Firearm deaths are a problem, both mass shootings and the broader class of gun violence. I am not open to the argument that mass shootings are per capita irrelevant given their low frequency relative to other deadly events. The reality is that mass shootings, particularly school shootings, are sufficiently frequent that they generate a predictable news cycle that culminates in the increasingly familiar despair over a political stalemate. We live in that despair and there is no denying it.

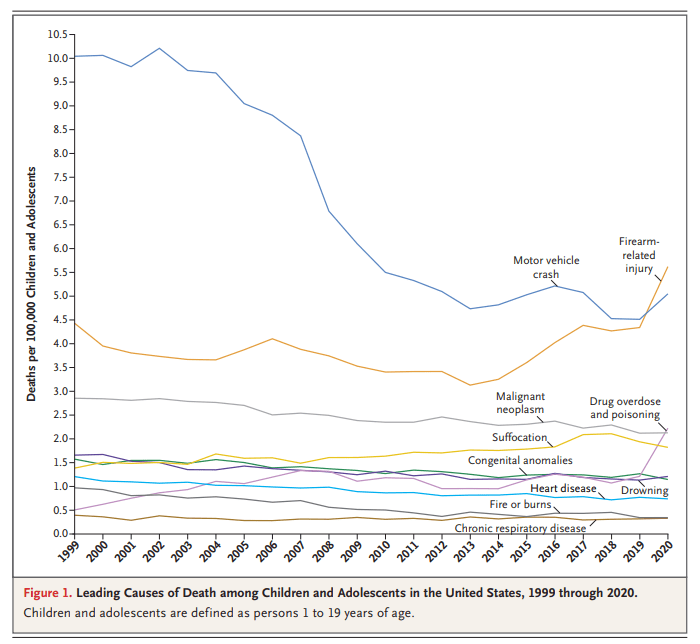

Firearms deaths cannot be dismissed as insignificant portions of the risk landscape. Firearms are the leading cause of death in the United States before the age of 18, outpacing traffic accidents and cancer. Yes, they fall to third place if we exclude teenagers. Yes, that is in part because of the progress we’ve made on traffic safety and cancer. Fine. Great job all around. None of that reduces the salience of firearms if we are trying to reduce child mortality.

I’ve written about firearms restrictions and mass shootings before and I am sufficiently pessimistic that I expect to write about it again. There was another mass shooting at a children’s school in Nashville. I admit I am sad and angry. I am trying to not be despondent. A nine-year old girl lost her life trying to pull a fire alarm to save her classmates. Her bravery shames me away from despondence. It should be shaming a lot more people, if I am being honest.

I am, however, also on the record that the stalemate of US firearms policy is an…ahem…

So what can be done? While “do nothing” is in fact often the optimal policy, I don’t believe that is the case with regard to firearms. Let’s talk some options through, both in terms of potential efficacy and political feasibility, all framed within the broader objective of reducing the supply and demand for killing capacity.

1. Ban aftermarket firearm modification of any sort, including cosmetic changes

End the toyification of firearms. If you believe that firearms are tools, great, but the firearm market would seem to disagree with you. We banned flavored tobacco products to keep then away from kids. Let’s ban the toyification of firearms to make them less appealing to idiots.

A firearm should provide you no more identity-signally consumption than owning a pick axe. It’s a tool. Treat it as one. Any modification should destroy it’s resale value and carry risk of misdemeanor punishment if observed in public (i.e. a gun range or hunting). Guns should be as plain as a shovel. I’m already judging you for owning this death toy. Owning it in school colors, or with a punisher logo, or in don’t you just love it purple? Congrats, now I’m even more sure I’m absolutely right and you should be banned from owning anything deadlier than a toaster oven.

I’ll be honest that I am speaking more anecdotally from personal interactions with enthusiastic assault weapon owners, but a big part of the appeal is no different from owning a 400 horsepower sports car or giant truck. Assault weapons ownership makes them feel powerful and cool in a way that a standard 12 gauge shotgun wouldn’t.

While I know the NRA will, by dint of their own pure policy of universal opposition, resist limits on firearms modification, the legal merits of opposing bans on after-market firearms modification would be considerably weaker. Firearms manufacturers, on the other hand, would earn better margins on weapons forcibly more uniform in design. Further, the returns to scale would favor larger incumbent firms, hopefully weakening lobbying resistance.

