I don’t like to follow politics, much less politics in another country. Policy on the other hand? I’m always hooked.

Most of us have heard of President Javier Milei by now. He became Argentina’s president in December of 2023. Prior, he had been in charge of a private pension company, a university professor who taught macroeconomics, had hosted a radio show, and has written several books. See his Wikipedia entry for more.

What makes him worth talking about is that he appears a little… unique. He’s boisterous and rattles off economic stories and principles like he wants you to get up and do something about it. To anyone in the US, he looks and behaves like a weird 3rd-party candidate – sideburns and all. He’s different. Here he is bombastically identifying which government departments he would eliminate:

I’ve enjoyed the spectacle, but haven’t paid super close attention. I know that he is libertarian in political outlook, drops references to Austrian economists and their ideas by the handful, and doesn’t mince words. Here he is talking at the Davos World Forum (English & Dubbed).

So what?

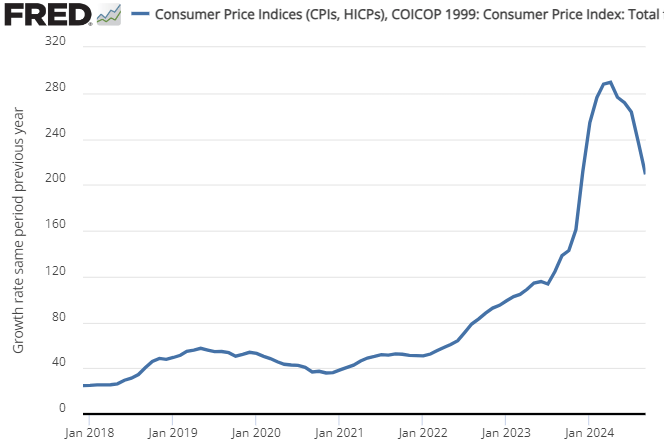

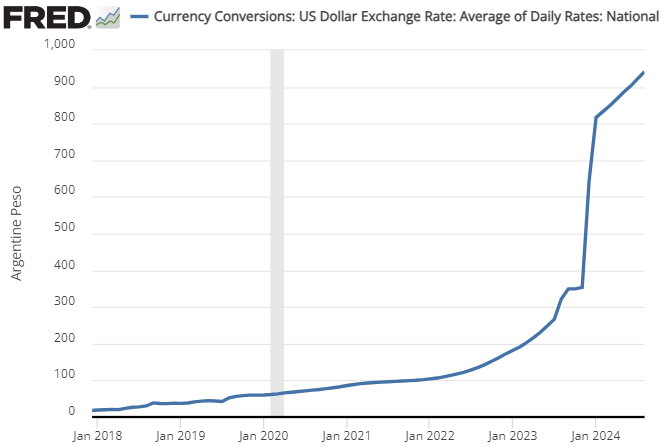

Argentina has a long history of high inflation and debt defaults. Every president always says that they’ll fix it, and then they don’t. There have been periods of lower inflation, but they don’t persist. Among Milei’s stated goals was to end that cycle and bring down inflation. His plan was to substantially reign in deficit spending by eliminating entire areas of government. We’re now approaching a year since Milei took office, and I thought that I would check in. Below is the CPI for Argentina since 2018. As soon as Milei took office prices spiked, but have started coming down more recently. Similarly, the Argentine Peso has fallen in value by 50% since he’s taken office. Ouch!

¿Por que?

The story that you get on the news depends on the affiliation of the company or reporter. On the left, people are eager to see Milei fail and they’re ready to point out both the peso devaluation, higher prices, and relatedly depressed economic activity. On the right, they point to the falling prices since April of 2024.

Almost nobody in the US mentions that, prior to Milei, the Argentine government had re-instituted capital controls in 2019. In short, this meant that US dollars weren’t legally allowed to leave the country. Capital controls are what countries do when they want to print a lot of money and also want to keep a stable exchange rate. Maintaining free trade would devalue the suddenly plentiful currency, so a government can introduce capital controls to prevent people from selling it for dollars (see the impossible trinity for more). Furthermore, printing money tends to increase prices. Argentina maintained price controls to help prevent high rates of measured inflation. Of course, this meant that many goods were not actually available for purchase (legally). To boot, Argentina had 6 recessions by 2023. Things were not OK. Read the US State Department report for more.

Once Milei abolished many of those capital controls and foreign exchange controls, the price of the peso plummeted. Since Argentina imports many goods, domestic prices also rose. In other words, the first quarter of 2024 saw many prices adjust such that they reflect supply and demand. Argentines are poorer then they thought they were. The Milei government has every intention of collecting more dollars in order to bolster the value of the peso. This is a common strategy among inflationary regimes. But they’re doing it with a less distortionary foreign-exchange taxes rather than capital controls.

As promised, Milei is in fact cutting government spending. The government is running huge surpluses, putting it in a good position to resolve it’s money-printing and debt addictions. Though the Argentine credit rating hasn’t risen since Millei has been in office, it also hasn’t continued the four-year trend of falling. Argentina’s dollar reserves have recently increased from their 2023 low, but it’s too soon to tell whether this is merely a blip.

What about the pain? Critics have said that high unemployment and recession can be attributed to Milei and his reckless policies. Given the prior capital, foreign exchange, and price controls, a lot of the economic scarcity was already baked-in and not reflected in higher prices. It was definitely Milei who abolished the price controls. But it wasn’t he who pushed the prices up so high that they warranted controlling. Macroeconomically, things are moving in the right direction.

A final word on inflation expectations is warranted. Economists tend to be a stuffy bunch. We like to be thoughtful and we don’t like fanfare. That jeopardizes precision (and we love precision). So, many economists haven’t exactly endorsed Milei. He’s just… too much. But, that may account for part of his recent inflationary success. By appearing un poco loco, he’s convinced the public that he really will get inflation down. By acting like he is single-mindedly obsessed, he helps the public and the bankers to believe him when he says that he will lower inflation with an accompaniment of specific policy details. In the 1980s, a much calmer Volcker convinced everyone that he’d let a painful recession happen if it meant reigning in inflation. And he succeeded.