As noted earlier, the main driver in inflation since 2021 has not been supply chain issues, but ongoing wage increases in (mainly) the service industry, fueled by a tight labor market. Some headlines note recent decreases in job openings, etc., suggesting that the end of inflation is near. The point of this post is that measures of labor market tightness remain at very high levels, and so it will be a while yet before the Fed can claim victory over inflation and start meaningfully reducing interest rates.

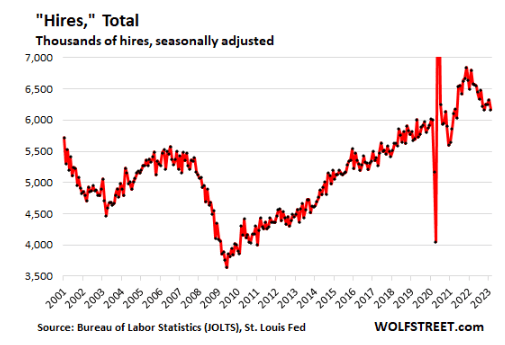

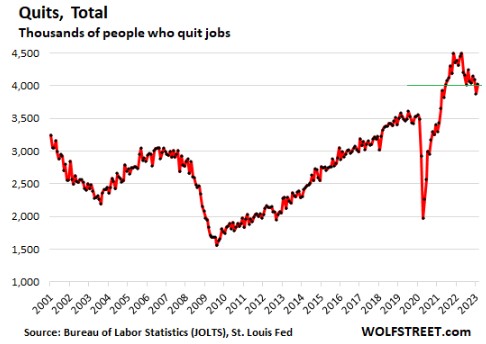

Below I will post a set of charts (courtesy of Seeking Alpha article by Wolf Richter) which make the following point: most measure of labor tightness remain at least as high as they were in late 2019, just before the pandemic hit. It is true that things have loosened up in the past few months, but that just means the labor market has gone from white-hot to merely red-hot. Let the data speak:

We hold that the current tightness of the labor market is largely a result of pandemic policies which incentivized a whole tranche of experienced workers to take early retirement and also put lots of cash in our pockets which we are spending generously on services . Those workers are not coming back, but at some point in the next 1-2 years the excess Covid cash will run out and we may finally get the long-expected recession. But if the government rushes in with enhanced unemployment benefits to ease the recession pain, we would expect inflation to remain well above the nominal 2% target