What do portfolio managers even get paid for? The claim that they don’t beat the market is usually qualified by “once you deduct the cost of management fees”. So, managers are doing something and you pay them for it. One thing that a manager does is determine the value-weights of the assets in your portfolio. They’re deciding whether you should carry a bit more or less exposure to this or that. This post doesn’t help you predict the future. But it does help you to evaluate your portfolio’s past performance (whether due to your decisions or the portfolio manager).

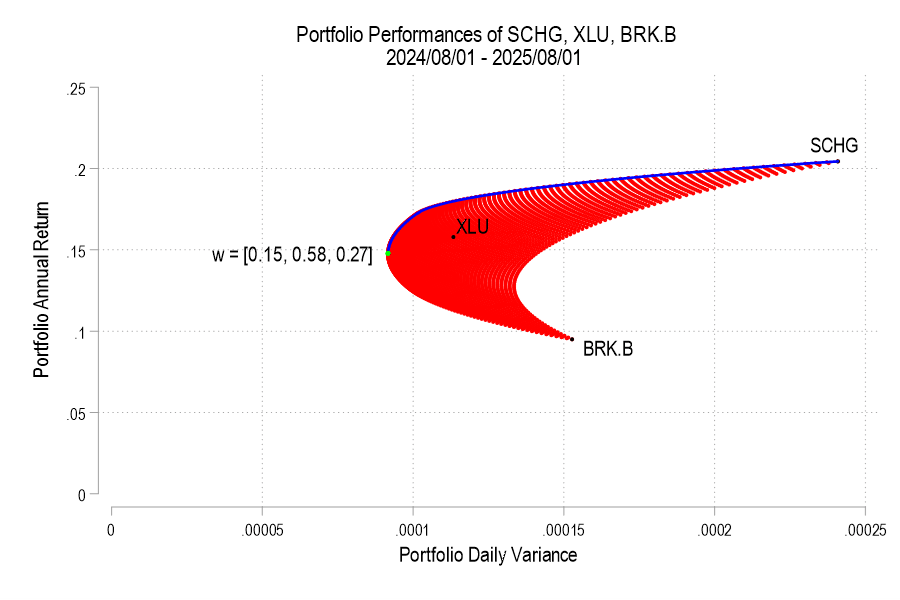

Imagine that you had access to all of the same assets in your portfolio, but that you had changed your value-weights or exposures differently. Maybe you killed it in the market – but what was the alternative? That’s what this post measures. It identifies how your portfolio could have performed better and by how much.

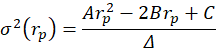

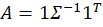

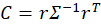

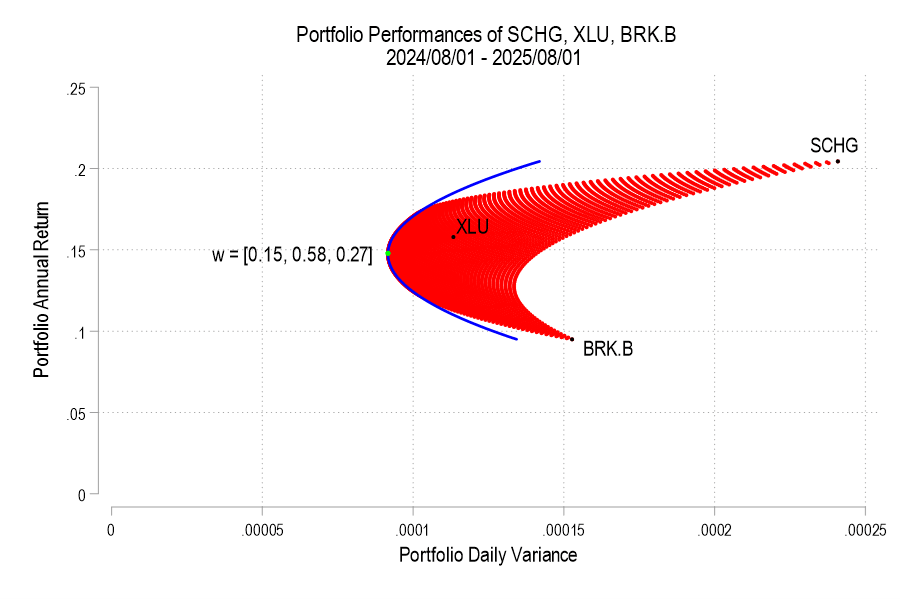

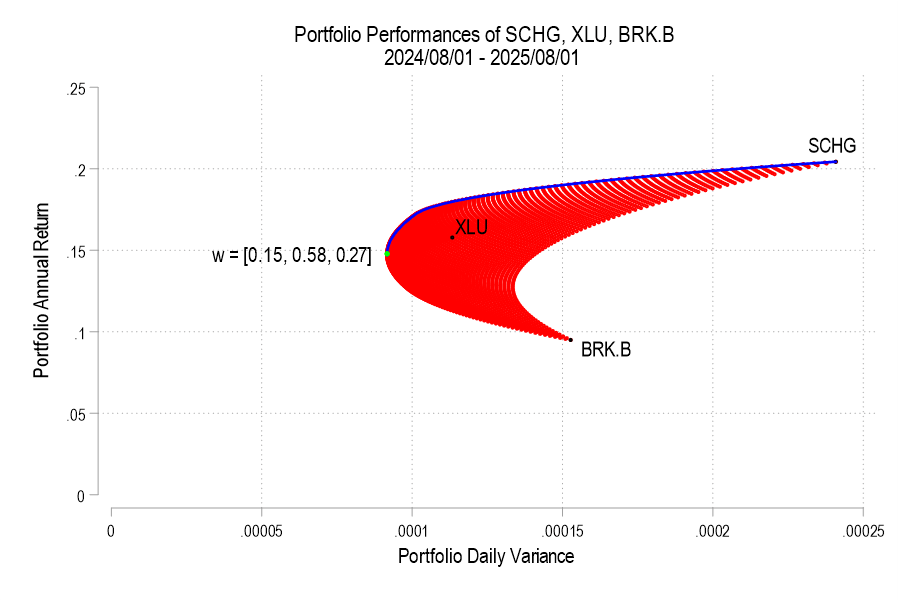

I’ve posted several times recently about portfolio efficient frontiers (here, here, & here). It’s a bit complicated, but we’d like to compare our portfolio to a similar portfolio that we could have adopted instead. Specifically, we want to maximize our return given a constant variance, minimize our variance given a constant return or, if there are reallocation frictions, we’d like to identify the smallest change in our asset weights that would have improved our portfolio’s risk-to-variance mix.

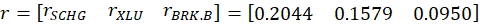

I’ll use a python function from github to help. Below is the command and the result of analyzing a 3-asset portfolio and comparing it to what ‘could have been’.

Continue reading