I’ve been traveling. Here are some things I noticed (on the internet, not on my travels). (On my travels I learned that rental golf carts are as fun as they look.)

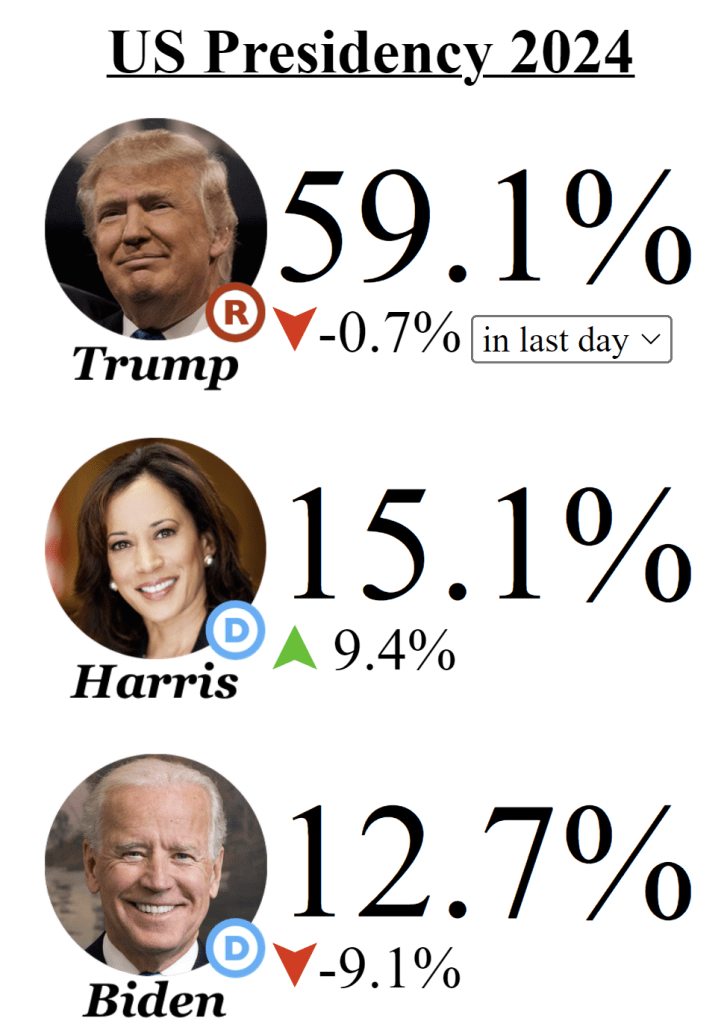

2. This is a poastmodern election. “Campaigners use the internet medium to dunk on their opponents instead of offer solutions to problems.”

“deeply online left wing instagram women are meeting, for the first time ever, deeply online right wing twitter guys. both have developed intricate, sacred language foreign to the other. both are waging war they thought already won. fyi in case you’re wondering about the meltdown”

I thought that meeting happened months ago with the “bear in the woods” discourse.

3. If it wasn’t so serious, American politics would be too funny for television.

4. This woman who gave up professional dancing and now has 8 kids.

One does wonder if the skills that get a person into Julliard relate to the ability to turn family into an Instagram sensation. Is this Ambitious Parenting?

“My day with the trad wife queen and what it taught me” This article about Ballerina Farm reads like the anti-“Hannah’s Children” (reviewed by my former student here)

Hannah Neeleman, the mom at Ballerina Farm, has told her story in what appears to be her own words here: https://ballerinafarm.com/pages/about-us Neeleman says that when she was living in Brazil, she would vacation at, “farms and ranches. A place where you could eat farm fresh cheeses and meats, learn about animals, watch chores being done, etc. We were hooked.” I’m tempted to say that it’s weird to say she was into watching other people do chores. But maybe the word “weird” just has lost all meaning after this week.

Jeremiah Johnson points out that, “It doesn’t matter that their farm isn’t a very productive farm, because the husband’s family founded JetBlue.” My take is that these are rich people who are taking a reality-show approach to their lives like wholesome Kardashians. The Neelemans are into watching people do farm chores. (Yes, they do chores themselves, too, but clearly a large professional staff runs the place.) Good for them. As I said at the beginning, I’m into renting golf carts now.