The Red lobster restaurant chain has historically positioned itself in what was hopefully a sweet spot between slow, expensive, full-service restaurants, and cheaper fast-food establishments. With its economies of scale, the Red Lobster franchise could engage in national advertising and improved supply contracts, giving it an advantage over small family-owned local restaurants.

The firm has been struggling for a number of years, caught between the quasi-upscaling of many fast-food chains, and the rise of fast-casual competitors like Chipotle. Also, seafood is more expensive to procure compared to chicken and beef, and the pandemic made a long-lasting dent in their revenues. That said, Red Lobster has been viable business for decades.

However, the firm has been adversely affected by financial engineering by outside companies. General Mills spun off Red Lobster to a company called Darden Restaurants in 1995. In 2014 Darden sold Red Lobster to a private equity firm called Golden Gate Capital for $2.5 billion. Golden Gate promptly plundered Red Lobster by selling its real estate out from under it. Instead of owning their own land and buildings, now the restaurants had to pay rent to landlords. This put a permanent hurt on the restaurant chain’s profits. After this bit of financial engineering, the private equity firm in 2019 sold a 49% stake to a company called Thai Union. Thai Union bought out the rest of Red Lobster ownership from Golden Gate in 2020.

The Iron Fist from Outside

Thai Union is a huge seafood producer, which operates massive shrimp farms in Southeast Asia and sells a lot of shrimp to Red Lobster.

Although Thai Union initially said they would not interfere in the operations of Red Lobster, that’s not how it panned out.

An article by CNN author Nathaniel Meyersohn details how Thai Union took effective control of red lobster management decisions by 2022. Given the restaurant chain’s poor financial performance, it’s understandable that Thai Union would want to shake things up, but unfortunately the hatchet men they brought in appeared to have done more harm than good. Numerous off the record conversations agreed that the outside CEO was unnecessarily rude as well as incompetent. Knowledgeable Red Lobster veterans were driven out, and morale plummeted. Per Meyersohn:

Thai Union’s damaging decisions drove the pioneering chain’s fall, according to 13 former Red Lobster executives and senior leaders in various areas of the business as well as analysts. All but two of the former Red Lobster employees spoke to CNN under the condition of anonymity because of either non-disclosure agreements with Thai Union; fear that speaking out would harm their careers; or because they don’t want to jeopardize deferred compensation from Red Lobster…

Former Red Lobster employees say that while the pandemic, inflation and rent costs impacted Red Lobster, Thai Union’s ineptitude was the pivotal factor in Red Lobster’s decline.

“It was miserable working there for the last year and a half I was there,” said Les Foreman, a West Coast division vice president who worked at Red Lobster for 20 years and was fired in 2022. “They didn’t have any idea about running a restaurant company in the United States.”

At Red Lobster headquarters, employees prided themselves on a fiercely loyal culture and low turnover. Some employees had been with the chain for 30 and 40 years. But as Thai Union installed executives at the chain, dozens of veteran Red Lobster leaders with deep knowledge of the brand and restaurant industry were fired or resigned in rapid succession. Red Lobster ended up having five CEOs in five years…

Former Red Lobster employees describe a toxic and demoralizing environment as Thai Union-appointed executives descended on headquarters and interim CEO Paul Kenny eventually took over the chain in 2022. Kenny, an Australian-born former CEO of Minor Food, one of Asia’s largest casual dining and quick-service restaurants, was part of the Thai Union-led investor group that acquired Red Lobster.

Kenny criticized Red Lobster employees at meetings and made derogatory comments about them, according to former Red Lobster leaders who worked closely with Kenny…

At the direction of Thai Union, Kenny became interim CEO, according to Red Lobster’s bankruptcy filing.

In the months after Kenny took over, Valade’s leadership team and other veteran leaders left. In July of 2022, the chief operations officer and six vice presidents of operations overseeing restaurants were abruptly fired shortly before Red Lobster’s annual general manager conference.

Kenny appointed a Thai Union frozen seafood manager, Trin Tapanya, as Red Lobster’s chief operations officer overseeing restaurants. Tapanya had no experience running restaurants. He did not respond to CNN’s requests for comment.

Other Thai Union representatives also became more closely involved across Red Lobster’s supply chain, finance, operations and strategy teams…Thai Union took a larger role in Red Lobster’s supply chain decisions, despite pledges in 2020 that it would not interfere.

Red Lobster had spent decades developing a wide array of suppliers to buy at competitive prices and mitigate the risks of becoming too reliant on any single supplier.

Thai Union blew that up.

Red Lobster employees say they were pressured by Thai Union representatives to buy more seafood from Thai Union. Thai Union representatives also began sitting in on meetings between Red Lobster and seafood suppliers, said one of the former Red Lobster employees who witnessed these conversations. Thai Union was the direct competitor of these other seafood suppliers, and suddenly had intimate access to their products, prices and strategy. “Our suppliers were really upset that [Thai Union representatives] were in those meetings with them,” this person said.

