I’m a big fan of Milton Friedman. I’m also a big fan of easy-to-remember phrases that impart great wisdom. It honestly made me wince the first time I said the following:

“Inflation is *not* everywhere and always a monetary phenomenon“.

The reasoning is as plain as day. Consider the quantity equation:

MV=PY

For the uninitiated, M is the money supply, V (velocity) is the average number of times dollars transacts during a period, P is the price level, and finally Y is real output during a period. This equation is often called the “equation of exchange” or “the quantity equation”. Strictly speaking, it is an identity. It is a truism that cannot be violated. All economists agree that the equation is true, though they may disagree on its usefulness.

Inflation is simply the percent change in price. We can rearrange the quantity equation, solving for price, in order to see the relationship between the price level and its determinants.

P= MV/Y

What does this mean? It means that more money results in more inflation, all else held constant. It means that higher velocity results in more inflation, all else held constant. It means that less output results in more inflation, all else held constant.

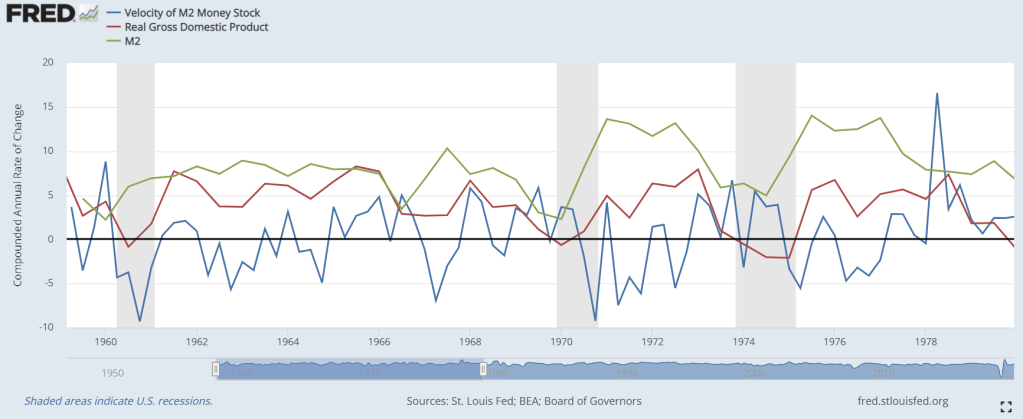

Why would Milton Friedman say that inflation is always caused by changes in the money supply if it is clear that there are two other causes of the price level? When Milton Friedman said his famous quote, output growth was relatively steady. Velocity growth was relatively steady. For his context, Milton Friedman was right. The majority of price and inflation volatility was found in changes in M. See below.

Strictly speaking however, Milton Friedman knew better and he knew that the statement was not strictly correct. Friedman was a public intellectual and he was a great simplifier. He taught many people many true things. At the time, people were blaming inflation on a great variety of things: taxes, fish catches, and unions, to name a few. Arguably, Friedman got them closer to the truth.

Now, there are economists that are pointing to total spending as the driver of inflation. After all, both sides of the equation of exchange describe NGDP (a.k.a. – Aggregate Demand or Aggregate Expenditure). Replacing M and V in the equation with NGDP yields:

P=NGDP/Y

What does this mean? It means that higher NGDP results in more inflation, all else held constant. It means that less output results in more inflation, all else held constant.

But economists dismissing M in lieu of AD are committing the same oversimplification. Y can also change! Maybe economists figure that our recent history is full of relatively stable Y growth and that we ought not pay attention to it. And indeed, unsurprisingly, RGDP growth has been less than NGDP growth.

But what is driving the current bought of inflation?

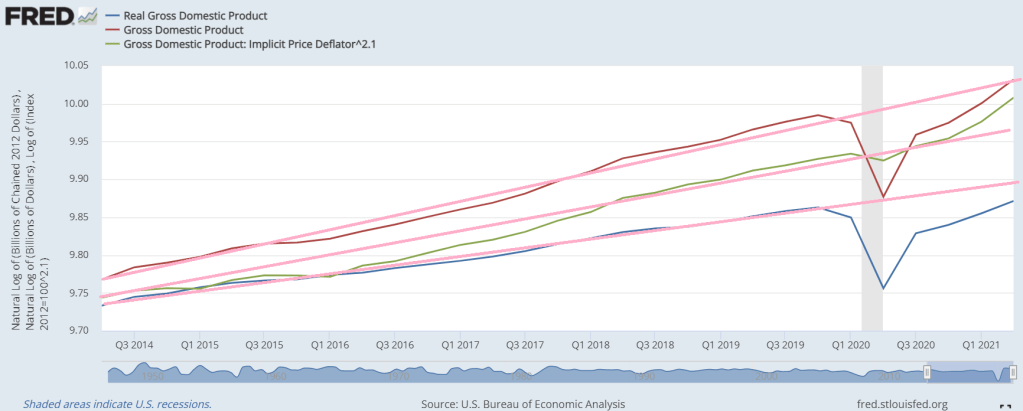

Pardon the crude image. The pink lines are eye-balled trend lines on natural logged data for AD, Y, and P. Prices are up. Is it because of exceptionally high NGDP? Nope. Total spending is back on pre-2020 trend. Does Y happen to be down? Yep, it sure is.

Right now, assuming the previous trend was anywhere close to potential output, inflation is not being driven by excess aggregate demand. It’s being driven by inadequate real output. The news tells the story. There have been supply-chain bottle-necks, difficulty employing, lockdowns, and fear of covid. Right now we have an output problem and higher prices are a symptom. We do not have an aggregate spending problem.

PS – In fact, it is my belief that the Fed successfully avoided a debt-deflation aggregate demand tumble that would have been catastrophic. Inflation is expected when supplies of goods decline.

Another pithy summary of inflation is “more dollars chasing fewer goods”

Sounds like you are pointing out the second half of this- our money supply stayed constant or increased while our ability to produce fell, causing inflation

LikeLike

You’re absolutely right. And the prescribed government response is very different depending on whether we have excess aggregate demand or a shortfall of output.

LikeLike

Crisp answer to the great current inflation question, thanks.

LikeLike

re: “inflation is not being driven by excess aggregate demand. It’s being driven by inadequate real output”

That’s the very definition of inflation. As Friedman said: “Inflation is always and everywhere a monetary phenomenon, in the sense that it cannot occur without a more rapid increase in the quantity of money than in OUTPUT.” That includes “supply chain issues” and “labor shortages”

LikeLike

Thanks for that! I didn’t know that the quote was incomplete. It’s unfortunate that the whole quote isn’t what caught on…

LikeLike