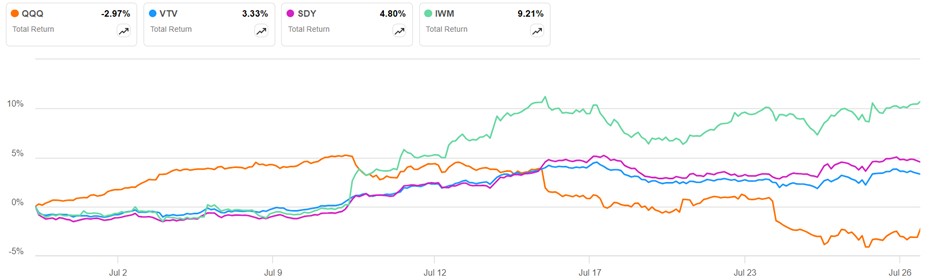

Tech stocks have been unstoppable for the past fifteen or so years. Here is a chart from Seeking Alpha for total return of the tech-heavy QQQ fund (orange line) over the past five years, compared to a value-oriented stock fund (VTV), a fund focused on dividend-paying stocks (SDY) and the Russel 2000 small cap fund IWM.

QQQ has left the others in the dust. There has been a reversal, however, in the past month. The tech stocks have sagged nearly 10% since July 11, while the left-for-dead small caps (IWM, green line) rose by 10%:

Some of this is just mean reversion, but there seems to be a deeper narrative shift going on. For the past 18 months, practically anything that could remotely be connected with AI, especially the Large Language Models (LLM) exemplified by ChatGPT, has been valued as though it would necessarily make every-growing gobs of money, for years to come.

In recent weeks, however, Wall Street analysts have started to question whether all that AI spending will pay off as expected. Here are some headlines and excerpts (some of the linked articles are behind paywalls):

““There are growing concerns that the return on investment from heavy AI spending is further out or not as lucrative as believed, and that is rippling through the whole semiconductor chain and all AI-related stocks,” said James Abate, chief investment officer at Centre Asset Management.”

““The overarching concern is, where is the ROI on all the AI infrastructure spending?” said Alec Young, chief investment strategist at Mapsignals. “There’s a pretty insane amount of money being spent.

Jim Covello, the head of equity research at Goldman Sachs Group Inc., is among a growing number of market professionals who are arguing that the commercial hopes for AI are overblown and questioning the vast expense required to build out infrastructure required for the computing to run and train large-language models.”

“It really feels like we are moving from a ‘tell me’ story on AI to a ‘show me’ story,” said Ohsung Kwon, equity and quantitative strategist at Bank of America Corp. “We are basically at a point where we’re not seeing much evidence of AI monetization yet.”

https://finance.yahoo.com/news/earnings-derail-stock-rally-over-130001940.html

Goldman’s Top Stock Analyst Is Waiting for AI Bubble to Burst

Covello casts doubt on hype behind an $16 trillion rally

He says costs, limited uses means it won’t revolutionize world

https://finance.yahoo.com/news/goldman-top-stock-analyst-waiting-111500948.html

Google stock got dinged last week for excessive capital spending, even though earnings were strong. Microsoft reports its Q4 earnings after the market closes today (Tuesday); we will see how investors parse these results.

Another Dot com bubble?

LikeLike