2. Tax ammunition, scale it with killing power

The tax on bullets should be onerous. The tax on ammunitaton with higher killing power (e.g. hollow points), armor piercing capability, or explosiveness should be so burdensome that the scale of acquisition should be trackable in a national database. It’s not just about reducing the amount of ammunition floating around society, but rendering large scale acquisition trackable.

I don’t know if this is politically feasible. A baseline tax on all ammunitition would be resisted feverishly, but focusing on deadlier ammunitition might create a window of feasibility.

The vegas shooter fired over 1000 rounds into a crowd, wounding and killing a total of 473 people. He had fourteen AR-15s, some of which had 100 round magazines and bump stocks to facilitate the fastest and most efficient means to commit as many murders as possible. Is it a perfect world if a $35 tax on top of the current $15 box of 20 rounds limited him to 500 rounds? No, but there are at least 10 more people alive today. And in the current landscape of firearm violence in the United States, I’ll take any marginal gain I can get.

3. Hold people responsible for crimes committed with their guns

Not just parents, either, but that’s a good start. I was given a rifle by my parents when I was 16. If I committed a crime with it, they should have been held responsible. Same should go for all weapons. If you can’t lock your guns securely, you shouldn’t own them. Firearms manufacturers absolutely have the ability to biometrically lock them. They don’t because it isn’t required. Legal liability would increase demand for exactly this ability. Biometric locks mean fewer accidents, gun thefts, and would reduce the broader supply of guns as people would be far more likely to have older weapons destroyed.

Now, I know some would argue that legal liability is a back-door tax on firearms. Here’s my counter-argument: yes, it absolutely is a tax, but if responsibility for your firearms is a tax you can’t afford, then you can’t afford a firearm. That’s called being an adult.

4. Absolute ban on names and images of perpertrators unless they are at large.

You will not become famous. There will not be a Netflix series about you. Your identity will be scattered to the wind long before it could even be resigned to the dustbin of history. Is this politically feasible? I think so. Sure, podcasts and tweets about shooters will still inevitably pop up still, but anything that lowers the historical status of shooters, the better. Broad regulation of when to name shooters seems low risk, high benefit.

5. End No-knock raids

People will own fewer guns if they feel safer in their homes, which means at the very least fewer firearms accidents. Reaffirming 4th Amendment rights would go a long way towards reducing citizen’s desperate need to express their 2nd Amendment rights. Ending all no-knock raids is more than politically feasible, I would go so far as to say it is potential political winner, though I’ll concede there will resistance from police unions.

6. Ban assault weapons

Let’s close with most discussed policy solution, an outright ban based centered around power and kill capacity. Banning a good with high demand is always difficult, just ask the war on drugs. If we’re going to try to ban assault rifles, we need to go in with our eyes open. Assault weapons are by and large consumption goods, if not outright toys, and in case you can’t hear the derision in my tone let me be clear I am absolutely judging you for owning one. They have zero value for hunting: a .556 round from an AR-15 will destroy your quarry. Better hunting option: anything firing .45-70 caliber ammunition. An assault rifle has negative value for defending your family at home. The through-wall collateral damage leaves you as likely to harm your family as any intruder. Better home defense option: any 12 gauge shotgun. An assault rifle is not a bulwark against tyranny any more than a samurai sword would have been living in a rural town in the Jim Crow South. We all need to accept that we are woefully outmatched in terms of physical and human capital in a confrontation on the local monopsolist on violence. Better option: join a peaceful political action organization. Join a major political party. Hell, join a local religious group. Resistance against tyranny is about numbers, not the stopping power of the weapon you or your drinking buddies are holding.

There is absolutely no more reason for civilians to own high power, high capacity assault rifles than there is for them to own anti-aircraft guns or weapons grade plutonium. It’s a disaster and it’s stupid. So why are we stuck here? Short answer: gerrymandering and lobbying. How do we get out? High shame campaign. Aggressive, unrelenting politics of shaming. No quarter taken, none given. Ads. With. The. Victims. It will be awful, I will cry. You will cry. It’s the only way. Why can 18 year olds vote? The Vietnam draft shamed us into giving draftees the right to vote before we sent them to die. Shame works when it is this pointed and undeniable. And there is no denying our shame.