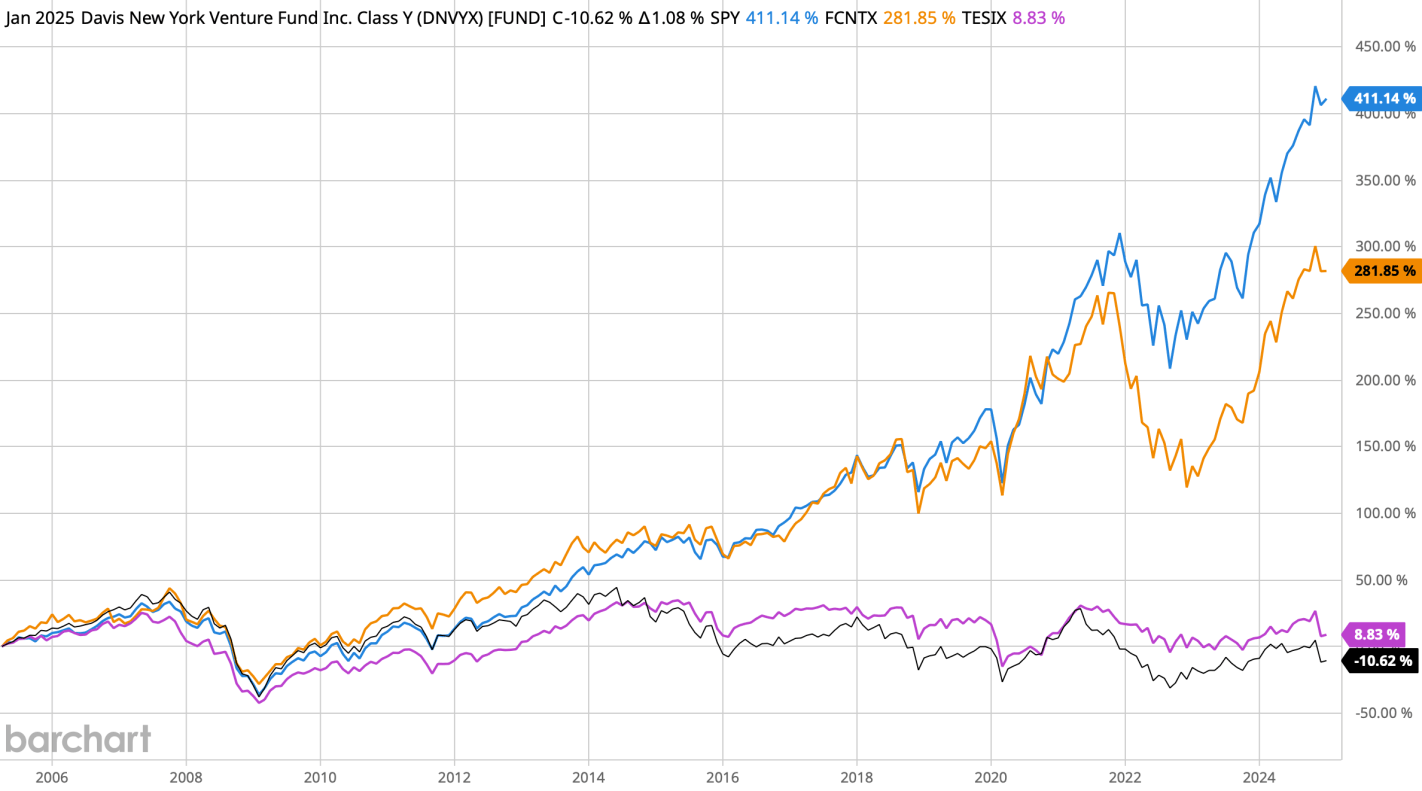

I can sum it up at much less than book length: the best investment advice for almost everyone is to buy and hold a diversified, low-fee fund that tracks an index like the S&P 500.

You could call Bogle’s book the Little Book of Passive Investing; but most of the rest of the series could be the Little Books of Active Investing. That is certainly the case for Joel Greenblatt’s entry, The Little Book that Beats the Market (or its 2010 update, The Little Book that Still Beats the Market).

Greenblatt offers his own twist on value investing that emphasizes just two value metrics- earnings yield (basically P/E) and return on capital (return on assets). The idea is to blend them, finding the cheapest of the high-quality companies. The specific formula is to pick stocks with a return on assets of at least 25%, then select the ~30 stocks with the lowest P/E ratio among those (excluding utilities, financials, and foreign stocks), then hold them for a year before repeating the process. He shows that this idea performed very well from 1988 to 2010.

