This is a quick follow-up to last week’s post on “Big Short” Michael Burry closing down his Scion Asset Management hedge fund. Burry had teased on X that he would announce his next big thing on Nov 25. It seems he is now a day or two early: Sunday night he launched a paid-subscription “Cassandra Unchained” Substack. There he claims that:

Cassandra Unchained is now Dr. Michael Burry’s sole focus as he gives you a front row seat to his analytical efforts and projections for stocks, markets, and bubbles, often with an eye to history and its remarkably timeless patterns.

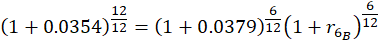

Reportedly the subscription cost is $39 a month, or $379 annually, and there are 26,000 subscribers already. Click the abacus and…that comes to a cool $ 9.9 million a year in subscription fees. Not bad compensation for sharing your musings on line.

Michael Burry was dubbed “Cassandra” by Warren Buffett in recognition of his prescient warnings about the 2008 housing market collapse, a prophecy that was initially ignored, much like the mythological Cassandra who was fated to deliver true prophecies that were never believed. Burry embraced this nickname, adopting “Cassandra” as his online moniker on social media platforms, symbolizing his role as a lone voice warning of impending financial disaster. On the About page of his new Substack, he wrote that managing clients’ money in a hedge fund like Scion came with restrictions that “muzzled” him, such that he could only share “cryptic fragments” publicly, whereas now he is “unchained.”

Of his first two posts on the new Substack, one was a retrospective on his days as a practicing doctor (resident in neurology at Stanford Hospital) in 1999-2000. He had done a lot of on-line posting on investing topics, focusing on valuations, and finally left medicine to start a hedge fund. As he tells it, he called the dot.com bubble before it popped.

The Business Insider summarizes Burry’s second post, which attacks the central premise of those who claim the current AI boom is fundamentally different from the 1990s dot.com boom:

The second post aims straight at the heart of the AI boom, which he calls a “glorious folly” that will require investigation over several posts to break down.

Burry goes on to address a common argument about the difference between the dot-com bubble and AI boom — that the tech companies leading the charge 25 years ago were largely unprofitable, while the current crop are money-printing machines.

At the turn of this century, Burry writes, the Nasdaq was driven by “highly profitable large caps, among which were the so-called ‘Four Horsemen’ of the era — Microsoft, Intel, Dell, and Cisco.”

He writes that a key issue with the dot-com bubble was “catastrophically overbuilt supply and nowhere near enough demand,” before adding that it’s “just not so different this time, try as so many might do to make it so.”

Burry calls out the “five public horsemen of today’s AI boom — Microsoft, Google, Meta, Amazon and Oracle” along with “several adolescent startups” including Sam Altman’s OpenAI.

Those companies have pledged to invest well over $1 trillion into microchips, data centers, and other infrastructure over the next few years to power an AI revolution. They’ve forecasted enormous growth, exciting investors and igniting their stock prices.

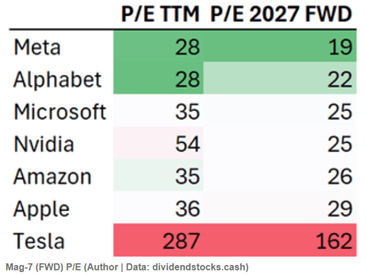

Shares of Nvidia, a key supplier of AI microchips, have surged 12-fold since the start of 2023, making it the world’s most valuable public company with a $4.4 trillion market capitalization.

“And once again there is a Cisco at the center of it all, with the picks and shovels for all and the expansive vision to go with it,” Burry writes, after noting the internet-networking giant’s stock plunged by over 75% during the dot-com crash. “Its name is Nvidia.”

Tell us how you really feel, Michael. Cassandra, indeed.

My amateur opinion here: I think there is a modest but significant chance that the hyperscalers will not all be able to make enough fresh money to cover their ginormous investments in AI capabilities 2024-2028. What happens then? For Google and Meta and Amazon, they may need to write down hundreds of millions of dollars on their balance sheets, which would show as ginormous hits to GAAP earnings for a number of quarters. But then life would go on just fine for these cash machines, and the market may soon forgive and forget this massive misallocation of old cash, as long as operating cash keeps rolling in as usual. Stocks are, after all, priced on forward earnings. If the AI boom busts, all tech stock prices would sag, but I think the biggest operating impact would be on suppliers of chips (like Nvidia) and of data centers (like Oracle). So, Burry’s comparison of 2025 Nvidia to 1999 Cisco seems apt.