Remember that one time, back when we had a global pandemic, when interest rates fell really low and everyone was borrowing and refinancing? Good times. But they were also times of surging demand for durable goods, supply chain disruptions, and shortages. Specifically, the price of lumber surged by 54% between 2019 and 2022. There were stories of contractors who were unable to do their jobs at their typical prices. Some of them went without work. Others did much less work. Theft of precious lumber was in the news.

As we know, sudden price spikes often make the front pages and the social media rounds. But they peter out and the subsequent decline in prices hardly ever gets coverage in the same way. People used to talk about higher gasoline prices all the time, but never discussed with the same enthusiasm when prices fell. The same is true for lumber. We heard hysterical stories of record high prices, alleged shortages, and the sawmills that lacked adequate capacity to keep up with demand.

What’s going on in the lumber market?

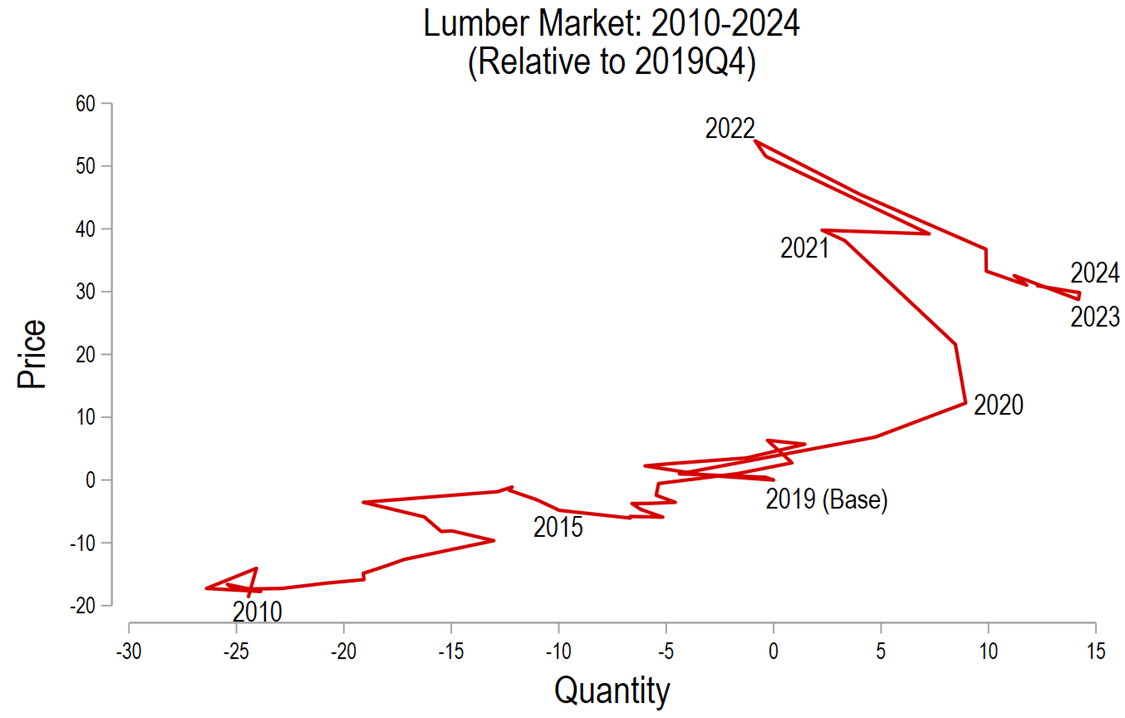

Here I’ll lean on the price and quantity series from the national accounts by industry for “Wood Products”. This includes lumber, wood flooring, plywood, etc. Below is a graph that charts out the supply-and-demand journey from 2010 through the second quarter of 2024. What do we see? Demand for lumber steadily increased from 2010 through 2019. Then, after a brief decline, there was a sudden boom in demand, soliciting 9% more output in a single year. Prices rose similarly by 12%. But in 2021 and 2022, the other shoe dropped. Higher labor and input prices, thanks to general economy-wide inflation, increased the costs of production. Less lumber was produced in early 2022 than pre-pandemic. The pattern was similar in the overall economy.

Since 2022, lumber prices have fallen by more than 16% all while output has risen by nearly 15%. For those keeping track, that’s more lumber at lower prices. Supply had time to catch up. For the economists in the room, the supply increased and there was a movement down along the demand curve.

The most recent numbers for the price index as of 2024Q3 reflect that prices dropped even further and are 22% higher than pre-pandemic. That’s just a little bit higher than the consumer prices (PCE) at 19% higher. Annually, lumber prices grew by an average of 0.6% faster than most goods and services in the economy. Which is… not exceptional. In fact, median wages for people over the age of 16 grew slightly faster such that Americans can now afford 2% more lumber now in 2024 than pre-pandemic.

My take away? If you see news about big price spikes, then set a reminder for yourself to check-in again later. Odds are good that the price movements and news were both just transitory.

Median wages is a useless number when your wages haven’t risen.

LikeLike

I used to work for a petroleum company. Yes, media and politicians howled and postured when prices went up (usually driven by global issues beyond and company’s control); when prices went back down again, crickets…or more accusations of nefarious scheming.

LikeLike

Gah! I replaced my deck in 2022. 😢

LikeLike