May you live in interesting times – apocryphal Chinese curse

In early 2025 I shared forecasts about the economy that turned out to be pretty good. This year, economic forecasts center around a boringly decent year (2.6% GDP growth, inflation below 3%, unemployment stays below 5%, no recession), though with high variance. But forecasts about politics and war foretell a turbulent year.

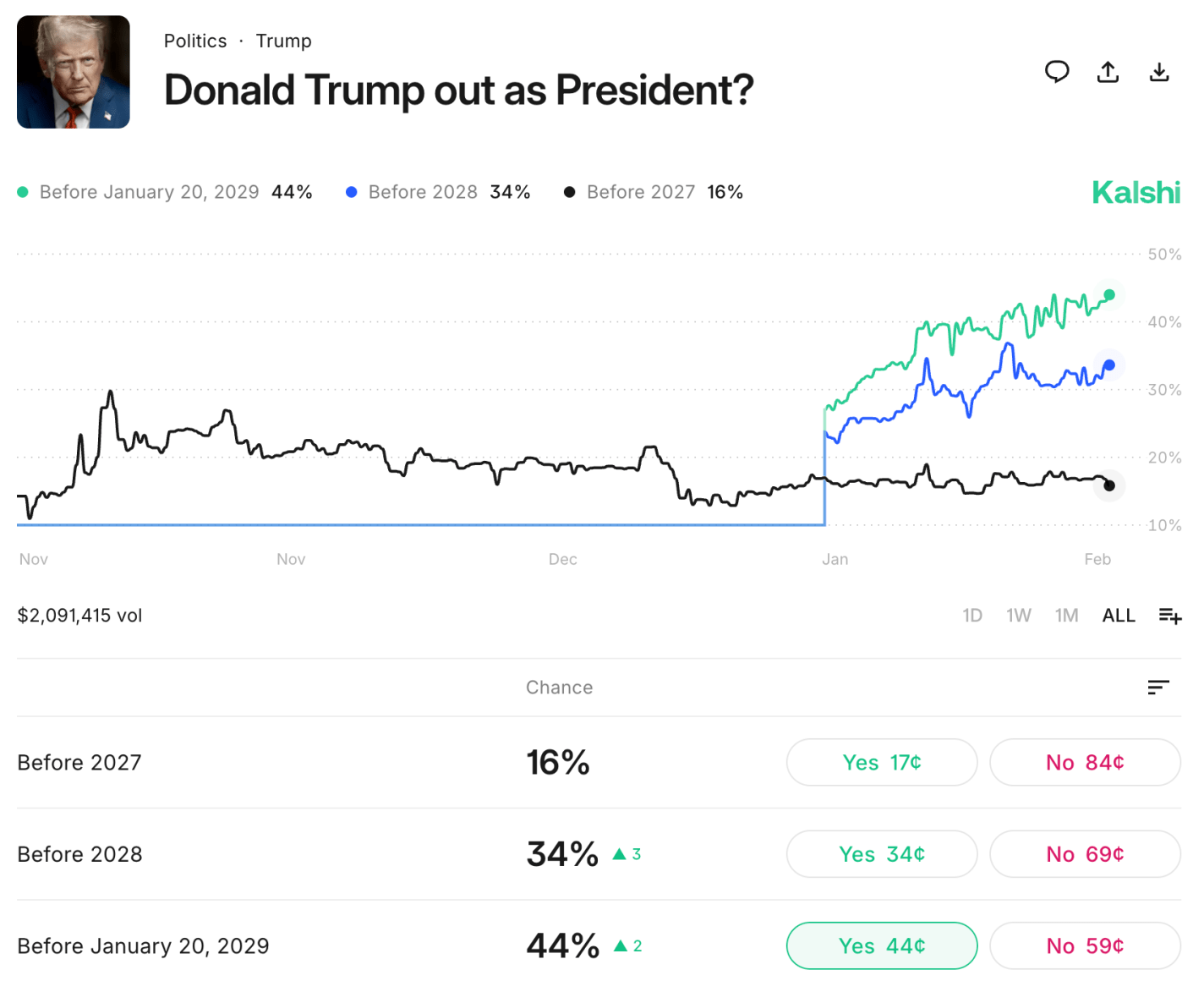

In the US, midterm elections have a 78% chance to flip control of the House and 35% chance to flip the Senate despite a tough map for Democrats. A midterm wave for the out-of-power party is typical in the US, given that the party in power always seems to over-play their hand and voters quickly get sick them. More surprising is that forecasters give a 44% chance that Donald Trump leaves office before his term is up, and a 16% chance that he leaves office this year. Markets give a 20% chance that he will be removed from office through the impeachment process, so the rest of the 44% would be from health issues or voluntary resignation.

