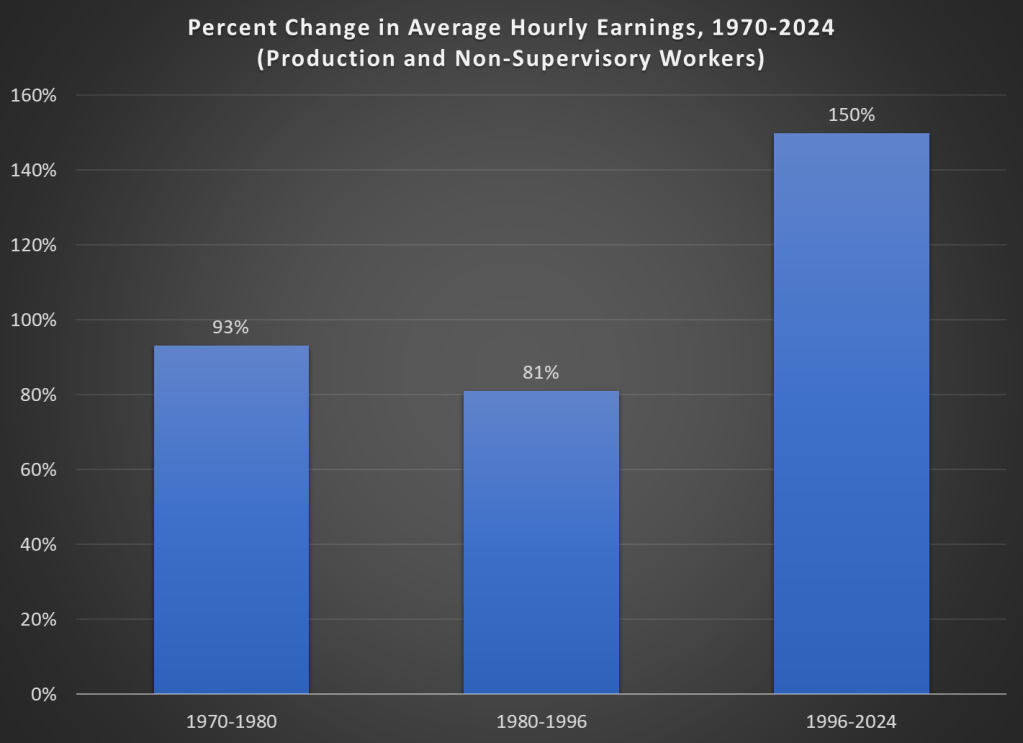

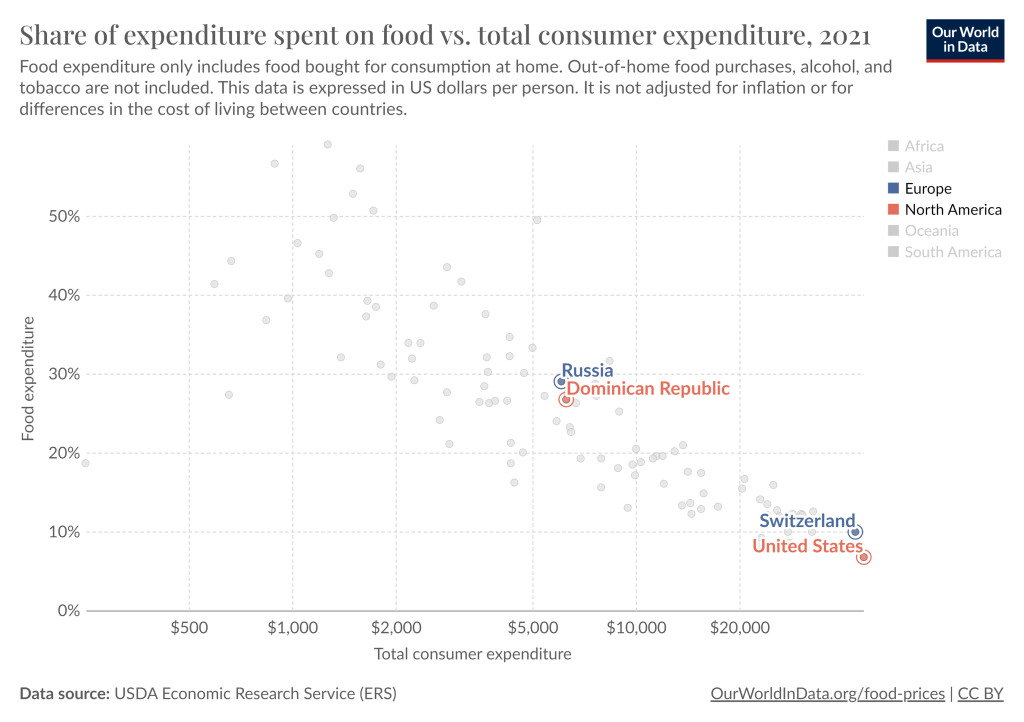

Thankfully for US consumers, grocery prices have leveled off. They haven’t fallen, of course, which will still lead to viral complaints about egg prices, etc. But over the past 4 years, wages have almost caught up with grocery prices.

Not so with fast food prices (“limited service meals”), which have definitely outpaced wages over the past 4 years, and continue to grow at an annual rate of about 5 percent (also more than wages).

Furthermore, if we go back to 2014, we see it’s not just a post-pandemic effect on fast food. Prices since 2014 are up 54 percent for fast food according to the BLS, more than the 31 percent overall CPI-U increase and more than average wages (46 percent).

An article from FinanceBuzz puts together some more specific data on a dozen fast-food chains in the US. Consumer favorites for a quick, cheap bite to eat like Taco Bell and McDonald’s have seen menu prices increase by 80 or even 100 percent!

Check out the article for even more specific food item data at each of these restaurants. For example, the most famous of fast-food sandwiches is the Big Mac, which is up from $3.99 in 2014 to $5.99 in 2024, a 50 percent increase. A Whopper meal at Burger King is up 79 percent. All the more reason to seek out deals in the apps, or just good-old in-store discounts, like the “buy one get one for $1” promo at most McDonald’s. This deal would get you two Big Macs for $7, or $3.50 each… less than in 2014! Or since today is Wednesday, you might want to head to Burger King, where Whoppers are $3 at most locations (regular price: around $6).

Price discrimination is alive and well at the drive-thru window, and if you are just ordering from the menu without any discounts, you are really going to feel the pain of inflation.