There is a community called #EconTwitter. This agglomeration of not-anonymous accounts links together professional economists, academics, and independent intellectuals. Twitter.com is the home base and origin of #EconTwitter. Mike wrote about turmoil in EconTwitter in December 2022. Find me on Twitter at @aboutJoy

The #EconTwitter group has experimented with leaving Twitter to join new networks. For some people, getting away from the billionaire owner is the explicit goal. Others join the new platform to be where the people are.

Mastodon launched in 2016 but it was not until recently that #EconTwitter made a go at that.

Mastodon is also part of the Fediverse ensemble of computer servers, which use shared protocols allowing users to interact with other users on computers running compatible software packages such as PeerTube and Friendica. Mastodon is crowdfunded and does not contain ads.

https://en.wikipedia.org/wiki/Mastodon_(social_network)

Fediverse? Protocols? The average Twitter user does not want to be bothered with “computer servers”. That’s part of the problem. On Mastodon I am @JoyBuchanan@econtwitter.net

When I joined, I was not confident that it would build on the initial momentum. The reason that the move to Mastodon was large and sudden is that Paul Goldsmith-Pinkham volunteered to set up econtwitter.net It’s paid for out of his research budget and he serves as the monitor. He can ban anyone who violates his speech/civility rules. So there is a moderator but not one paid by Mastodon.

I wrote about “Content Moderation Strategy” back in April 2022 when Elon at Twitter was big news.

Elon Musk buying Twitter is the big news this week. He wants to enhance free speech on the site and, according to him, make it more open and fun. Some fans are hoping that he will make the content moderation and ban policy more transparent.

me in April 2022

Some people thought Twitter would crash – as in go offline – because of Elon. That has not happened, but users and brands have been irked by his management and personal style.

EconTwitter at Mastodon is still going. As far as I can tell, most people have reverted to Twitter for their main feed because the audience is larger and writers want engagement. The level of engagement at Mastodon probably peaked about a month after Paul started the server for economists. One reason I think it never overtook real EconTwitter is that economists like having a big audience that includes journalists and sociologists. Silo-ing on an EconTwitter-dedicated server was less fun. People say they don’t want to have to deal with weird strangers online, but revealed preference indicates otherwise.

Another notable development was the launch of Bluesky. I’m there as @joybuchanan.bsky.social

Making a good handle at the beginning is easy and there is some upside if it turns out to attract a large community. A few “Twitter famous” people will join these new apps and commit to posting just in an attempt to unseat Twitter. This sort of works in the sense that both networks are still operating, however neither ever got close to the Twitter scale.

Threads, launched this week, might be different.

Mark Zuckerberg opened up Threads for anyone with an Instagram account, which most of us already have. Millions of people joined in just two days. If you already have an Insta, then you can download the free Threads app on your phone and port over your Insta account.

I’m @_Joy_Buchanan_ on Threads. The underscores might look awkward, but there is no “early adopter” phenomenon here, unless you were an early adopter of Instagram.

Brands and celebrities are comfortable on Threads, so it will be able to make money without asking users to pay for a Blue Check. I have no problem with Elon asking Twitter users to pay. Someone who is worried about free speech should want to be able to pay for service.

The Silicon Valley phrase is: “If you’re not paying for the product, you are the product.“

That’s going to be true on Threads, since I’m not paying for the product.

Threads will not kill Twitter, but it is going to make a bigger dent than Bluesky and Mastodon did. Nothing is free and nothing is perfect. I know a lot of people are upset about Twitter. However, there are some people who got a voice through it. People stuck inside authoritarian countries had a way to send messages out to a global audience.

Here is my most bullish case for Threads: it might unite the “TikTok generation” that never joined Facebook or Twitter but had Instagram with the older people from Twitter who never joined TikTok. The Twitterers will stay if they get enough attention.

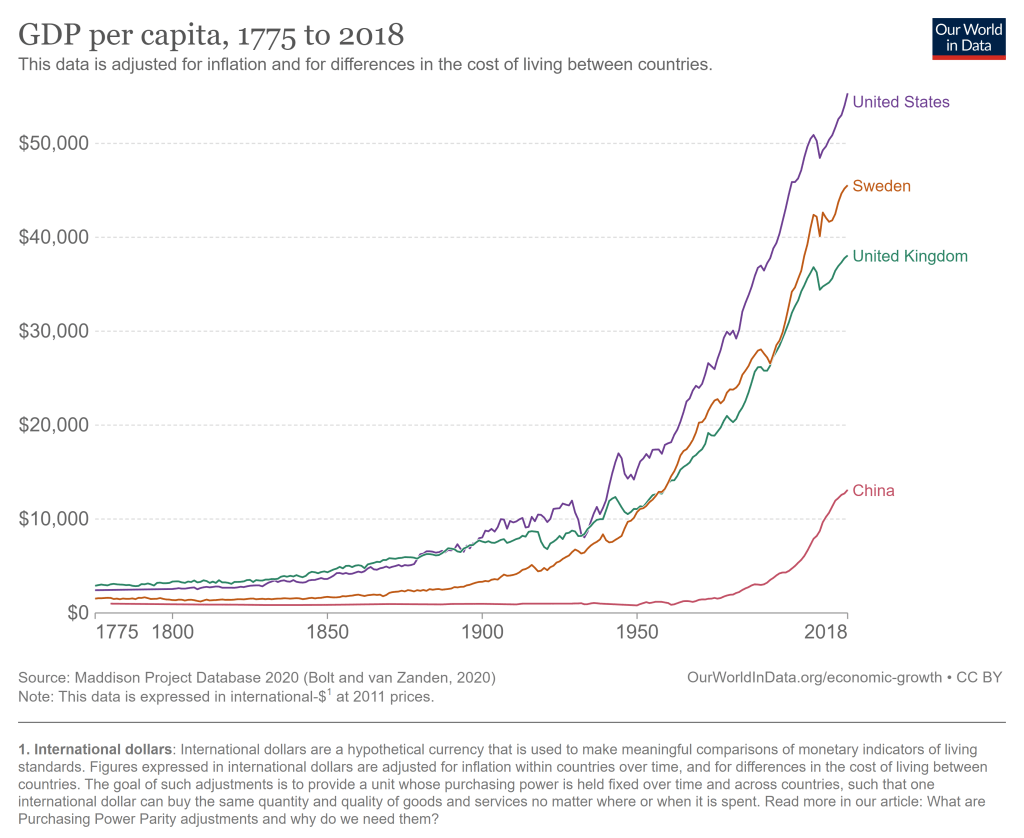

Thus, Threads might put a dent in TikTok, too. Zuckerberg is probably sophisticated enough to make a “TikTok person” feel engaged by sending them more food videos and less BLS update charts.

Continue reading →