UPDATE 2/19/2026: the last GDPNow estimate from the Atlanta Fed is 3.0% and the Kalshi markets are now predicting 2.8%. I would expect this is a slightly better range than the 3.3-3.6% from my post written on 2/18/2026.

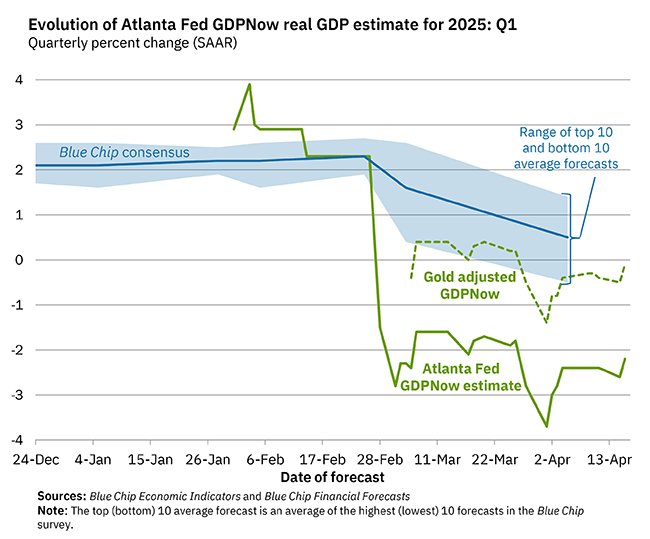

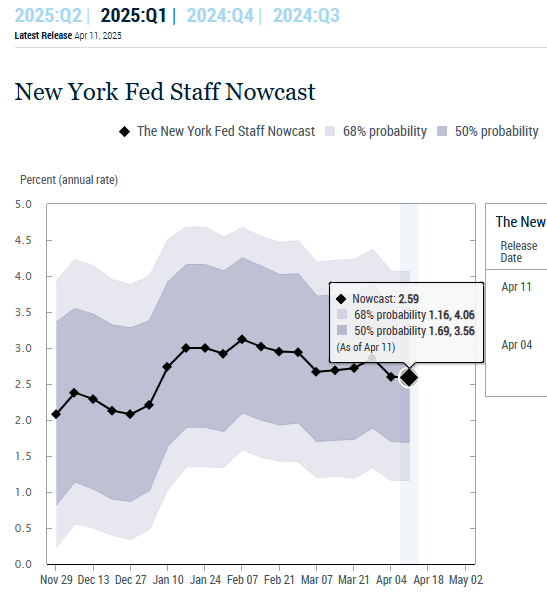

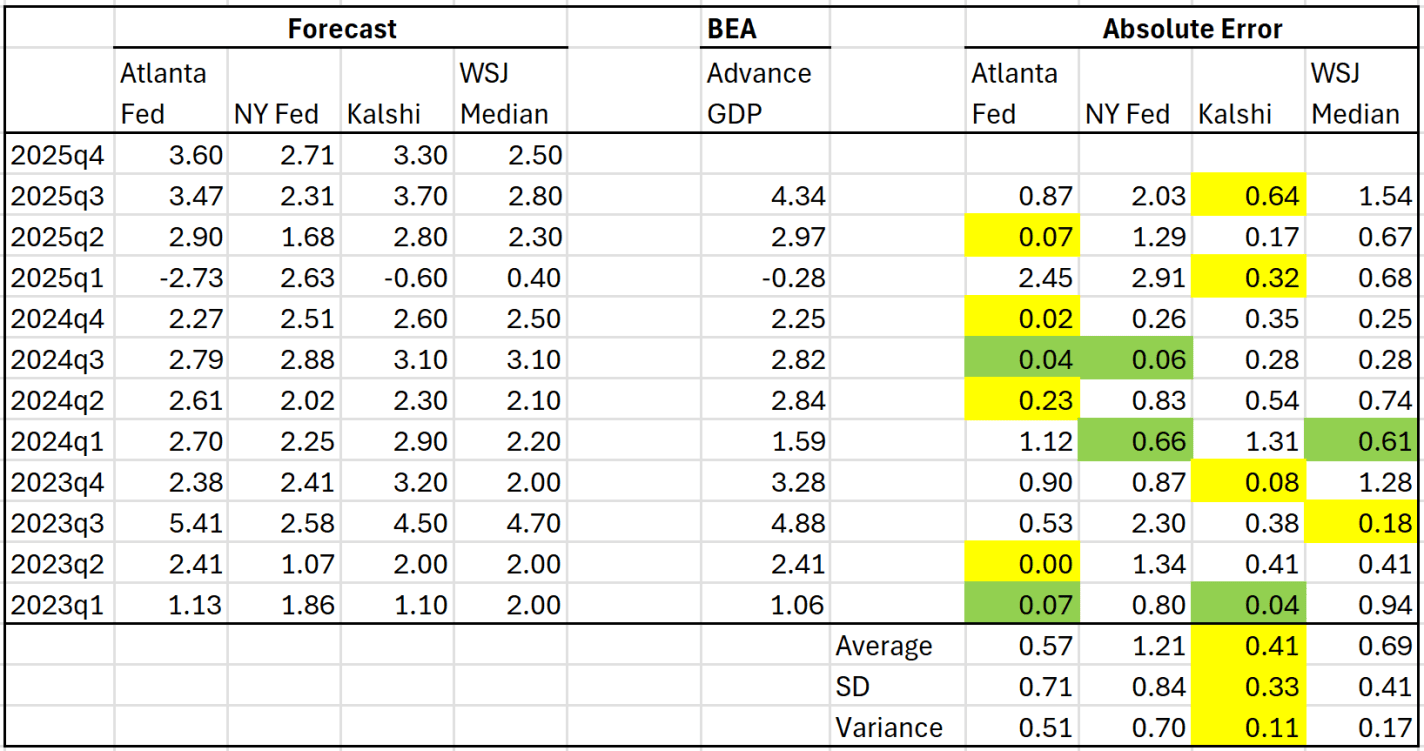

In April 2025 I wrote about several different forecasts for GDP growth. At the time the latest GDP quarter available was 2025Q1. We’ve had two more quarters of data since then, plus a highly anticipated report for Q4 coming out this Friday. How have these different predictions done recently? Here is the updated table from that prior post:

When I wrote the post in April 2025, I said that a simple average of the Atlanta Fed and Kalshi forecasts was the best simple predictor of the actual BEA advance figure. Based on the middle quarters of 2025, I think that continued to be true: each of them was the best estimate in one quarter, and perhaps just as importantly the NY Fed and WSJ survey of economists understated GDP growth pretty significantly.

There is still one more Atlanta Fed GDPNow update coming tomorrow before we get the actual BEA data on Friday, but based on where the numbers are now, we should expect Q4 to be around 3.4-3.5% (annualized) growth rate. This would put the total 2025 calendar year growth at around 2.3% — decent, but still below 2024’s 2.8% growth.