The 2025 first quarter GDP data came in slightly bad: negative 0.3%. I think the number is a bit hard to interpret right now, but it’s hard to spin away a negative number. A big factor pulling down the accounting identify that we call GDP was a massive increase in imports, specifically imports of goods. It’s likely this is businesses trying to front-run the potential tariffs (and keep in mind this was pre-“Liberation Day,” so probably even more front running in April), so the long-run effect is harder to judge.

But aside from the interpretation of the GDP estimate, we can ask a related question: did anyone predict it correctly? I have written previously about two GDP forecasts from two different regional Federal Reserve banks. They were showing very different estimates for GDP!

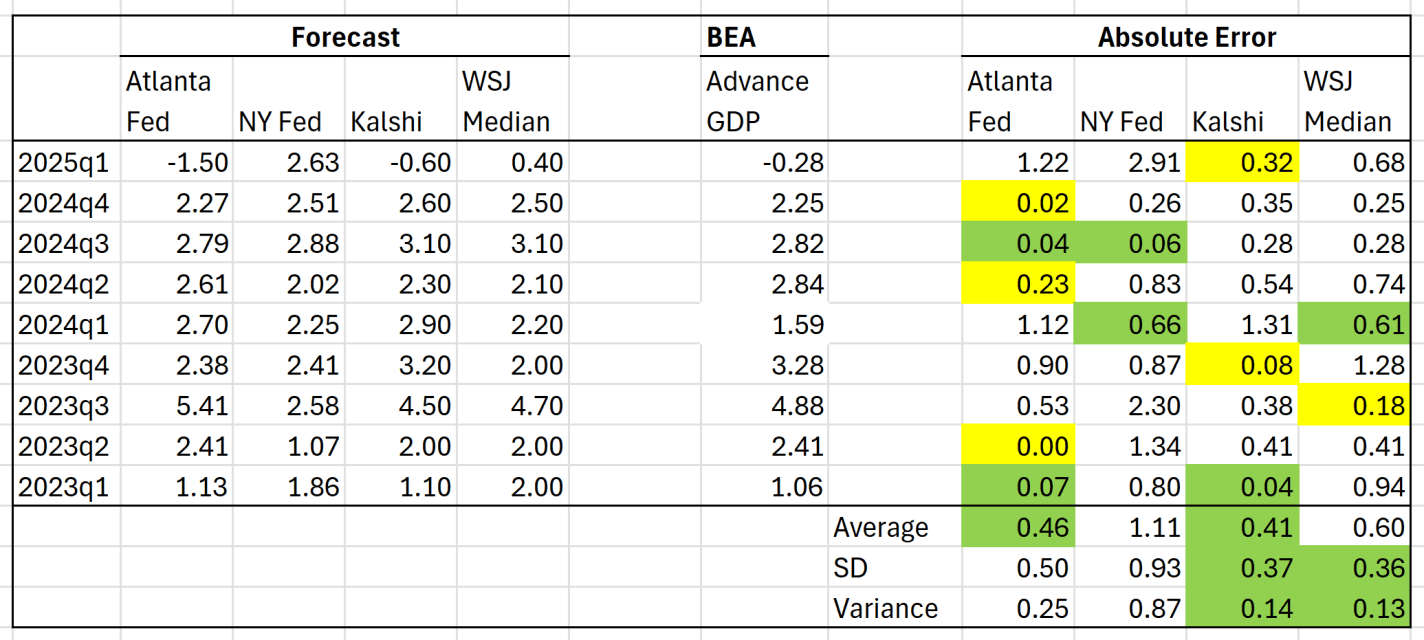

Both the Fed estimates ending up being pretty wrong: -1.5% and +2.6%. But there are two other kinds of forecasts we can look at.

The first is from a survey of economists done by the Wall Street Journal. The median forecast in that survey was positive 0.4%. This survey got the direction wrong, but it was much closer than the Fed models.

Finally, we can look at prediction markets. There are many such markets, but I’ll use Kalshi, because it’s now legal to use in the US, and it’s pretty easy to access their historical data. The average Kalshi forecast for Q1 (a weighted average of sorts across several different predictions) was -0.6%. Pretty close! They got the direction right, and the absolute error was smaller than WSJ survey. And obviously, much better this quarter than the Fed models.

But this was just one quarter, and perhaps a particularly weird quarter to predict (Atlanta Fed even had to update their model mid-quarter, because large gold inflows were throwing of the model). You may say that weird quarters are exactly when we want these models to perform well! But it’s also useful to look at past predictions. The table below summarizes predictions for the past 9 quarters (as far back as the current NY Fed model goes):