I’ve written about government spending before. But not all spending is the same. Building a bridge, buying a stapler, and taking from Peter to pay Paul are all different types of spending. I want to illustrate that last category. Anytime that the government gives money to someone without purchasing a good or service or making an interest payment, it’s called a ‘transfer’. People get excited about transfers. Social security is a transfer and so is unemployment insurance benefits. Those nice covid checks? Also transfers.

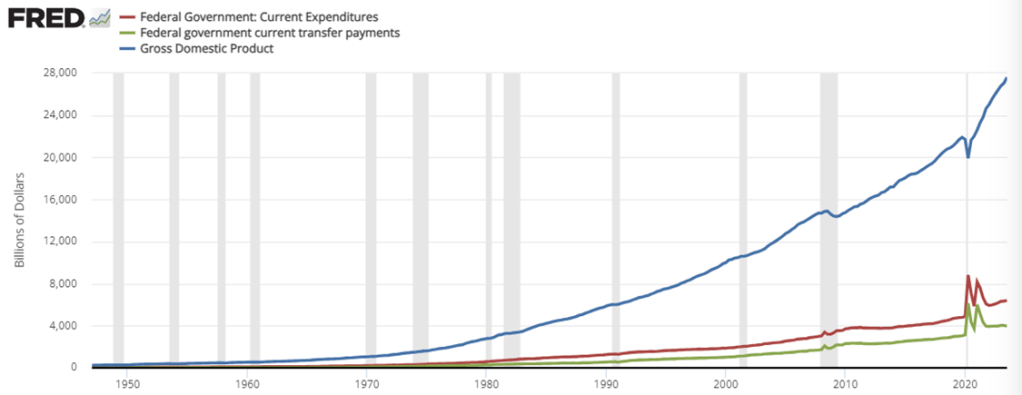

Here I’ll focus on Federal transfers, though the data on all transfers is very similar if you include states in the analysis. Let’s start with the raw numbers. Below is data on GDP, Federal spending, and federal transfers. Suffice it to say that they are bigger than they used to be. They’ve all been growing geometrically and they all exhibit bumps near recessions.

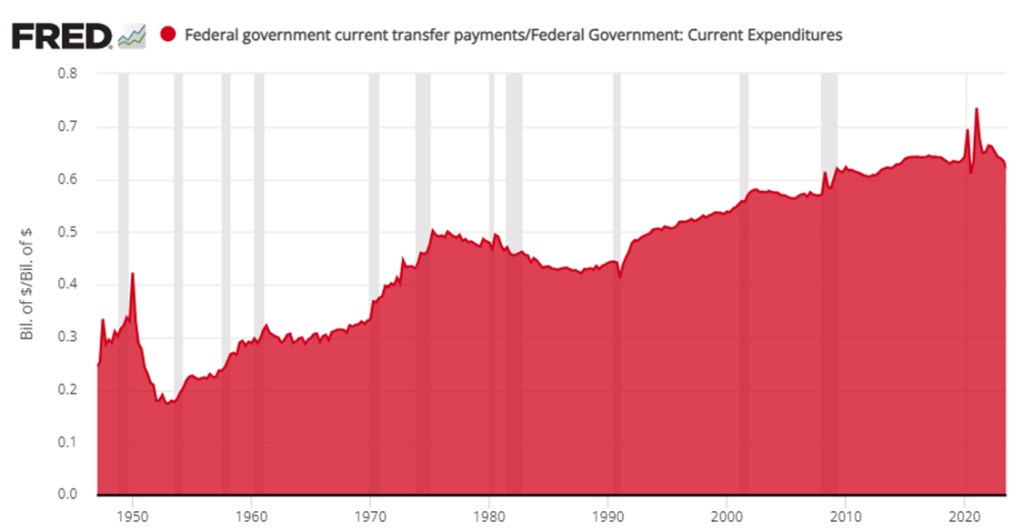

It’s hard to see much from the above except that the vertical axis is in billions of dollars and that we spend trillions. The government transfers more, spends more generally, and we have more income than previously. What about the share of transfers? Let’s examine a couple of ratios. The below graph shows us that the government has a track record of transferring more and more as time passes. That is, providing investment and services has become a smaller part of what the federal government does. The data starts in 1947 with transfers composing less than 25% of government spending. Now, transfers compose more than 60% of outlays.

