Wild pigs kill more people worldwide than sharks do (I didn’t know that a week ago). They do much damage to agriculture and the environment, and transmit diseases:

According to the U.S. Department of Agriculture, feral hogs cause approximately $2.5 billion in agricultural damages each year…Nearly 300 native plant and animal species in the U.S. are in rapid decline because of feral swine, and many of the species are already at risk, according to Animal and Plant Health Inspection Service. The swine also carry at least 40 parasites, 30 bacterial and viral illnesses, and can infect humans, livestock and other animals with diseases like brucellosis and tuberculosis.

Besides eating and injuring crops and livestock, hogs damage the environment:

…They will also feed on tree seeds and seedlings, causing significant damage in forests, groves and plantations… Rooting — digging for foods below the surface of the ground — destabilizes the soil surface, uprooting or weakening native vegetation, damaging lawns and causing erosion. Their wallowing behavior destroys small ponds and stream banks, which may affect water quality. They also prey upon ground-nesting wildlife, including sea turtles. Wild hogs compete for food with other game animals such as deer, turkeys and squirrels, and they may consume the nests and young of many reptiles, ground-nesting birds and mammals.

Pigs are smart (ahead of dogs and horses), tough, and adaptable, and they breed very quickly. The protected, overfed, calm hogs you see on farms quickly turn lean and mean if they have to fend for themselves in the wild. You pretty much only see female pigs or castrated males on the farm, since whole males (boars) are intrinsically aggressive and destructive. But vigorous 200-pound boars, with their 3 inch-long, razor-sharp tusks, are well-represented in feral swine.

This is a growing problem. The population of wild pigs in the southern third of the U.S. has increased significantly in the past few decades. There have historically been some wild pigs in spots like Florida and Texas, escapees from Spanish settlers long ago. But they seem to be spreading northward, largely because hunters transplant them:

From 1982 to 2016, the wild pig population in the United States increased from 2.4 million to an estimated 6.9 million, with 2.6 million estimated to be residing in Texas alone. The population in the United States continues to grow rapidly due to their high reproduction rate, generalist diet, and lack of natural predators. Wild pigs have expanded their range in the United States from 18 States in 1982 to 35 States in 2016. It was recently estimated that the rate of northward range expansion by wild pigs accelerated from approximately 4 miles to 7.8 miles per year from 1982 to 2012 (12). This rapid range expansion can be attributed to an estimated 18-21% annual population growth and an ability to thrive across various environments, however, one of the leading causes is the human-mediated transportation of wild pigs for hunting purposes.

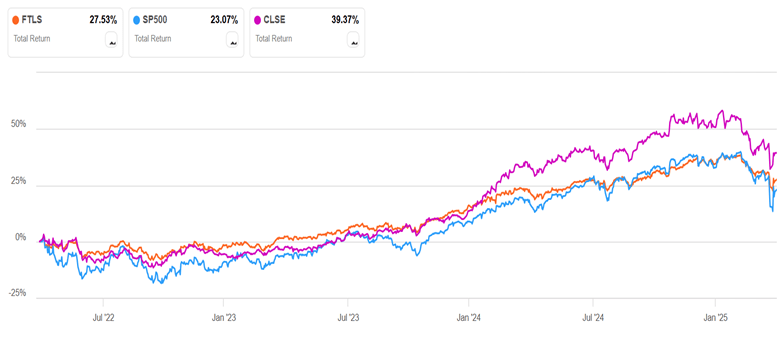

As for pigs attacking and killing humans, a definitive study was recently made in 2023 by Mayer, et al., covering 2000-2019. This report includes informative tables and charts, such as:

and

Comparison of mean annual number of human fatalities from attacks by various wild animals for time periods ranging between 2000 and 2019. From Mayer, et al.

About half of these fatalities occurred in rural regions of India. Government policies there prohibit farmers from killing marauding pigs, so farmers try to chase them away from their fields with rakes and stones. Sometimes that provokes the pig to attack, slashing at thigh level and often lacerating the femoral artery. But a disturbing 39% of deadly attacks were unprovoked, including a horrific case with an elderly woman in Texas. So danger to humans is an issue, though for perspective, far more people are killed each year by snakes (100,000), rabid dogs (30,000), and crocodiles (1000). In the U.S., over 100 people are killed a year, and 30,000 injured, by collisions with deer (see here for a market-based solution for this problem).

What to do? Hunters in many states are free to blast away at feral pigs year-round, since they are considered a harmful, invasive (non-native) species. Paradoxically, however, allowing hunting of pigs can be counterproductive: amateur hunting does not eliminate enough pigs to stop their spread, and it incentivizes hunters to transport pigs to new regions to make for more targets. For instance, Arkansas allows hunting and even transport of pigs, and has seen swine populations skyrocket. The state of Missouri, next door, took the enlightened approach of banning hunting and transport, leaving population control to wildlife professionals. By removing the sport-hunting incentive, Missouri removed the incentive to transport them, which stymied their spread.

To control pig populations, the pros mainly set up baited large corrals, and monitor them remotely with webcams. After several weeks, the local pigs get comfortable coming there to feed. When the cameras show that every single pig in the herd is in the corral, the gate is sprung shut remotely. Then the pros drive out to, er, euthanize the pigs. The goal is to wipe out the entire herd, and leave no sadder-but-wiser survivors who will be harder to catch next time. Once a hog population has become established in an area, it typically takes ongoing eradication efforts to keep the numbers down.

If you want to do your own part to reduce the surplus swine population, the following notable opportunity came to my attention: for a largish fee the Helibacon company will train you in firing automatic weapons and take you up in a chopper where you can mow down a marauding herd in the low Texas scrubland. It sounds like a guy thing, but Helibacon reminds us that full auto is for ladies, too. See also PorkChoppersAviation for similar service.

This is actually a fine example of a free market solution to a problem: wild hogs were such a problem for landowners that they were paying expensive professional helo hunters to take out herds, but in Texas, “All that changed in 2011, when the state legislature passed the so-called pork chopper law, which allowed hunters to pay to shoot feral hogs out of helicopters – and a new business model was born.” Hunters are happy to pay to hunt, helo companies are happy to take their money, and landowners are happy to have pigs reduced for free. Voila, voluntary exchange creates value…