I thought this was going to be another election post, but it didn’t turn out that way.

My plan was to do another annual portfolio review, with a focus on changes I’ll make to my portfolio as a result of how the election impacts various market themes, and how my take on the election differs from the market’s take. But as I looked at my portfolio, what struck me wasn’t how the election changes things, but instead how severely my stock picks underperformed the incredible 26% return the S&P has posted so far this year.

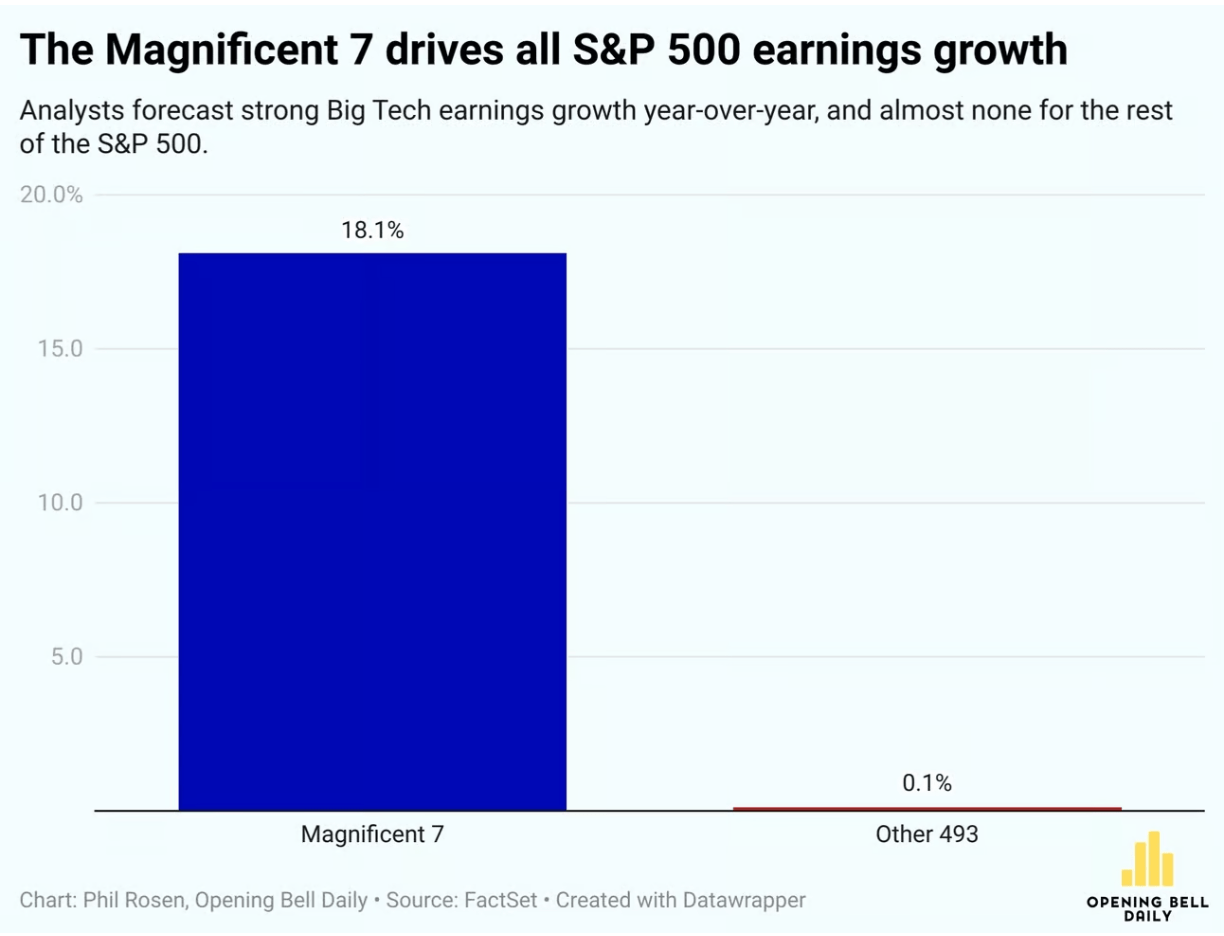

My first couple years of stock picking tended to match the S&P, roughly what you’d expect if markets are efficient and I’m just throwing darts. But more recently so much of the overall return of the market has been driven by just 7 mega-cap stocks, the “Magnificent 7”, that if you don’t own them you are probably underperforming big time.

