A stopped clock is occasionally right. And so are perma-bears, those commentators or analysts who continually predict that GDP and stocks will plunge – perhaps in the next quarter, but more often say six months from now. (And that deadline keeps getting pushed back every six months).

When I was first getting started investing, I was overly influenced by these seemingly cautious and sober souls, and I consequently lost out considerably compared to my colleagues who blithely stayed fully invested. So I hold my native pessimism in check when investing, and stay mainly in the market, but with a little cash in reserve just in case The Big One hits.

All that said, I do try to sample various points of view. If I have been mainly seeing positive chatter, I turn to my favorite perma-bear, an analyst named Jeffrey Snider. His YouTube channel is called Eurodollar University, and he runs a subscription service as well.

Jeff seems like a genuinely nice guy, who believes that his dire readings of the macroeconomic tea leaves are helping folks avoid disaster. His demeanor is more like an earnest teacher, not a huckster trying to sell something. I should add that he offers meaningful insights on the Eurodollar scene, which is globally significant and which most analysts do not understand or even recognize.

But Jeff’s bias is nearly always toward the negative, and it is something of a good-natured joke among his viewers. Typical comments: “ The market can remain irrational longer than Jeff can stay pessimistic” and “Jeff is the best on Youtube. I watch his videos every night right before I go to bed. In less than 5 minutes, I’m in a semi-conscious coma. Its better than any sleeping pill. That smooth soothing voice extoling the virtues of a collapsing economy works wonders. A++”.

Well, what is the bear-meister saying now? He claims that the seemingly red-hot employment numbers that have been reported in recent months are less hot than they appear. I will paste in a few snips from his recent YouTube, It Just Happened…The JOB MARKET JUST BROKE!! .

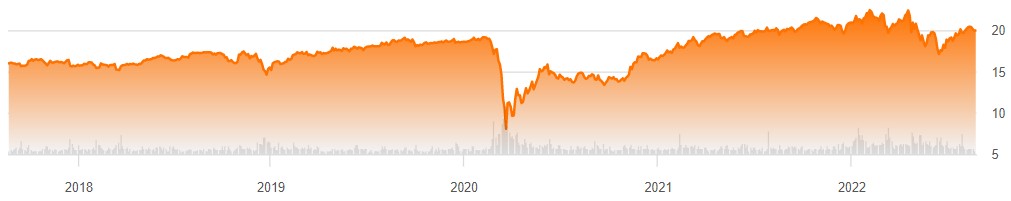

One point he makes is that there has been a persistent, inaccurate bias to the upside in the payroll numbers reported by the BLS. These big numbers are what gets reported; what does not get reported so much is, month after month, these monster payroll increases are quietly revised downwards, often by substantial amounts:

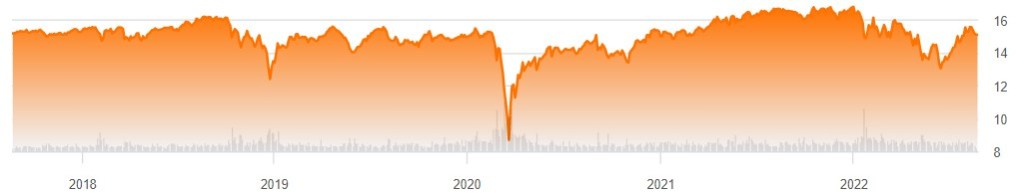

Even with the adjustments, these still seem like large increases in employment. Undaunted, Jeff pokes holes in the hot labor market scenario by claiming that full time employment is actually stagnant; it is the rise in part-time workers that creates the seemingly large army of the newly employed. The fact that total hours worked has plateaued seems to support his case here:

Another factor is worker hoarding. Employers were so burned trying to scramble for workers during the 2022 reopening-from-Covid that they are keeping their workers on payroll (even part-time), just in case the economy picks up and they need to pull them in full-time. A case in point is manufacturing. New orders are down considerably this year, and headed even lower, yet manufacturers have not cut their workforces appreciably:

If orders stay low for a long enough time, however, the manufacturers will have no choice but to start massive layoffs.

As another indicator of labor market softness, temporary workers may be a leading indicator of employment trends. They are not such a core part of a company, so there is less hoarding of them. And temporary help services have been in a steady decline this year, which is consistent with a cooler economy:

Sell Everything??

As I said, it is worth considering all sides. I think the specific points mentioned above are all valid ones. I would add that if students actually start payments on all those loans which taxpayers and the Fed have subsidized for the past three years, that will finally put a crimp in the spending. Also, the surprise downgrade of U.S. federal debt by the Fitch rating agency , and resulting jump in interest rates, has finally gotten people talking about out-of-control government spending, for one week anyway. Also, the great China-reopening that was supposed to jump-start the global economy seems to be pretty flat.

However, a couple of counter-points to the bearish narrative:

First, even if manufacturing is rolling over, in the U.S. it is fairly small relative to services. At least in some geographical areas, my anecdotal reports say that it is still a challenge to get good workers to do services.

Second, the tidal wave of cash from pandemic giveaways that washed into our collective bank accounts is still not depleted. Consumer confidence is high, and we are spending freely. This economy is a big, big ship, and it is still steaming full ahead, brushing aside high interest rates and yield curve inversions. The recession seems to continually recede. There will inevitably be a downturn someday, of course, but absent some geopolitical event, I think it may take some time for it to arrive.

And finally, even if the long-awaited recession does arrive, it may not necessarily be so bad for stocks. Since the 2008-2009 Great Financial Crisis, the Fed has taken a very active role in supporting the markets. Wall Street has been conditioned to expect the Fed to flood the system with money if a serious downturn occurs. Also, the Street is betting that there will be enough howls of pain over the high interest being paid on the federal debt that unbearable pressure will be brought on the Fed to loosen up; the vaunted independence of that institution will be put to the test, with Congressional threats to alter their charter if they don’t cave to pressure. And so, “[economic] bad news is [investing] good news”, in contrast to the pre-2008 world. Furthermore, federal deficit spending ramps up during recessions, and as noted in The Kalecki Profit Equation: Why Government Deficit Spending (Typically) MUST Boost Corporate Earnings , this deficit spending tends to boost earnings.

And so even if Jeff Snider is correct that the economy is rolling over and will soon slide downward, this may not give investors a very useful signal. As another one of his YouTube viewers has commented, “This channel is a masterclass in learning that knowledge about the macro environment does not provide an edge in markets.”