Despite the nearly universal outcry, President Trump was standing firm on his massive tariffs. “No backing down”, etc., despite the evaporation of trillions of dollars in stock values. On Tuesday, April 8, White House spokesperson Karoline Leavitt affirmed: “The President was asked and answered this yesterday. He said he’s not considering an extension or delay. I spoke to him before this briefing. That was not his mindset. He expects that these tariffs are going to go into effect.” However, the next day, Wednesday, April 9, Trump announced on his social media platform, Truth Social, that for all countries but China, there would be a 90-day pause in reciprocal tariffs.

What happened here? The common explanations are that (1) the chaos and losses in the markets had finally grown intolerable, or that (2) the president had planned all along to pause the tariff hikes on April 9. I suspect there is some merit to both of these factors – -despite all the prior warnings, I think (1) Trump did not expect such market devastation (he sincerely believes that he is making the American economy great, so why should markets crash?), and also (2) that he had indeed planned to play around with tariff implementations in pursuit of deals.

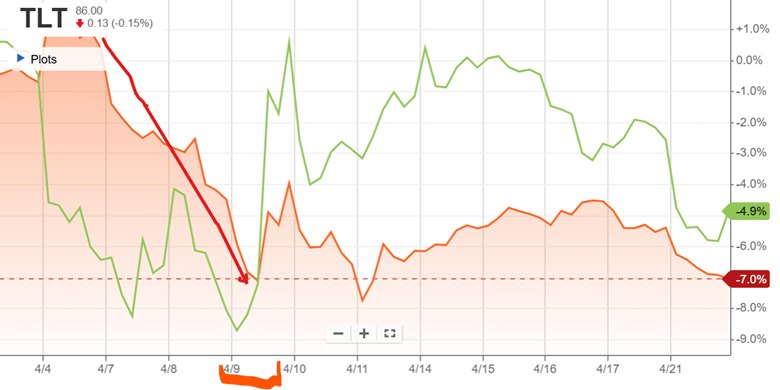

But what some analysts pointed out as a further factor was the drop in the market value of U.S. Treasury bonds, which correlates directly to a rise in interest rates. The actions of the Administration have seemingly caused market participants, especially abroad, to question the risk-free status of U.S. debt. If the government has to pay higher interest on its debt, it is game over, as interest payments will spiral up and consume an ever-higher share of the federal budget. The chart below shows in orange the price movement of the TLT fund, which holds long-term T-bonds, plummeting on April 7, 8, and 9 (red arrow), as an indicator of rising rates. TLT price then shot upwards, along with stocks (the green line is S&P 500 fund SPY) late on April 9, in the relief following the tariff announcement:

As Treasury Secretary, Scott Bessent would be particularly sensitized to the interest rate issue, and able to communicate that to the boss. He has been a successful hedge fund trader and manager, so he understands the plumbing of the system, unlike some other presidential advisors. Up till then, however, economist Peter Navarro, who is ultra-hawkish on tariffs, had had the ear of the president.

So, what did Bessent do? (This is the part that only came to my attention a few days ago, even though technically this is old news). It seems he enlisted the support of Commerce Secretary Lutnick, and adroitly chose a time when Navarro was tied up in a meeting, and barged in on the president in an unscheduled meeting so they could get him alone. And it worked! Evidently, they persuaded him that now was the time to do the clever deal-making thing and issue a pause. It’s a mark of how readily the president can change his mind that his own press spokespeople were unaware of this volte-face, and had to scramble to make sense of it. It is also interesting that cabinet members are resorting to cloak-and-dagger tactics to get policy done.

Bessent naturally gave all the credit to the president for the decision, but he and Lutnick had photos taken to show who saved the financial world – for now:

Scott Bessent (standing, left) and Howard Lutnick (right) with President Trump as he signs 90-day pause in reciprocal tariffs. Source: Daily Mail.

The president’s recent musings about trying to fire the supposedly independent Fed chairman have since contributed to interest rates going back up again, but that is another story.