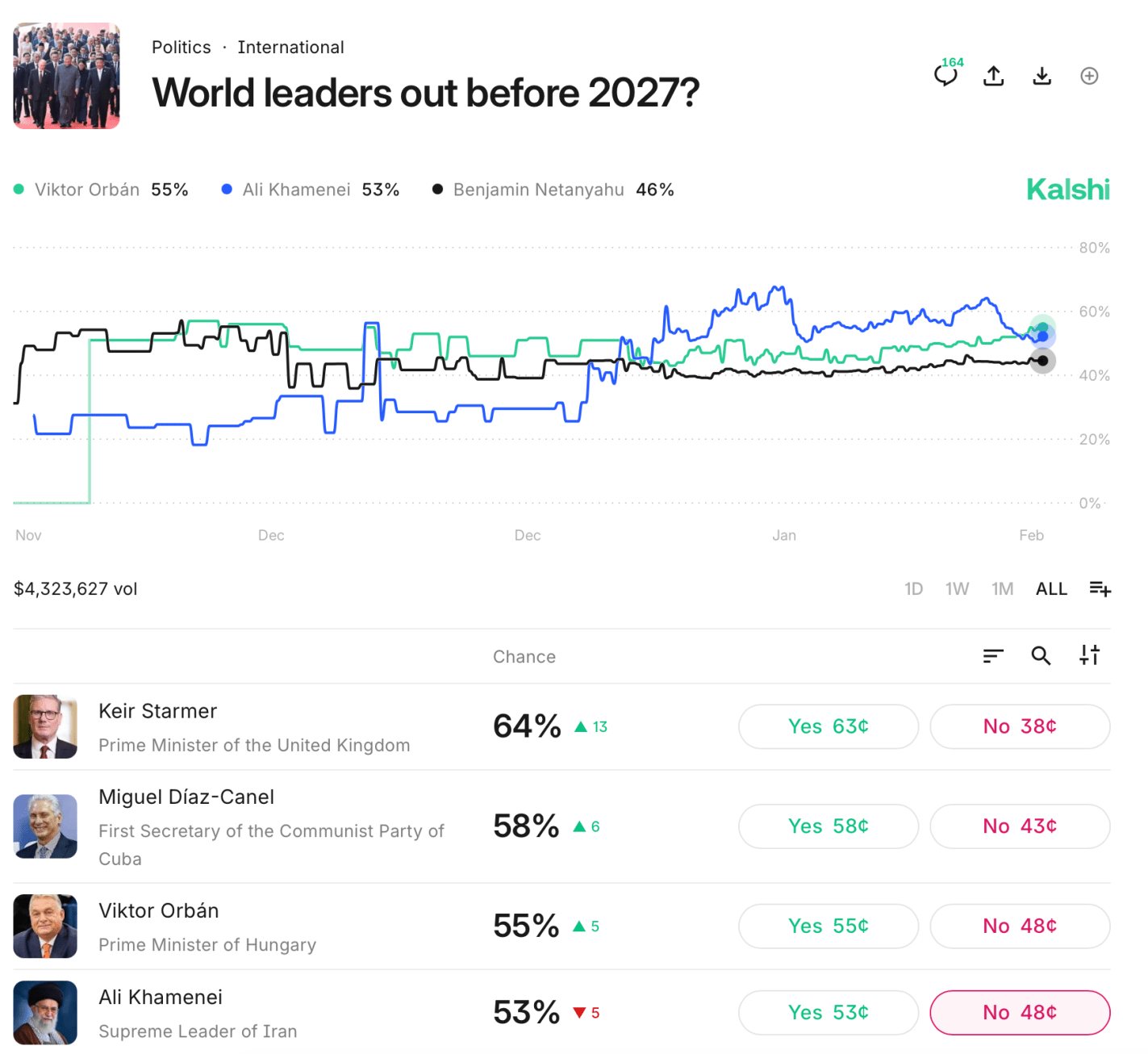

Forecasters at Kalshi predict a greater than even chance that 4 notable world leaders leave office this year:

I find this especially notable because Viktor Orban is the only one who would be removed through regularly scheduled elections. In the UK, Keir Starmer was just elected Prime Minister in 2024 and doesn’t have to face reelection until 2029; but he is so unpopular that his own Labor Party is likely to kick him out of office if local elections in May go as badly as polls indicate. If so, he would join Boris Johnson and Liz Truss as the third British PM in four years to leave office without directly losing an election. The leaders of Cuba and Iran don’t face real elections and would presumably be pushed out by a popular uprising or US military action.

Some other important world leaders will probably stay in office this year, but forecasters still think there is a significant chance they leave: Israel’s Netanyahu (49%), Ukraine’s Zelenskyy (32%), and Russia’s Putin (14%). For the latter two, this belief could be tied to the surprisingly high odds given to a ceasefire in the Russia-Ukraine war this year (45%). Orban leaving office could be tied into this, as Hungary has often vetoed EU support for Ukraine.

Myself, I find most of these market odds to be high, and I’m tempted to make the “nothing ever happens” trade and bet that everyone stays in office. But even if all these markets are 10pp high, it still implies quite an eventful year ahead. Prepare accordingly.