Of course buying a broad index, especially a market-cap-weighted one like the S&P, is a way to ensure you own at least a piece of the big winners, which is one reason economists usually recommend buying the broad index. And I did this with 80% of my portfolio, to match my 80% belief in the efficient markets hypothesis. But I’m now back up to 90% belief in efficient markets, at least for stocks.

This efficiency seems to change a lot over time. Probably fewer than 10% of US stocks have obvious mis-pricings right now; really none stand out as super mispriced to a casual observer like me. Instead, it seems like every 10 years or so a broad swathe of the market is driven crazy by a bubble or a crash, and you get lots of mispricing- like tech in 2000, forced/panic selling at the bottom in 2009, or meme stocks in 2021. The rest of the time, the stock market is quite efficient. So, in typical times, just be boring and buy and hold a broad index fund.

Of course, you might think that AI is a bubble now. I certainly don’t love the 68 P/E on NVIDIA, but this doesn’t strike me as a true bubble driven by irrational hope- peoples’ hopes have proven well justified so far, with AI performing miracles and the Mag 7 delivering huge profits. So like Scott, I’m finally giving up on being overweight value stocks. Perhaps our capitulation is the sign that growth’s decade-plus run is finally about to reverse; but if so, I’ll try not to regret it. After all, the S&P has plenty of value stocks too.

So here’s what I’m doing:

I’m going through my portfolio and asking, not the wrong questions like “is there anything good about this stock”, or “do I think this will beat cash”, but instead “do I really think this is likely to beat a broad index like SPY or VT”?

Sell INTC: Finally getting rid of this company that managed to post big loses in the middle of the AI boom while the Feds shoveled money at them.

Sell TAN: Solar also managed to have a terrible 3 years in the market even as the government sent them lots of subsidies; now the subsidies are falling, and the P/E is over 100 even though the index is down by two thirds. At least they installed lots of capacity along the way; I still believe in solar the technology, and I’m glad I have panels, but I’m not optimistic about these stocks over the next few years.

Sell NVAX: Like solar, they made a great technology but don’t know how to execute it profitably, and I’m tired of waiting for management to get their act together. Best case is that a company that knows what they are doing acquires them. Easier antitrust from the new administration could facilitate this, but anti-vaxers getting appointments in HHS could hurt them.

Sell EOG, MGY, LNG: I bought a bunch of gas stocks back in 2022 because they were stupidly cheap, with P/Es of 5-6, but they have now appreciated to reasonable P/Es of 10-13.

Sell OEC, OBE, CHRD, MBGYY, DKL: Turns out they were cheap for a reason.

Sell all TUR, some EPOL: I liked these at P/E 5 but they are starting to seem risky at P/E 8, especially Turkey.

Sell GMOM: How has a momentum-based ETF been flat during two years when markets were way up? Isn’t this exactly the sort of thing that should have been allocating heavily to continuous winners like the Mag 7?

Sell GAA: The 0.37 expense ratio doesn’t look terrible, but then it allocates to a bunch of other ETFs that charge their own fees. I can get global stocks with much lower fees through VT, and buying global bonds and real estate at my age is just silly.

Sell GVAL: Giving up on being overweight value, and if I just want global stocks there are much lower-fee options like VT.

Sell SMIN, FLIN: I like India’s real-world prospects but think this is probably priced in at this point; their stocks are the most expensive in the world. Think I’ll get enough India through the lower-fee global index.

Sell GS, TORM: Here’s one election related choice: these are still cheap at P/E 3 but I don’t love shipping when we’re about to kick off a trade war.

Sell GD, BAESY, RNMBY: Usually people think Republicans will be good for defense stocks, but I’m not convinced that will be true this time around. The plan at least looks to be to end wars and cut spending, especially on the traditional primes. Perhaps Europeans will spend more to make up for it, but I don’t want to bet on that.