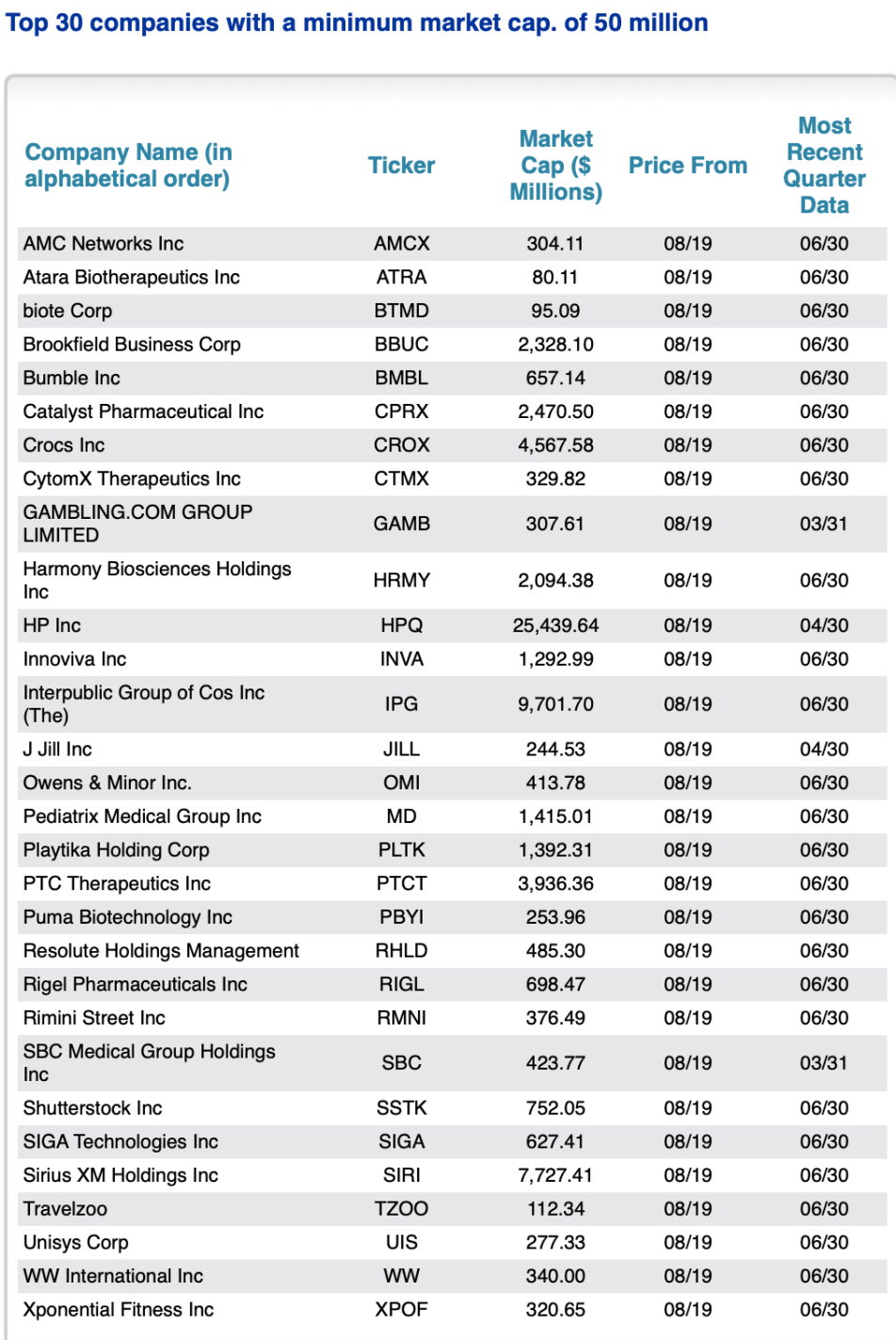

How has it done since? He still maintains the website, https://www.magicformulainvesting.com, that gives updated stock screens to implement his formula, which is nice. But the site doesn’t offer updated performance data, and his company (Gotham Capital) offers no ETF to implement the book’s strategy for you despite offering 3 other ETFs, which suggests that Greenblatt has lost confidence in the strategy. Here are the top current top stocks according to his site (using the default minimum market cap):

Perhaps this is worthwhile as an initial screen, but I wouldn’t simply buy these stocks even if you trust Greenblatt’s book. When I started looking them up, I found the very first two stocks I checked had negative GAAP earnings over the past year, meaning Greenblatt’s formula wouldn’t be picking them if it used correct data. The site does at least have a good disclaimer:

“Magic Formula” is a term used to describe the investment strategy explained in The Little Book That Beats the Market. There is nothing “magical” about the formula, and the use of the formula does not guarantee performance or investment success.

Greenblatt’s Little Book is a quick and easy way to learn a bit about value investing, but I think Bogle’s Little Book has the better advice.