So, who will build the roads? Well, yes that’s still the government. But let’s not act like that’s most of what the government does. Let’s acknowledge that 60 cents of every dollar that the Federal government spends is being given to someone and not spent providing a material good or service. And, since spending comes from taxes and debt, it’s looking more and more like the federal government is a means by which to reallocate incomes rather than solve collective action problems.*

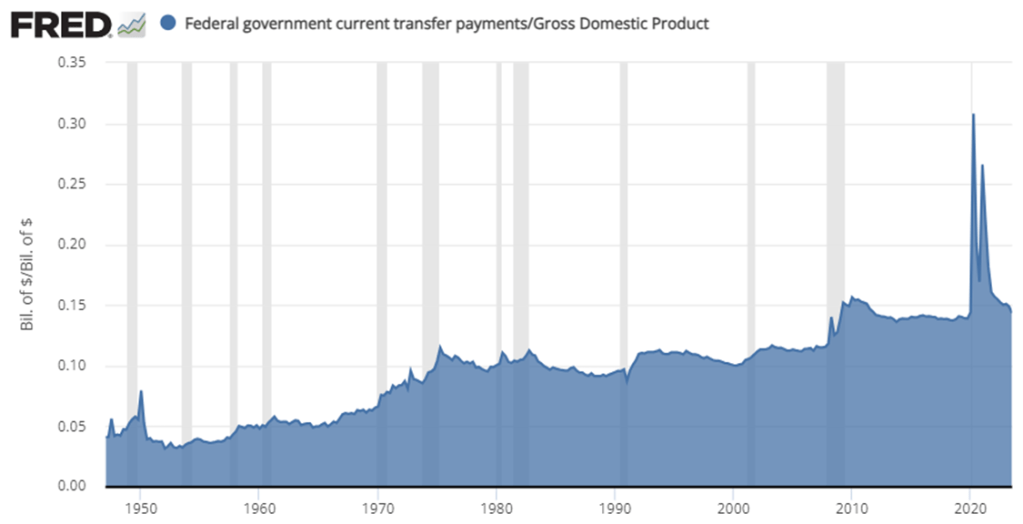

What about transfers as a proportion of our economy? Below is the federal transfer-to-GDP ratio. Whether it’s any better or worse depends on your perspective. What is true is that transfers have increased as a proportion of all spending in the US. The data starts at less than 5% in 1947, and now it’s just below 15%. However, Covid aside, it’s stayed mostly level since the financial crisis. Over the decades, there has been much less of a gradual rise and more of a ratcheting effect. It’s pretty clear that transfers rise during recessions. They usually subside, albeit to a higher level than prior (paging Bob Higgs). This is where biases are revealed. Some people see the change as a means of asserting distributive justice. Others see it as a means of eroding incentives and property rights.**

We can also see that Covid really was exceptional. More than 30% of all spending in the US was due to transfers during the 2nd quarter of 2020. Wow!

Finally, there is something to be said for leaning into your competitive advantage. The federal government famously spends money poorly. Define that however you like. The government is famously good at two things: 1) Violence and 2) taking money from some people and giving it to others. We can see that, as a proportion of total spending, the federal government has really leaned into that latter activity.

*One could say that re-distribution of incomes directly addresses the collective action problem of adjusting that distribution. Let’s let that one topic lie for another time.

** The third option is that it’s a product of political outcomes that are desired by no individual person and that it’s just part of the pie of resources over which we compete.

And all that transfer is being funded by debt. Easy to imagine what will happen to the economy if debt cannot be increased OR transfers are funded by taxation.

Federal spending is magic show….till it isn’t 🙂

LikeLike