Buy SPY and VT: Putting most of the money from these sales into the S&P; keeping the rest in cash safely earning 4% or in prediction markets where, unlike stocks, I actually seem to have some alpha. Not owning lots of individual stocks also simplifies taxes. Maybe all those economists were on to something!

As a professional portfolio manager, I would offer the following quick bits of advice—some general and some specific to the environment we find ourselves in today.

In general don’t try to outperform in the most efficient subclass of the equity market on the planet, large U.S. stocks. The idea that any of us know more than the market in this case is a fools errand. SPIVA is your guide here as +90% of very highly compensated, very well equipped professionals consistently fail to outperform.

More specifically:

Large growth stocks in the U.S are crazy expensive today, but large value stocks aren’t much better. You seem to be choosing between dirty shirts. The clean ones are elsewhere.

Small cap stocks look very attractive both relative to large caps and relative to their own history. Undoubtedly there are fundamental, efficient market reasons for this. However, it is likely an exaggerated position that I would suggest is based on a few factors. One is a risk-off world that has seen a flight to the most well-known and safest equity class, large cap U.S. Another is a typical infatuation with a truly sensational and promising real-world development (AI, et al.). This is likely overplayed. So too is the recency bias of strong earnings and great performance (momentum) for these elite stocks. Small value stands particularly attractive today in comparison.

Additionally, international stocks look attractive and especially value-oriented companies including small caps.

Finally, beware buying into a class (S&P 500) where the CAPE ratio is this high. There is a good reason Vanguard (among others) is projecting ~3% annual returns for this group over the next decade.

LikeLiked by 1 person

Thanks for the comment. What you’re saying is exactly the kind of thing I’ve been thinking for the last 3 years, which is why my main account (the 80% that’s all indexed, not the 20% I discussed in this post) has been 50% in US small and mid-caps and 20% in foreign stocks. But at least over the past 3 years, I would have been much better off putting it all in the US large caps that already seemed expensive back in ’21.

Perhaps history will finally re-assert itself soon. But when I ask myself “what will the next world-changing company be”, I think it is either already a US large cap or will quickly become one. Next most likely is a US private co I can’t invest in, or a Chinese company with great technology that is run to build a lot without really benefitting foreign investors. Perhaps I’m wrong, or returns will stop being driven by a handful of great companies; and I’m certainly not planning to go to 100% US large cap. But now that I’m thinking about it, 50% US small to mid seems excessive.

LikeLiked by 1 person

Keep the faith. History is on your side.

LikeLike

( 1 ) “..I’m finally giving up on being overweight value stocks. Perhaps our capitulation is the sign that growth’s decade-plus run is finally about to reverse..” – – ha, yes, when the last of us bears finally capitulate is when they ring the bell at the top…

( 2 ) Just charting GMOM vs MTUM and SPMO (two other momo funds) and S&P500. Looks like the algo in GMOM keeps it pretty flat, so it missed big upswings. SPMO has actually outperformed S&P500. (I am planning to write post on momentum funds)

( 3 ) Thanks for observation on SMIN, I have been buy-and-holding it, b/c India is the Next Big Thing. But will have to reconsider if its future is already priced in.

LikeLiked by 1 person

India was the sell I was least confident on, since you could say my big issue is unwillingness to pay for growth. I’m the guy that sold NVDA last May “because the AI boom is already priced in”

LikeLike

Twice this year, I sold a chunk of SMIN after like 5% drop, figuring it had topped. And almost immediate had to buy back in at slight loss, as it went on to make new highs. But has been making lower highs and lower lows since Sept and it is about to crash through 200 day moving average. As usual, dilemma whether to trade on momentum (it’s going down) or value (now the P/E is finally reasonable).

Which is why I am leaning toward using more active funds, let them do the deciding while I sip mint juleps on the verandah.

LikeLiked by 1 person

just seeing that you had so many individual stocks in your portfolio stresses me out. We are economists, I’m a trained macro economist. I’m not an expert in financial forensics. I have interesting things to say about ETFs and index funds and interest rates, but I’ve got nothing better than luck when it comes to individual companies.

LikeLike