Red Lobster now claims that Thai Union pushed out other shrimp suppliers, “leaving Thai Union with an exclusive deal that led to higher costs to Red Lobster”.

The “Endless Shrimp” Disaster

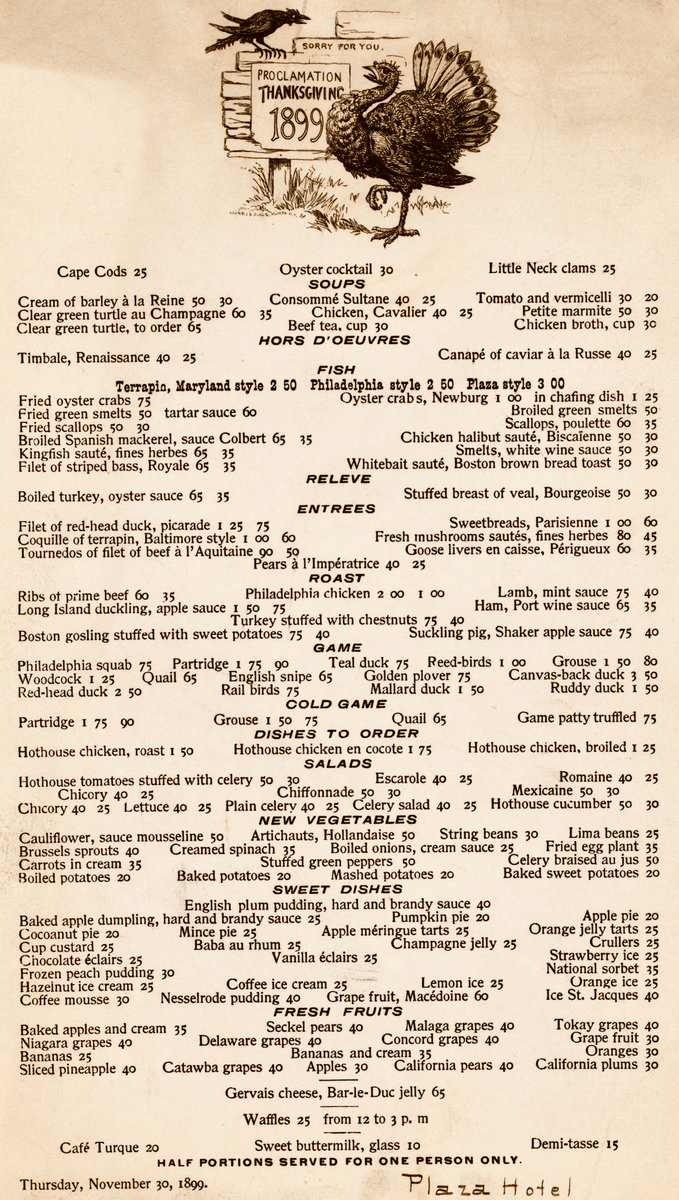

The final blow to Red Lobster was offering an every-day special of all the shrimp you can eat. The firm had historically offered occasional all you can eat specials, to draw in first-time customers. But they had learned from a disastrous extended all you can eat crab special back in 2003, that if you are not very careful, you can lose a ton of money letting people eat all they want of an expensive food item.

Apparently, Thai Union pressured Red Lobster into offering an every-day “Endless Shrimp” special starting in June, 2023. Old guard Red Lobster management tried to push back, but were overruled. For Thai Union, this was of course a chance to sell more shrimp. But it led to huge losses on the part of Red Lobster. Internet personalities boosted their viewings by wolfing down plate after plate after plate of expensive shrimp:

The deal quickly went viral on social media. People started posting videos on Tik Tok showing how many shrimp they could eat. It became something of a challenge where people would try to eat as many shrimp as possible to gain social media clout. For example, a YouTuber called The Notorious Bob ate 31 plates of shrimp. Each plate has six shrimp so he ate 186 shrimp in total … another YouTuber called Sir Yacht stayed at Red Lobster for 10 hours and ate 200 shrimps throughout the day.

Red Lobster has now filed for Chapter 11 bankruptcy protection from its creditors, while it further downsizes to try to stay afloat. Thai Union has written down its investment in Red Lobster to the tune of $540 million, and its creditors now own the company.

The various actors in our current financial system played their usual roles here: General Mills spun off a non-core business; a private equity firm plundered its acquisition and then dumped it, presumably making gobs of money in the process for its partners; a supplier acquired a downstream company to develop a more integrated business line; a venerable American brand simply lost ground (think: Sears) in the competitive market place as tastes and competition changed over time, with vicious cost-cutting unable to save it.

This story is somewhat tragic, but I’m not sure there are any real villains, apart from the obnoxious outside CEO. Thai Union is a powerhouse seafood supplier, but they simply did not understand the American restaurant business and could not come up with a viable plan to fix Red Lobster. The now-unemployed restaurant workers may be victims, but the cooks and wait staff and store managers who worked extra hard, short-handed to keep serving their customers well despite horrible upper management – – to me, those are the heroes here.